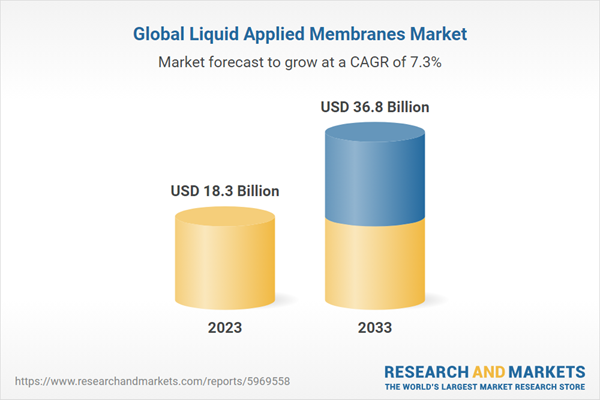

The global liquid applied membranes market reached a value of nearly $18.3 billion in 2023, having grown at a compound annual growth rate (CAGR) of 4% since 2018. The market is expected to grow from $18.3 billion in 2023 to $ 25.7 billion in 2028 at a rate of 7%. The market is then expected to grow at a CAGR of 7.5% from 2028 and reach $36.8 billion in 2033.

Growth in the historic period resulted from the stringent regulations for energy efficiency and building codes, rapid urbanization, shift towards green building materials and practices and increasing infrastructure development expenditure by governments. Factors that negatively affected growth in the historic period were geo-political tensions and lack of awareness and poor handiwork.

Going forward, the increasing population density and urbanization, growth in residential and commercial construction activities, rapid growth in renovation and remodeling projects and increasing need for protection against weathering and UV radiation will drive the growth. Factor that could hinder the growth of the liquid applied membranes market in the future include limited availability of skilled labor for proper membrane application.

The liquid applied membranes market is segmented by type into elastomeric, cementitious, bituminous and other types. The elastomeric market was the largest segment of the liquid applied membranes market segmented by type, accounting for 44.8% or $8.2 billion of the total in 2023. Going forward, the elastomeric segment is expected to be the fastest growing segment in the liquid applied membranes market segmented by type, at a CAGR of 7.5% during 2023-2028.

The liquid applied membranes market is segmented by application into roofing, walls, underground and tunnels and other applications. The roofing market was the largest segment of the liquid applied membranes market segmented by application, accounting for 43.4% or $7.9 billion of the total in 2023. Going forward, the underground and tunnels segment is expected to be the fastest growing segment in the liquid applied membranes market segmented by application, at a CAGR of 7.6% during 2023-2028.

The liquid applied membranes market is segmented by end-use into residential construction, commercial construction, and public infrastructure. The residential construction market was the largest segment of the liquid applied membranes market segmented by end-use, accounting for 42% or $7.7 billion of the total in 2023. Going forward, the residential construction segment is expected to be the fastest growing segment in the liquid applied membranes market segmented by end-use, at a CAGR of 7.3% during 2023-2028.

Asia Pacific was the largest region in the liquid applied membranes market, accounting for 39.1% or $7.1 billion of the total in 2023. It was followed by North America, Western Europe and then the other regions. Going forward, the fastest-growing regions in the liquid applied membranes market will be Asia Pacific and Western Europe where growth will be at CAGRs of 7.9% and 7% respectively. These will be followed by Eastern Europe and North America where the markets are expected to grow at CAGRs of 6.7% and 6.5% respectively.

The global liquid applied membranes market is fairly fragmented, with a large number of small players operating in the market. The top ten competitors in the market made up to 17.6% of the total market in 2022. Dow Inc was the largest competitor with a 3.8% share of the market, followed by BASF SE with 2.1%, Carlisle Companies Inc with 1.9%, Firestone Building Products with 1.7%, SOPREMA with 1.6%, Saint-Gobain with 1.6%, Henkel Polybit LLC with 1.4%, Sika AG with 1.3%, Mapei SpA with 1.2% and H.B Fuller Construction Products Inc with 1.1%.

The top opportunities in the liquid applied membranes market segmented by type will arise in the elastomeric segment, which will gain $3.6 billion of global annual sales by 2028. The top opportunities in the liquid applied membranes market segmented by application will arise in the roofing segment, which will gain $3.3 billion of global annual sales by 2028. The top opportunities in the liquid applied membranes market segmented by end-use will arise in the residential construction segment, which will gain $3.3 billion of global annual sales by 2028. The liquid applied membranes market size will gain the most in China at $1.8 billion.

Market-trend-based strategies for the liquid applied membranes market include launch of superior liquid applied membrane products, strategic collaborations and acquisitions to provide specialized waterproofing solutions, increasing investments in manufacturing facilities to meet the growing demand, introduction of self-repairing sheet waterproofing products and release of upgraded mobile applications for liquid products.

Player-adopted strategies in the liquid applied membranes market include focus on enhancing its business capabilities through the launch of new products.

To take advantage of the opportunities, the analyst recommends the liquid applied membranes companies to focus on product innovation and performance enhancement, focus on introducing self-repairing sheet waterproofing products, focus on mobile applications for enhanced customer support, focus on elastomeric segment, expand in emerging markets, continue to focus on developed markets, focus on strategic partnerships and collaborations, focus on expanding distribution channels, provide competitively priced offerings, participate in trade shows and events, continue to use B2B promotions, prioritize digital marketing channels, focus on residential construction sector and focus on targeting underground and tunnels segment.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Liquid Applied Membranes Global Market Opportunities and Strategies to 2033 provides the strategists; marketers and senior management with the critical information they need to assess the global liquid applied membranes market as it emerges from the COVID-19 shut down.Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description

Where is the largest and fastest-growing market for liquid applied membranes? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The liquid applied membranes market global report answers all these questions and many more.The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider liquid applied membranes market; and compares it with other markets.

The report covers the following chapters:

- Introduction and Market Characteristics - Brief introduction to the segmentations covered in the market, definitions, and explanations about the liquid applied membranes market.

- Key Trends - Highlights the major trends shaping the liquid applied membranes market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario - The report provides an analysis of the impact of the COVID-19 pandemic, impact of the Russia-Ukraine war and impact of rising inflation on the global and regional markets, providing strategic insights for businesses in the liquid applied membranes market.

- Global Market Size and Global historic (2018-2023) and forecast (2023-2028, 2033F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional Analysis - Historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison by region and country.

- Market Segmentation - Contains the market values (2018-2023) (2023-2028, 2033F) and analysis for each segment by type, by application and by end-use in the market. Historic (2018-2023) and forecast (2023-2028) and (2028-2033) market values and growth and market share comparison by region market.

- Regional Market Size and Growth - Regional market size (2023), historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape - Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Key Mergers and Acquisitions - Information on recent mergers and acquisitions in the market is covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Market Opportunities and Strategies - Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions and Recommendations - This section includes recommendations for liquid applied membranes providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

1) by Type: Elastomeric; Cementitious; Bituminous; Other Types2) by Application: Roofing; Walls; Underground and Tunnels; Other Applications

3) by End Use: Residential Construction; Commercial Construction; Public Infrastructure

Key Companies Mentioned: Dow Inc; BASF SE; Carlisle Companies Inc; Firestone Building Products; SOPREMA

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; Italy; Spain; UK; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; liquid applied membranes indicators comparison

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- Dow Inc

- BASF SE

- Carlisle Companies Inc

- Firestone Building Products

- SOPREMA

- Saint-Gobain

- Henkel Polybit LLC

- Sika AG

- Mapei SpA

- H.B Fuller Construction Products Inc

- Pidilite Industries Limited

- CICO Technologies Limited

- Shenzhen Landun Holding Co

- GCP Applied Technologies Inc

- Carlisle Companies Inc

- DuPont

- Paul Bauder

- Mapei S.p.A. (Italy)

- BASF SE (Germany)

- SOPREMA S.A.S.(France)

- Saint-Gobain Corporation (France)

- MBCC Group (Germany)

- PPG Industries Inc

- BASF SE

- Emulbit Sp. z o.o

- Fatra S.A

- Weber Saint-Gobain Polska Sp. z o.o

- TechnoNICOL Corporation

- GAF Materials Corporation

- Carlisle Construction Materials

- Tremco Incorporated

- Henry Company

- Firestone Building Products

- BASF Corporation

- Polyglass USA

- Western Colloid

- Soprema Inc

- IKO Industries

- Grupo Mapei Mexico

- Meximper

- Construcolor Mexico

- Viapol Ltda

- Elastomax Impermeabilizações

- Geotex Brasil

- KÖSTER Argentina

- Grupo Habita

- DVP Chile

- Tecnocoat Chile

- Impermeabilizaciones y Recubrimientos de Colombia (IMPERCOL)

- Pintuco

- Pinturas Vencedor

- Edilcor

- Rav Bariach

- Kimia Israel

- Yemal Israel

- Sika Saudi Arabia

- Al-Khaleej Training and Education

- Al Watania for Industries (WATANIYA)

- Alchimica Building Chemicals

- Kemper Middle East

- Almuftah Group

- Qatar Insulation Company

- Polimoon Kalıp ve Plastik Sanayi A.S

- Imperbel Egypt

- Chemical & Allied Products (CAP) Plc

- Pidilite Industries Nigeria Limited

- TAL

- Dumuzas

- Roko Construction Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 298 |

| Published | May 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 18.3 Billion |

| Forecasted Market Value ( USD | $ 36.8 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 69 |