Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Evolving Dynamics of Fleet Management and Its Strategic Importance in Driving Operational Efficiency and Sustainability in Modern Enterprises

In an era defined by rapid technological advancement and heightened regulatory demands, organizations are compelled to reevaluate their fleet operations with a sharper focus on efficiency, visibility, and sustainability. The integration of advanced telematics, predictive analytics, and connected vehicle solutions has transcended traditional asset tracking, evolving into a strategic mission-critical function that underpins operational resilience. Additionally, the proliferation of experimental propulsion technologies and alternative fuels is reshaping capital allocation and lifecycle management priorities, while regulatory bodies impose stricter emissions standards that require proactive compliance strategies.As fleet sizes continue to expand and diversify, decision-makers are tasked with orchestrating complex ecosystems of hardware, software, and services to extract maximum value. Hardware components such as high-definition cameras, onboard units, and sensors provide real-time data capture, while software platforms enable deeper analytical insights that inform route planning, maintenance scheduling, and driver performance enhancement. Complementary services, encompassing strategic consulting, seamless system integration, and ongoing support and maintenance, ensure that solution deployments remain aligned with organizational objectives and evolving operational contexts.

Looking ahead, the imperative for digital transformation will intensify as emerging technologies like AI-driven decision support and edge computing converge with fleet operations. This convergence will necessitate a clear roadmap that balances near-term operational imperatives with long-term strategic aspirations, reinforcing the vital role of fleet management as a linchpin for sustainable growth.

Illuminating Revolutionary Technological, Regulatory, and Operational Transformations Redefining Fleet Management Paradigms Across the Industry Landscape

The fleet management landscape is undergoing a fundamental metamorphosis driven by the seamless integration of Internet of Things devices, AI-powered analytics, and cloud-native architectures. Connected sensors and onboard units are no longer peripheral assets but central pillars that deliver granular insights into vehicle health, driver behavior, and environmental conditions. As these technologies mature, they are fostering new paradigms of proactive maintenance and operational optimization that were unimaginable a decade ago.Simultaneously, the transition toward electric and hybrid propulsion systems is redefining traditional maintenance regimes, charging infrastructures, and total cost considerations. In parallel, the advent of high-bandwidth connectivity options such as cellular 5G networks and satellite communications is enabling real-time data streaming from even the most remote locations. This convergence of electrification and ubiquitous connectivity empowers fleet operators to orchestrate dynamic routing strategies and deliver enhanced customer experiences with unparalleled reliability.

Furthermore, heightened regulatory scrutiny and evolving sustainability mandates are compelling organizations to harness integrated ecosystem platforms that unify hardware, software, and service offerings. By leveraging advanced telematics analytics in tandem with rigorous compliance frameworks, fleet managers are positioning themselves to meet stringent emissions targets and safety standards. Ultimately, these transformative shifts are catalyzing a new era of innovation where data-driven decision-making and ecosystem collaboration become the cornerstones of competitive advantage.

Assessing the Comprehensive Effects of Newly Implemented Tariffs on Fleet Management Operations Supply Chains and Cost Structures in 2025 US Market Dynamics

The imposition of new tariffs in 2025 has introduced a complex layer of cost considerations for fleet management stakeholders across the United States. Components such as cameras, onboard units, sensors, and advanced communication modules have experienced incremental price adjustments that directly affect capital expenditure planning. Organizations are thus compelled to revisit their sourcing strategies and negotiate more favorable terms with suppliers to mitigate these elevated input costs.In response, many operators are exploring nearshoring and localized manufacturing partnerships, seeking to establish regional supply chains that buffer against international tariff fluctuations. This strategic shift is accompanied by an increased emphasis on modular hardware designs that facilitate component substitution without comprehensive system overhauls. Moreover, service providers are adapting contractual models to offer more flexible engagement structures, blending fixed and variable fee arrangements to share the risk associated with cost volatility.

These cumulative changes are reshaping the competitive landscape, as both equipment manufacturers and solution integrators invest in resilient logistics networks and agile production processes. Companies that proactively embrace these adjustments stand to benefit from enhanced supply chain transparency and greater negotiating leverage, while those that delay adaptation may encounter prolonged lead times, elevated operating expenses, and diminished responsiveness to evolving customer requirements.

Unveiling In-Depth Multidimensional Segmentation Insights Shaping Hardware, Software, Propulsion and Application Strategies Within Fleet Management Markets

Insight into market segmentation reveals that in the offering dimension, hardware spans a spectrum that includes high-definition cameras such as dashcams, rear view units, and sensing cameras, along with onboard units and sensor arrays that enable comprehensive data acquisition. This is complemented by an array of service deliverables encompassing strategic consulting, seamless system integration, and robust support and maintenance offerings, while the software layer delivers capabilities in fleet analytics and reporting, real time tracking, route optimization, and sophisticated telematics analytics.When analyzed by propulsion type, the technological landscape encompasses electric, hybrid, and traditional internal combustion engine vehicles, each presenting distinct operational profiles and maintenance imperatives. Examining fleet size segmentation highlights the divergent requirements of large, medium, and small fleets, where scale influences solution architecture, resource allocation, and service level expectations.

Connectivity options further differentiate fleet management solutions, ranging from short-range Bluetooth and Wi-Fi networks to expansive cellular coverage and resilient satellite links, thereby accommodating a broad spectrum of operational geographies and data transmission demands. Deployment preferences also diverge between cloud-native platforms that offer scalability and rapid deployment, and on premise solutions that provide tighter control over data governance and localized processing.

Finally, segmenting by end use industry and application underscores the diverse functional needs across verticals such as construction, energy and utilities, government operations, oil and gas, retail and eCommerce, and transportation and logistics, with the latter encompassing both last mile delivery and long haul operations, as well as specialized applications including compliance and regulatory reporting, driver management and safety, freight and fuel management, maintenance management in both predictive and preventive forms, route optimization and navigation, and vehicle tracking and diagnostics.

Highlighting Critical Regional Variations and Strategic Opportunities Across Americas Europe Middle East Africa and Asia Pacific in Fleet Management Ecosystem

The Americas region remains at the forefront of fleet management innovation, driven by robust infrastructure investments, a strong regulatory emphasis on safety and emissions reduction, and a competitive landscape that fuels rapid technology adoption. North American operators, in particular, are leveraging advanced telematics and analytics platforms to enhance operational transparency and drive driver performance initiatives, while Latin American markets are increasingly embracing modular solutions tailored to diverse geographic and economic conditions.Europe Middle East and Africa present a mosaic of regulatory environments and logistical challenges that demand adaptable fleet management strategies. European markets, underpinned by stringent emissions standards and comprehensive compliance regimes, are trailblazing the shift toward electrification and integrated urban mobility solutions. In parallel, Middle Eastern and African operators are capitalizing on satellite connectivity and rugged hardware systems to address vast operational territories and emerging infrastructure developments.

Asia Pacific is characterized by its rapid digital transformation and heterogeneous market maturity, where advanced economies prioritize cloud-based platforms and AI-driven decision support, while emerging markets are accelerating investment in essential telematics infrastructure. The convergence of technology hubs, manufacturing prowess, and dynamic regulatory frameworks is positioning this region as a critical arena for innovative partnerships, localized solution development, and scalable deployment models.

Examining Pioneering Fleet Management Providers and Their Strategic Innovations Competitive Positioning and Partnerships Driving Market Leadership

Industry leaders in the fleet management space have demonstrated a clear emphasis on developing end-to-end ecosystems that integrate hardware, software, and service offerings into cohesive platforms. Through targeted acquisitions and strategic partnerships with telecommunications providers, these companies are expanding their connectivity capabilities and reinforcing their position as comprehensive solution providers. Investment in AI-driven analytics modules and intuitive user interfaces further differentiates their offerings in a crowded competitive field.A number of providers are collaborating with original equipment manufacturers to embed telematics functionality directly into vehicle architectures, streamlining deployment and reducing installation complexity. This trend toward factory-fitted connectivity and sensor integration is reshaping traditional aftermarket dynamics, prompting both technology firms and automotive partners to co-develop tailored solutions for specific operational contexts such as long haul transportation and first responder deployments.

In addition, service-centric organizations are leveraging flexible consumption models and outcome-based agreements to align value creation with client objectives. By offering performance-based pricing and managed service frameworks, these companies are addressing the demand for predictable operating expenses and measurable return on investment. Consequently, the competitive landscape is evolving beyond standalone product offerings toward fully managed, data-driven service engagements that deliver continuous performance optimization.

Delivering Strategic Action Plans and Roadmaps for Industry Leaders to Accelerate Technology Adoption Optimize Operations and Achieve Sustainable Market Success

Executives should pursue a holistic integration strategy that aligns hardware deployment, software analytics, and service support under a unified governance framework to foster seamless data flow and minimize operational silos. Embracing modular solution architectures will enable incremental upgrades, allowing organizations to pilot advanced capabilities such as predictive maintenance and dynamic routing without disrupting core operations. To ensure maximum technology ROI, leadership must define clear performance metrics and establish cross-functional teams tasked with continuous monitoring and refinement of fleet initiatives.Furthermore, early investment in skills development and change management is essential to drive user adoption and sustain long-term transformation. By partnering with solution providers offering hands-on training, ongoing technical support, and collaborative innovation workshops, organizations can accelerate the development of internal expertise and cultivate a culture of data-driven decision making. It is equally important to explore alternative financing models, including subscription-based structures and outcome-based agreements, to align cost structures with evolving operational needs and budgetary constraints.

Finally, industry leaders are encouraged to engage in pilot programs that test emerging technologies such as edge computing, advanced driver assistance systems, and electric vehicle fleet orchestration. These targeted experiments should be governed by defined success criteria, with a focus on scalability and interoperability, to pave the way for broader deployment. By adopting this phased approach, organizations can mitigate adoption risks while capitalizing on breakthrough innovations that drive competitive advantage in a rapidly evolving landscape.

Detailing Research Frameworks Data Collection Techniques Analytical Approaches and Validation Procedures Underpinning Fleet Management Market Understanding

This analysis was developed through a rigorous multi-stage approach combining both qualitative and quantitative research techniques to ensure robust and actionable insights. An initial phase of secondary research involved a comprehensive review of industry publications, regulatory filings, technical white papers, and relevant government records to establish context and identify key market drivers. This was augmented by stakeholder mapping to pinpoint influential manufacturers, technology providers, and end-user organizations for further exploration.In the primary research phase, structured interviews and advisory roundtables were conducted with senior executives, operations managers, and technical specialists across diverse geographies and verticals. These engagements provided firsthand perspectives on solution performance, implementation challenges, and emerging use cases. Quantitative data was gathered via validated survey instruments that probed adoption trends, investment priorities, and technology preferences, with responses subjected to rigorous consistency checks and cross-validation.

Data triangulation processes integrated findings from multiple sources to reconcile discrepancies and reinforce confidence in the conclusions. Analytical techniques, including scenario analysis and sensitivity mapping, were applied to assess the resilience of strategic recommendations under varying operational and regulatory conditions. The final outputs were vetted through peer reviews and expert panels to verify methodological soundness and alignment with current industry practices.

Synthesizing Critical Insights and Strategic Imperatives to Provide a Coherent Vision of Future Developments Innovations and Challenges in Fleet Management

The evolving confluence of advanced connectivity, electrification, and regulatory rigor is redefining the fleet management domain, underscoring the critical role of integrated solutions in achieving operational excellence. Through a nuanced understanding of segmentation dynamics, regional variations, and competitive strategies, decision-makers can craft tailored approaches that address specific organizational imperatives, whether related to safety, sustainability, or cost optimization. The analysis of tariff impacts further highlights the importance of resilient supply chain architectures and adaptive procurement frameworks.Furthermore, the spotlight on leading companies and their strategic initiatives provides a clear blueprint for building and sustaining differentiated capabilities in hardware, software, and service ecosystems. By internalizing the actionable recommendations and learning from established best practices, organizations are better positioned to navigate technological transitions and regulatory complexities. Ultimately, the synthesis of these insights equips stakeholders with a coherent vision for leveraging data-driven intelligence, modular deployments, and outcome-based models to drive continuous improvement.

As fleet operations become increasingly interwoven with digital platforms and environmental stewardship goals, the imperative for strategic alignment between technology investments and organizational objectives has never been more pronounced. This conclusion affirms the necessity of a forward-looking mindset, one that champions iterative innovation and collaborative partnerships to secure sustained competitive advantage in a rapidly evolving global landscape.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

22. China Fleet Management Market

Companies Mentioned

The key companies profiled in this Fleet Management market report include:- Bridgestone Corporation

- Chevin Fleet Solutions

- Cisco Systems, Inc.

- Continental AG

- Denso Corporation

- Ford Motor Company

- Geotab Inc.

- GPS Insight

- International Business Machine Corporation

- JLG Industries, Inc. by Oshkosh Corporation

- Michelin Group

- Netradyne

- Octo Group S.p.A

- Oracle Corporation

- Pidge Technologies Private Limited

- Powerfleet, Inc.

- Rarestep, Inc.

- Roadz, Inc.

- Robert Bosch GmbH

- Samsara Inc.

- Scania CV AB by Volkswagen Group

- Siemens AG

- Solera

- Tenna LLC

- Trimble Inc.

- Verizon Communications Inc.

- Wheels, LLC

- Zenmov Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2032 |

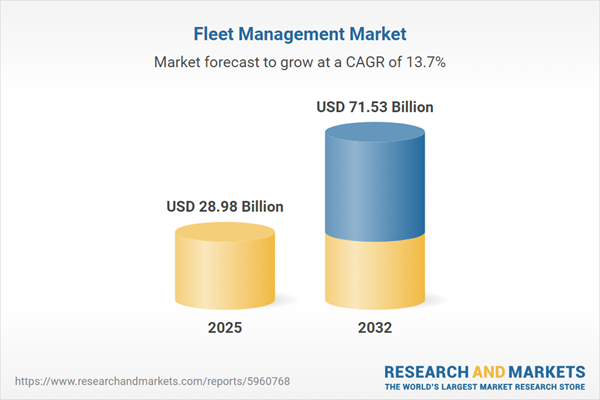

| Estimated Market Value ( USD | $ 28.98 Billion |

| Forecasted Market Value ( USD | $ 71.53 Billion |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |