Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces substantial hurdles due to the high production costs and technical intricacies associated with next-generation semiconductor materials. As the industry increasingly adopts wide-bandgap materials such as Gallium Nitride (GaN) to accommodate higher frequencies, the fabrication process becomes more complex and capital-intensive. This expensive production framework, coupled with the engineering challenges of ensuring linearity and efficiency at millimeter-wave frequencies, presents a significant barrier that could slow widespread adoption in budget-conscious sectors and potentially hamper the overall speed of market expansion.

Market Drivers

The accelerated rollout of 5G telecommunications infrastructure and the increasing adoption of 5G-enabled smartphones serve as the main volume drivers for the RF power amplifier market. Modern 5G networks rely on massive MIMO arrays and millimeter-wave frequencies, necessitating a considerably larger number of power amplifiers per base station and handset compared to previous generations to guarantee signal integrity. The intensity of this demand is highlighted by user adoption rates; the Ericsson Mobility Report from June 2024 indicates that global 5G subscriptions topped 1.7 billion by the first quarter of 2024. This wireless expansion contributes to a broader industrial surge, with the Semiconductor Industry Association projecting global semiconductor sales to exceed $600 billion in 2024, underlining the massive electronic ecosystem supporting these critical components.In parallel, the modernization of defense radar and electronic warfare systems is propelling the high-performance segment of the market, speeding up the transition toward Gallium Nitride (GaN) technology. Next-generation military architectures, particularly Advanced Active Electronically Scanned Array (AESA) radars, demand amplifiers that offer exceptional power density and thermal efficiency, making GaN a critical requirement. This technological evolution is supported by substantial strategic funding; the U.S. Department of Defense's Fiscal Year 2025 budget request in March 2024 allocated $310.7 billion for procurement and research, creating a reliable, high-value demand stream for specialized RF hardware that operates independently of consumer electronics cycles.

Market Challenges

The significant expenses and technical difficulties linked to next-generation semiconductor materials represent a major obstacle to the expansion of the global radio frequency power amplifier market. As the industry moves toward materials capable of managing higher voltages and frequencies, such as Gallium Nitride, the manufacturing process becomes increasingly capital-intensive. These advanced materials necessitate specialized production environments and exacting engineering standards to maintain linearity and efficiency, thereby driving up the overall cost structure. This financial pressure limits the broad application of these amplifiers in cost-sensitive areas and hinders manufacturers from rapidly scaling production for lower-margin consumer devices.The magnitude of investment required to support this advanced manufacturing is evident in recent industry figures. Data from SEMI indicates that global sales of semiconductor manufacturing equipment were expected to reach $109 billion in 2024, highlighting the steep entry barriers and operational costs facing producers. Consequently, the resulting higher unit prices for advanced amplifiers may discourage price-sensitive sectors from upgrading their hardware, which could temper the market's potential growth rate despite the strong underlying demand for connectivity.

Market Trends

The development of specialized amplifiers for V2X automotive communication is fundamentally reshaping the market as vehicles evolve into connected autonomous platforms. Unlike standard consumer electronics, these RF components must withstand harsh thermal environments while ensuring ultra-low latency for critical safety data exchange between vehicles and infrastructure. This sector is expanding rapidly as manufacturers integrate high-performance radar and connectivity modules that rely heavily on robust amplification hardware to ensure uninterrupted signal fidelity in congested urban settings. The financial impact of this automotive integration is substantial; NXP Semiconductors reported in their 'Fourth Quarter and Full-Year 2023 Results' from February 2024 that their automotive revenue increased by 5% year-on-year to $1.90 billion in the fourth quarter, underscoring the growing commercial value of this semiconductor segment.Simultaneously, the aerospace sector is accelerating its transition from Traveling Wave Tubes to Solid-State Amplifiers (SSPA) to satisfy the requirements of dense Low Earth Orbit (LEO) satellite constellations. Although traditional tubes historically provided higher power, their bulk and complex high-voltage needs make them unsuitable for the compact, mass-manufactured satellites defining the "New Space" era. Solid-state alternatives deliver the superior reliability and reduced size, weight, and power (SWaP) metrics essential for modern orbital payloads, allowing operators to maximize launch efficiency. This technological pivot is driven by unprecedented deployment volumes; the Satellite Industry Association's '2024 State of the Satellite Industry Report' from June 2024 noted a record 2,781 commercial satellites were deployed in 2023, representing a 20% increase compared to the previous year.

Key Players Profiled in the RF Power Amplifier Market

- Skyworks Solutions, Inc.

- NXP Semiconductors N.V.

- Qorvo, Inc.

- Broadcom Inc.

- Infineon Technologies AG

- Analog Devices, Inc.

- Murata Manufacturing Co., Ltd.

- STMicroelectronics International N.V.

- Mitsubishi Electric Corporation

- Renesas Electronics Corporation

Report Scope

In this report, the Global RF Power Amplifier Market has been segmented into the following categories:RF Power Amplifier Market, by Class:

- Class A Power Amplifier

- Class B Power Amplifier

- Class AB Power Amplifier

- Class C Power Amplifier

- Class D Power Amplifier

- Others

RF Power Amplifier Market, by Technology:

- Silicon

- Silicon germanium

- Gallium arsenide

- Others

RF Power Amplifier Market, by End User:

- Consumer electronics

- Industrial

- Telecommunication

- Military

- Defense

- Automotive

- Others

RF Power Amplifier Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global RF Power Amplifier Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this RF Power Amplifier market report include:- Skyworks Solutions, Inc.

- NXP Semiconductors N.V.

- Qorvo, Inc.

- Broadcom Inc.

- Infineon Technologies AG

- Analog Devices, Inc.

- Murata Manufacturing Co., Ltd.

- STMicroelectronics International N.V.

- Mitsubishi Electric Corporation

- Renesas Electronics Corporation

Table Information

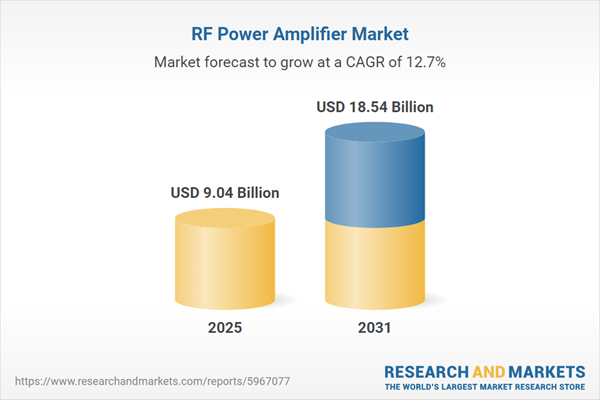

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 9.04 Billion |

| Forecasted Market Value ( USD | $ 18.54 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |