Speak directly to the analyst to clarify any post sales queries you may have.

MARKET DRIVERS

Growing Preference for Lightweight & Compact Gear: Modern campers prioritize convenience and portability. Lightweight and compact camping sleeping bags allow them to explore without feeling burdened. Ultralight camping sleeping bags, designed to weigh significantly less than traditional ones, are ideal for backpackers covering long distances. Compact camping sleeping bags with innovative designs compress into small packages, saving valuable space in backpacks. Collapsible cookware, foldable pots, cups, and utensils allow campers to enjoy hot meals without sacrificing space. Even furniture like compact chairs, tables, and hammocks enhance comfort without adding bulk.Increasing Participation in Outdoor Recreational Activities: The surge in outdoor recreational activities has significantly influenced the camping gear market. As more people seek adventure and solace in nature, the demand for high-quality gear has risen. Hikers exploring national parks, climbers conquering peaks, water sports enthusiasts paddling down rivers, and cyclists embarking on bikepacking trips require specialized gear. Whether it's durable tents, insulated camping sleeping bags, lightweight backpacks, or safety harnesses, the market caters to diverse outdoor pursuits that market players can address.

U.S. CAMPING SLEEPING BAGS MARKET HIGHLIGHTS

- The mummy camping sleeping bags segment holds the largest share, with over 55% of the U.S. market in 2023. The segmental growth is primarily due to its compact design and lightweight, which is well-suited and more favorable for backpackers and hikers. The versatility of mummy bags makes them suitable even for extreme conditions and specialized activities like alpine climbing and winter camping, presenting an opportunity for niche market penetration and premium pricing strategies.

- The hybrid insulation segment showcases the highest growth rate in the U.S. market, with a CAGR of 7.20% by revenue during the forecast period. Hybrid insulation camping sleeping bags combine the best attributes of down and synthetic materials. They balance warmth, weight, and moisture resistance, making them versatile for various camping conditions and environments, thus growing the segment.

- The one-season segment shows significant growth, with the fastest-growing CAGR in the U.S. camping sleeping bags market. This growth is primarily due to its lightweight and breathable insulation. It is suitable for mild temperatures and caters to campers engaged in summer backpacking trips, music festivals, and outdoor events.

- The individual end-user segment dominates the U.S. camping sleeping bags market share. The individual end-user segment represents the largest segment comprising outdoor enthusiasts, backpackers, and recreational campers who purchase sleeping bags for personal use during camping trips, hiking excursions, and outdoor adventures, thus helping the segment to grow.

- The landscape of sleeping bag innovation extends beyond mere convenience, delving into advanced technology to redefine the camping experience. Brands such as Feathered Friends prioritize lightweight designs and integrate intelligent features. Smartphone-controlled heating elements allow campers to regulate the temperature inside their sleeping bags, providing comfort. This ongoing pursuit of innovation underscores the industry's commitment to staying at the forefront of technological advancements and meeting consumers' evolving expectations.

- There is a growing emphasis on the sustainability market, with environmentally conscious practices becoming integral to brand identity. Market players such as Katabatic Gear and Western Mountaineering exemplify this commitment by adopting eco-friendly materials and manufacturing processes. Using recycled materials in sleeping bag construction addresses waste and resource depletion concerns. By embracing sustainability, these brands contribute to environmental conservation and tap into a growing market segment seeking products aligned with their values.

VENDOR LANDSCAPE

The U.S. camping sleeping bags market report contains exclusive data on 31 vendors. The U.S. camping sleeping bags market's competitive scenario is intensifying, with global and domestic players offering a diverse range of products. Regarding market share, a few major players are currently dominating the market. Some companies that are currently dominating the market are Big Agnes, Exxel Outdoors, Marmot, REI, and Mountain Hardwear.In 2023, Therm-a-Rest, one of the prominent vendors, introduced the Space Cowboy 45-Degree Synthetic Mummy Sleeping Bag. This bag showcases innovation by seamlessly combining a lightweight design with synthetic insulation, catering to warm-weather camping enthusiasts. The use of synthetic materials not only ensures durability but also enhances moisture resistance, addressing common challenges faced during summer expeditions. This strategic launch in July reflects Therm-a-Rest's commitment to meeting seasonal demands and providing campers with a reliable option for summer adventures.

SEGMENTATION & FORECAST

- By Product

- Mummy Sleeping Bags

- Rectangular Sleeping Bags

- Others

- By Insulation

- Synthetic

- Down

- Hybrid

- By Season

- 1 Season

- 2 Season

- 3-Season & above

- By End-users

- Individual

- Government & Defences

- Event Organizers

VENDORS LIST

Key Vendors

- Big Agnes

- Exxel Outdoors

- Marmot

- Mountain Hardwear

- REI

Other Prominent Vendors

- Black Diamond

- The Coleman Company

- The North Face

- Johnson Outdoors

- Decathlon

- ALPS Mountaineering

- Western Mountaineering

- Cascade Designs

- Feathered Friends

- Retrospec

- Montbell

- Outdoor Vitals

- Snugpak

- Patagonia

- Eddie Bauer

- Wiggy's

- NEMO Equipment

- TETON

- Jack Wolfskin

- Zpacks

- Warmlite

- Sea to Summit

- Salewa

- EXPED

- Butler Bags

- Rab

KEY QUESTIONS ANSWERED

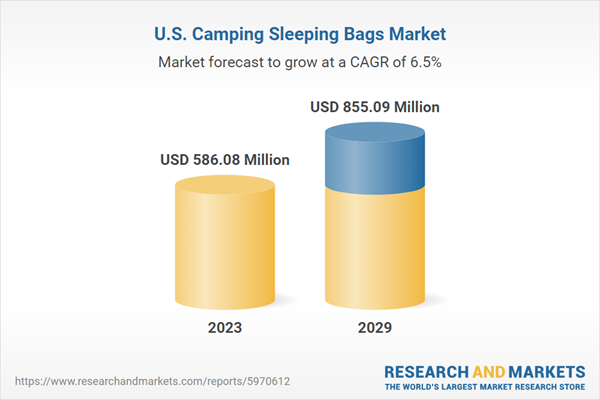

1. How big is the U.S. camping sleeping bags market?2. What is the U.S. camping sleeping bag market's growth rate?

3. What are the key drivers of the U.S. camping sleeping bags market?

4. Who are the major U.S. camping sleeping bag market players?

Table of Contents

Companies Mentioned

- Big Agnes

- Exxel Outdoors

- Marmot

- Mountain Hardwear

- REI

- Black Diamond

- The Coleman Company

- The North Face

- Johnson Outdoors

- Decathlon

- ALPS Mountaineering

- Western Mountaineering

- Cascade Designs

- Feathered Friends

- Retrospec

- Montbell

- Outdoor Vitals

- Snugpak

- Patagonia

- Eddie Bauer

- Wiggy's

- NEMO Equipment

- TETON

- Jack Wolfskin

- Zpacks

- Warmlite

- Sea to Summit

- Salewa

- EXPED

- Butler Bags

- Rab

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 92 |

| Published | May 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 586.08 Million |

| Forecasted Market Value ( USD | $ 855.09 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 31 |