Audio Visual Hardware Market Growth & Trends

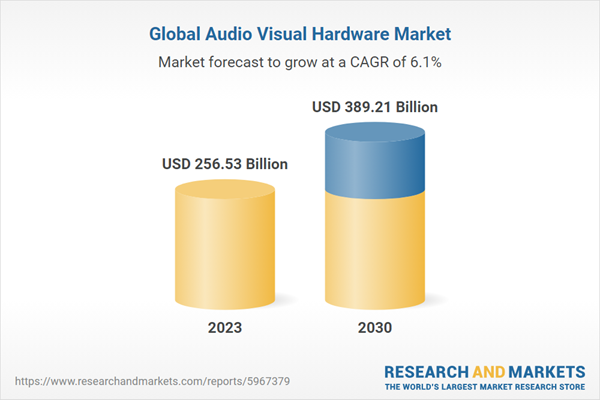

The global audio visual hardware market size is expected to reach USD 389.21 billion by 2030, registering a CAGR of 6.1% from 2024 to 2030. Rapid advancements in display technologies have led to the development of high-resolution screens, such as 4K and 8K displays, in the market. These displays offer significantly more pixels per inch, resulting in clearer, sharper, and more detailed images. In addition, the incorporation of High Dynamic Range (HDR) technology enhances contrast and color accuracy, providing a more lifelike visual experience. Faster refresh rates contribute to smoother motion handling, crucial for applications, such as gaming and video playback. These developments collectively contribute to the production of immersive audio visual (AV) system, meeting the rising expectations of consumers who demand superior image quality for various entertainment and professional purposes.Audiophiles seeking exceptional sound quality are the primary consumers of amplifiers that offer high-fidelity audio experiences. To cater to this demand, manufacturers are designing amplifiers with features, such as high-power output and advanced Digital-to-Analog Converters (DACs). For instance, in February 2022, Marantz introduced the Model 40n streaming amplifier, demonstrating the growing emphasis on audiophile-grade performance within the amplifier segment. The Model 40n aligns with this trend by boasting features, such as high-current design and advanced digital-to-analog conversion (DAC) technology, delivers 70 watts per channel, and prioritizes high-fidelity sound reproduction. The ongoing convergence of wireless technologies with emerging smart technologies, such as voice assistants and smart home devices, is a key trend observed in the market.

This allows for seamless integration and control of AV equipment using voice commands or automation routines, further enhancing user convenience. The growing popularity of wireless AV devices has led to the introduction of several new products from leading vendors in recent years. For instance, in February 2023, LG Electronics unveiled its 2023 LG Soundbar series in India, which includes the flagship model S95QR. This all-in-one soundbar boasts a 9.1.5 channel system with wireless rear speakers, creating an immersive and dynamic soundscape. It features a powerful output of 810W and five up-firing channels, three built into the soundbar and two in the rear speakers. The market in North America is shifting significantly toward hybrid work solutions, owing to the continued move to remote & hybrid work patterns.

Unified Communications and Collaboration (UC&C) solutions are gaining popularity, providing integrated communication and collaboration tools to help streamline operations in distant work environments. Immersive technologies like virtual reality (VR) and augmented reality (AR) are increasingly gaining popularity, notably in gaming, entertainment, and business applications. Furthermore, digital signage solutions are becoming increasingly important for companies looking to improve customer engagement and communication in the retail, hospitality, and transportation industries. Overall, the North America regional market is distinguished by innovation, adaptation to changing work dynamics, and a focus on improving user experiences in a variety of industries.

Audio Visual Hardware Market Report Highlights

- The equipment segment led the market and accounted for a share of 76.90% in 2023. AI-powered features, such as voice control, gesture recognition, and facial recognition, were being integrated into audio visual system, providing users with more intuitive and personalized experiences. Smart assistants like Amazon Alexa and Google Assistant were also being integrated into AV devices, allowing users to control them with voice commands

- The professional segment accounted for the largest revenue share in 2023. The adoption of video over internet protocol (IP) solutions was on the rise in the professional AV market. IP-based distribution and streaming of audio & video content offered greater flexibility, scalability, and cost-effectiveness compared to traditional AV infrastructures

- Artificial intelligence (AI) is being integrated into AV hardware to enhance functionality and user experience. This includes AI-powered features, such as voice control, gesture recognition, automatic content analysis, and intelligent scene optimization. AI algorithms can optimize audio & video quality, automate camera tracking, and enhance noise cancellation in conferencing systems

- The integration of the Internet of Things (IoT) and AI technologies is driving innovation in Europe’s AV hardware market. IoT-enabled AV devices, such as smart displays and sensors, may collect data, evaluate user behavior, and automate processes to increase efficiency and user experiences. AI-powered technologies, such as voice and facial recognition, are also being incorporated into AV hardware to allow for more intuitive and personalized interactions

- North America dominated the global market and accounted for a share of 31.9% in 2023. The gaming and esports industries are experiencing rapid growth in North America, driving demand for gaming peripherals, monitors, and audio equipment. High-performance gaming hardware with features, such as high refresh rates, low latency, and immersive audio, is in high demand among gamers and eSports enthusiasts

Table of Contents

Companies Mentioned

- Amphenol Corporation

- AVI Systems Inc.

- Avidex Industries, LLC

- AVI-SPL Inc.

- Belden Inc.

- Black Box

- CCS Presentation Systems Inc.

- Conference Technologies Inc.

- Corning Incorporated

- Electrosonic

- Ford Audio-Video LLC

- HARMAN International

- LG Corporation

- Samsung Electric Corporation

- Solotech Inc.

- Sony Corporation

- Switchcraft, Inc.

- TE Connectivity

- Wesco International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | April 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 256.53 Billion |

| Forecasted Market Value ( USD | $ 389.21 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |