Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, a substantial hurdle impeding market growth is the lack of economic feasibility in developing novel drugs, resulting in a critical shortage of new treatment options. The exorbitant costs of research, combined with minimal returns on investment for short-course therapies, deter sustained commercial engagement. Data from the International Federation of Pharmaceutical Manufacturers and Associations in 2024 indicated that there was merely one antibiotic candidate in Phase III clinical trials addressing the four bacterial pathogens deemed critical priorities. This scarcity of late-stage candidates highlights the significant financial barriers that currently suppress innovation within the industry.

Market Drivers

The rising prevalence of multidrug-resistant pathogens acts as the primary engine driving the Global Hospital Infection Therapeutics Market. As bacteria develop sophisticated resistance mechanisms, standard antibiotic treatments are becoming increasingly ineffective, compelling the adoption of advanced, reserve-line therapeutics. This necessity is intensified by the growing incidence of hospital-acquired infections, particularly within intensive care units where vulnerable patients face elevated risks. In May 2024, the World Health Organization's 'WHO Bacterial Priority Pathogens List 2024' identified 15 families of antibiotic-resistant bacteria as critical priorities for new drug development. Furthermore, the Centers for Disease Control and Prevention reported in July 2024, within its 'Antimicrobial Resistance Threats in the United States, 2021-2022' analysis, that hospital-onset antimicrobial-resistant infections rose by 20% during the COVID-19 pandemic compared to pre-pandemic levels, demonstrating the persistent need for effective medical interventions.Concurrently, supportive regulatory frameworks and government funding play a vital role in sustaining market momentum by mitigating the high risks associated with antimicrobial drug development. Since the commercial return on short-course antibiotics is often insufficient to attract private equity, public sector investment has become essential for maintaining a robust clinical pipeline.

Governments and international organizations are increasingly utilizing push incentives to assist biotech companies through the expensive early stages of research. For instance, the UK Department of Health and Social Care committed £85 million in May 2024, as part of its 'Confronting antimicrobial resistance 2024 to 2029' national action plan, to support global partnerships and research initiatives against antimicrobial resistance. This provision of non-dilutive capital de-risks the development process for pharmaceutical firms, ensuring a consistent flow of novel therapeutic candidates entering the market to address the crisis.

Market Challenges

The most significant obstacle facing the Global Hospital Infection Therapeutics Market is the lack of economic viability in developing novel antimicrobial agents. This structural market failure arises because the high costs associated with research and development are not matched by adequate returns on investment, largely because new antibiotics are typically reserved as last-resort treatments to prevent resistance rather than being sold in high volumes. This adverse economic environment discourages pharmaceutical companies from maintaining their antimicrobial portfolios, leading to a withdrawal of capital and a stagnant pipeline that fails to produce the high-value products necessary for robust market growth.This disruption in the supply of innovative treatments directly constrains financial expansion by forcing the market to rely on older, lower-cost generics rather than premium novel therapies. A 2024 report by the International Federation of Pharmaceutical Manufacturers and Associations highlighted that, due to these incentive-related challenges, only ten new antibiotics were approved by stringent regulatory authorities between 2017 and 2023, with just two classified as innovative. This minimal output of novel therapeutics severely limits revenue opportunities and inhibits the market's ability to address evolving medical needs.

Market Trends

The integration of AI-driven drug discovery is fundamentally reshaping the Global Hospital Infection Therapeutics Market by accelerating the identification of novel antimicrobial compounds that traditional screening methods often miss. This technological incorporation allows pharmaceutical companies to rapidly analyze vast chemical libraries and predict molecular efficacy against resistant bacterial strains, thereby revitalizing a stagnant clinical pipeline. By utilizing machine learning algorithms, developers can optimize lead candidates for safety and potency at unprecedented speeds, directly addressing the critical shortage of effective treatments for hospital-acquired infections. Highlighting this trend, The Silicon Review reported in March 2025, in an article titled 'Pfizer's $2B AI-Powered Antibiotics to Combat Superbugs', that Pfizer has committed $2 billion to an AI-powered discovery platform specifically designed to automate the identification of next-generation treatments for multidrug-resistant pathogens.Simultaneously, the market is witnessing the significant emergence of phage therapy as a credible alternative to conventional antibiotics. As bacterial resistance mechanisms compromise standard drug classes, therapeutic focus is shifting toward bacteriophages - viruses that specifically target and neutralize pathogenic bacteria without harming beneficial microbiota or inducing broad-spectrum resistance. This trend represents a paradigm shift from chemical to biological interventions, offering precision treatment options for difficult-to-treat conditions like bacteremia and catheter-associated infections. According to the 'Third Quarter 2025 Results' report from Armata Pharmaceuticals in November 2025, the company’s lead phage candidate, AP-SA02, achieved a 100% clinical response rate without relapse in patients with complicated Staphylococcus aureus bacteremia, underscoring the high therapeutic potential of these novel biological agents.

Key Players Profiled in the Hospital Infection Therapeutics Market

- Merck & Co., Inc.

- Pfizer Inc.

- Bayer AG

- GlaxoSmithKline plc

- Daiichi Sankyo Company, Limited

- AbbVie Inc.

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Allergan plc

- AstraZeneca plc

Report Scope

In this report, the Global Hospital Infection Therapeutics Market has been segmented into the following categories:Hospital Infection Therapeutics Market, by Drug Type:

- Antibiotics Drugs

- Antifungal Drugs

- Antiviral Drugs

- Others

Hospital Infection Therapeutics Market, by Application:

- Bloodstream Infections

- Pneumonia

- Surgical Site Infections

- Urinary Tract Infections

- Gastrointestinal Disorders

- Other Hospital Infections

Hospital Infection Therapeutics Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hospital Infection Therapeutics Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Hospital Infection Therapeutics market report include:- Merck & Co., Inc.

- Pfizer Inc.

- Bayer AG

- GlaxoSmithKline PLC.

- Daiichi Sankyo Company, Limited

- AbbVie Inc.

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Allergan PLC.

- AstraZeneca PLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

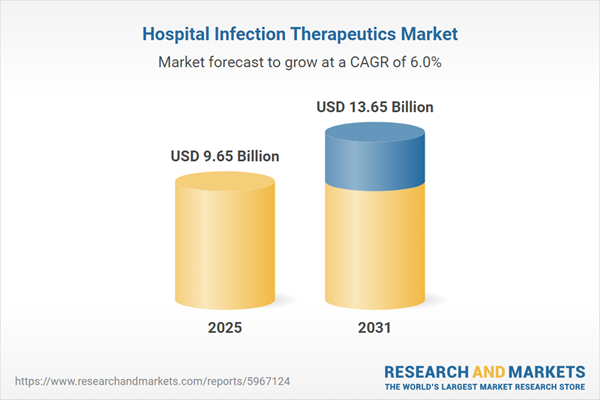

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 9.65 Billion |

| Forecasted Market Value ( USD | $ 13.65 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |