Global Enterprise Artificial Intelligence (AI) Market - Key Trends & Drivers Summarized

Exploring the Rise of AI in the Corporate World

Enterprise Artificial Intelligence (AI) is rapidly emerging as a transformative force across corporate ecosystems, enabling organizations to scale intelligence across operations, customer interactions, and strategic decision-making. Unlike narrow AI applications confined to individual tools or functions, enterprise AI encompasses the integration of machine learning (ML), natural language processing (NLP), computer vision, and advanced analytics into the fabric of an organization’s workflows. From automating business processes and enhancing supply chains to improving customer insights and forecasting market trends, AI is increasingly viewed as a foundational enabler of digital transformation. Organizations across sectors - including finance, retail, manufacturing, healthcare, and logistics - are adopting enterprise AI to unlock efficiencies, boost innovation, and remain competitive in a data-driven economy.A major trend driving enterprise AI adoption is the rise of AI-as-a-Service (AIaaS), which provides scalable, cloud-based AI tools without requiring deep in-house technical expertise. This model is empowering organizations to embed AI capabilities into customer relationship management (CRM), enterprise resource planning (ERP), and human capital management (HCM) systems. Another key trend is the convergence of AI with robotic process automation (RPA) to deliver intelligent automation that not only performs repetitive tasks but also learns and adapts to new conditions. In parallel, enterprise-grade AI platforms are being built with explainability, governance, and compliance features to ensure accountability and alignment with ethical AI principles. This is particularly important in regulated industries like finance, insurance, and healthcare.

How Is Enterprise AI Enhancing Operational Intelligence and Business Agility?

Enterprise AI is enabling a profound shift from reactive to predictive and prescriptive decision-making. In operations, AI-powered systems are analyzing real-time data from sensors, machines, and logistics networks to predict maintenance needs, optimize inventory levels, and reduce supply chain disruptions. Predictive analytics are being applied across finance functions to detect fraud, forecast cash flows, and assess credit risk, thereby enhancing resilience and agility in uncertain market environments. AI is also transforming enterprise planning, budgeting, and forecasting through continuous data ingestion and scenario modeling, allowing leaders to test strategic outcomes before execution.In human resources, AI is improving workforce planning by forecasting attrition risks, identifying skill gaps, and enhancing talent acquisition through resume screening and behavioral analysis. Enterprises are leveraging AI-driven sentiment analysis to gauge employee engagement and organizational culture in real time. Marketing and sales teams are using AI for dynamic pricing, customer segmentation, lead scoring, and content personalization - shifting engagement from mass communication to one-to-one interactions at scale. By embedding AI into core functions, enterprises are gaining the ability to adapt quickly to change, align resources more efficiently, and drive measurable outcomes with greater precision.

Where Is AI Creating Competitive Advantage Across Industry Verticals?

The application of enterprise AI is expanding rapidly across diverse industry verticals, each capitalizing on AI’s unique capabilities to solve sector-specific challenges. In retail and e-commerce, AI is powering hyper-personalized shopping experiences, intelligent recommendation engines, and real-time inventory optimization. In manufacturing, AI is optimizing production schedules, enhancing quality control through computer vision, and reducing downtime through predictive maintenance. In the financial services sector, AI is driving algorithmic trading, customer risk profiling, and real-time compliance monitoring, while also enabling conversational banking and intelligent underwriting in insurance.In healthcare, enterprise AI is enabling patient triage, diagnostic support, drug discovery, and operational optimization of hospital systems. Energy and utility companies are leveraging AI to optimize grid performance, forecast energy demand, and manage assets in harsh environments. Meanwhile, transportation and logistics providers are integrating AI to improve route planning, automate fleet management, and enhance last-mile delivery accuracy. Across all these sectors, the ability to unify vast datasets, extract actionable insights, and automate decisions is giving early adopters of enterprise AI a measurable edge in cost efficiency, speed, and innovation.

What’s Fueling the Growth in the Enterprise AI Market?

The growth in the enterprise AI market is driven by several factors that stem from both technological maturity and strategic imperatives across industries. First, the exponential rise in data volume - originating from IoT devices, digital transactions, customer interactions, and internal systems - requires intelligent solutions to harness its full value. AI platforms capable of processing structured and unstructured data at scale are becoming indispensable for organizations seeking to convert raw data into strategic insights. Second, advancements in cloud infrastructure, edge computing, and open-source AI tools are making enterprise-grade AI solutions more accessible, affordable, and deployable across both large enterprises and mid-market organizations.Another key driver is the growing adoption of hybrid and remote work models, which demand intelligent automation and enhanced digital workflows to maintain productivity and collaboration. As organizations prioritize agility, scalability, and resilience, enterprise AI is being embedded into digital transformation roadmaps to support real-time decision-making, cost optimization, and risk mitigation. The increasing sophistication of low-code/no-code AI development platforms is also democratizing AI across business units, allowing non-technical users to build and deploy AI models tailored to their functional needs.

Additionally, regulatory pressures and rising expectations for ethical AI are prompting enterprises to invest in explainable AI, model governance, and auditability - further strengthening enterprise readiness and trust in AI systems. Finally, competitive pressure to innovate, reduce time-to-market, and improve customer experience is pushing organizations to treat AI not as an add-on but as a strategic capability. Together, these drivers are setting the stage for exponential growth in enterprise AI, positioning it as a cornerstone of the intelligent enterprise of the future.

SCOPE OF STUDY:

The report analyzes the Enterprise Artificial Intelligence (AI) market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Technology (Natural Language Processing (NLP), Machine Learning, Computer Vision, Speech Recognition, Other Technologies); Deployment (Cloud, On-Premise); End-User (IT & Telecom, Retail, BFSI, Media & Advertising, Healthcare, Automotive & Transportation, Other End-Users)

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Language Processing (NLP) segment, which is expected to reach US$65.8 Billion by 2030 with a CAGR of a 34.2%. The Machine Learning segment is also set to grow at 31.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.3 Billion in 2024, and China, forecasted to grow at an impressive 30.9% CAGR to reach $23.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Enterprise Artificial Intelligence (AI) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Enterprise Artificial Intelligence (AI) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Enterprise Artificial Intelligence (AI) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as C3.ai, Inc., Capacity, Dataiku, Inc., Defined.ai, Hewlett Packard Enterprise Development LP (HPE) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 40 companies featured in this Enterprise Artificial Intelligence (AI) market report include:

- C3.ai, Inc.

- Capacity

- Dataiku, Inc.

- Defined.ai

- Hewlett Packard Enterprise Development LP (HPE)

- IBM Corporation

- Infor

- Intellectsoft

- LeewayHertz

- NVIDIA Corporation

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- C3.ai, Inc.

- Capacity

- Dataiku, Inc.

- Defined.ai

- Hewlett Packard Enterprise Development LP (HPE)

- IBM Corporation

- Infor

- Intellectsoft

- LeewayHertz

- NVIDIA Corporation

Table Information

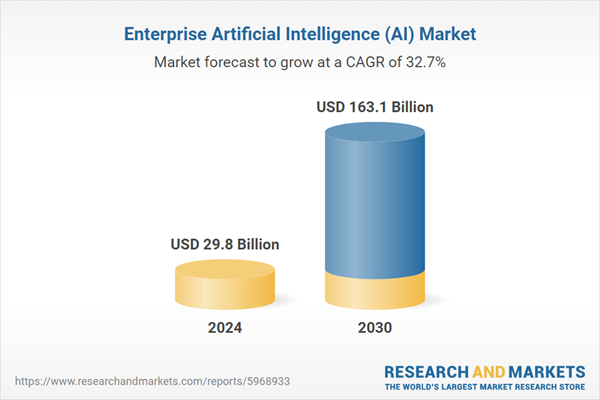

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 29.8 Billion |

| Forecasted Market Value ( USD | $ 163.1 Billion |

| Compound Annual Growth Rate | 32.7% |

| Regions Covered | Global |