Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This strong market demand is mirrored by substantial financial turnover in major industrial regions. For instance, the ZVEI Automation Association reported that the process automation industry in Germany achieved a turnover of 26.8 billion euros in 2024, highlighting the significant capital flow into these essential technologies. However, a major hurdle restricting wider market growth is the substantial initial capital expenditure required for purchasing and installing these sophisticated systems. This financial obstacle, compounded by the recurring costs of specialized maintenance and technical training, continues to restrict adoption among price-sensitive small and medium-sized enterprises.

Market Drivers

A growing focus on process optimization and efficiency serves as a key accelerator for the Global Process Analyzer Market, especially in resource-heavy industries such as chemicals and petrochemicals. Manufacturers are actively deploying continuous monitoring systems to curtail raw material wastage, lower energy usage, and boost throughput while maintaining safety standards. This pursuit of operational excellence is demonstrated by significant capital investments in production infrastructure upgrades. As noted by the American Chemistry Council in their 'Mid-Year Situation & Outlook' from June 2025, capital expenditure on chemical industry projects increased by 3.9% to 39 billion dollars in 2024, signaling the sector's dedication to modernizing facilities with advanced instrumentation, which directly stimulates demand for analyzers providing real-time compositional data.The swift uptake of Industry 4.0 and smart manufacturing further drives market expansion by requiring the integration of intelligent analytical devices into digital plant ecosystems. Industrial operators are increasingly depending on AI-powered analyzers that offer predictive maintenance insights and seamless connectivity to central control systems, thereby improving decision-making processes. This digital transformation is generating substantial revenue for technology providers focused on smart measurement solutions. For example, Emerson Electric Co. reported in its 'Fiscal 2025 Investor Summary' from November 2025 that net sales for its Intelligent Devices segment hit 12.4 billion dollars in fiscal 2025. This trend is supported by broader industrial momentum, as evidenced by Siemens reporting a 28 percent increase in orders to 24.7 billion euros during the third quarter of fiscal year 2025, highlighting the strong global demand for automation and industrial technologies.

Market Challenges

The substantial initial capital expenditure required to procure and install complex process analyzer systems acts as a major restraint limiting the broader growth of the global market. These instruments demand significant upfront investment not only for the hardware itself but also for integrating them into existing production infrastructures, a process that frequently involves costly customization and operational downtime. Moreover, the total cost of ownership is markedly increased by operational expenses associated with specialized maintenance and the technical training needed for staff to manage these sensitive instruments effectively. This severe financial load compels many budget-conscious small and medium-sized enterprises to postpone adoption or persist with slower, off-line laboratory testing methods, thereby narrowing the market's reach in price-sensitive sectors.This financial hurdle becomes particularly damaging during times of economic tightening, when constrained capital budgets reduce the capacity of industrial manufacturers to fund instrumentation upgrades. The effect of such fiscal limitations is visible in recent investment trends within key user industries. According to the American Chemistry Council, capital spending growth in the U.S. chemical industry was projected to decelerate to 2.3% in 2024, as elevated borrowing costs and economic uncertainty suppressed investment activities. This slowdown in capital expenditure directly impedes the purchase of auxiliary technologies such as process analyzers, as manufacturers are forced to favor essential operational costs over acquiring advanced monitoring systems, consequently stalling market momentum.

Market Trends

The focus on Carbon Capture and Green Chemistry Monitoring Applications is transforming the market as industries increasingly prioritize decarbonization efforts. Manufacturers now require high-precision analyzers to track CO2 capture efficiency and ensure the purity of green hydrogen, creating a need for instrumentation that can withstand novel renewable energy process conditions. The magnitude of this opportunity is highlighted by recent surges in investment; according to the Hydrogen Council's 'Hydrogen Insights 2024' report from September 2024, committed capital for clean hydrogen projects reaching the final investment decision stage increased to 75 billion dollars. This capital influx fuels the demand for specialized process analytical technology necessary to uphold the safety and quality standards of emerging green energy infrastructure.Concurrently, advancements in Non-Contact Laser-Based Spectroscopy are gaining traction, gradually replacing traditional extractive methods that demand frequent maintenance. Technologies such as Tunable Diode Laser Absorption Spectroscopy (TDLAS) are becoming preferred for real-time, in-situ measurements because they eliminate the need for sample handling systems, thereby significantly lowering operational costs in harsh environments.

Major industry players are actively broadening their portfolios to accommodate this shift toward optical solutions. For instance, ABB reported in its 'Q3 2024 results' from October 2024 that it acquired the Födisch Group to strengthen its Measurement & Analytics division, adding roughly 55 million dollars in annual revenues from advanced emission measurement. This acquisition highlights the strategic move toward robust, non-contact analytical systems over legacy measurement techniques.

Key Players Profiled in the Process Analyzer Market

- ABB Ltd.

- Endress+Hauser AG

- Siemens AG

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

- Emerson Electric Co.

- Danaher Corporation

- Mettler-Toledo International Inc.

- SUEZ SA

- Honeywell International Inc.

Report Scope

In this report, the Global Process Analyzer Market has been segmented into the following categories:Process Analyzer Market, by Liquid Analyzer:

- pH/ORP Analyzer

- Conductivity Analyzer

- Turbidity Analyzer

- Dissolved Oxygen Analyzer

- Liquid Density Analyzer

- MLSS Analyzer

- TOC Analyzer

Process Analyzer Market, by Gas Analyzer:

- Oxygen Analyzer

- Carbon Dioxide Analyzer

- Moisture Analyzer

- Toxic Gas Analyzer

- Hydrogen Sulfide Analyzer

Process Analyzer Market, by Industry:

- Oil & Gas

- Petrochemicals

- Pharmaceuticals

- Water & Wastewater

- Power

- Food & Beverages

- Paper & Pulp

- Others

Process Analyzer Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Process Analyzer Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Process Analyzer market report include:- ABB Ltd

- Endress+Hauser AG

- Siemens AG

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

- Emerson Electric Co.

- Danaher Corporation

- Mettler-Toledo International Inc.

- SUEZ SA

- Honeywell International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

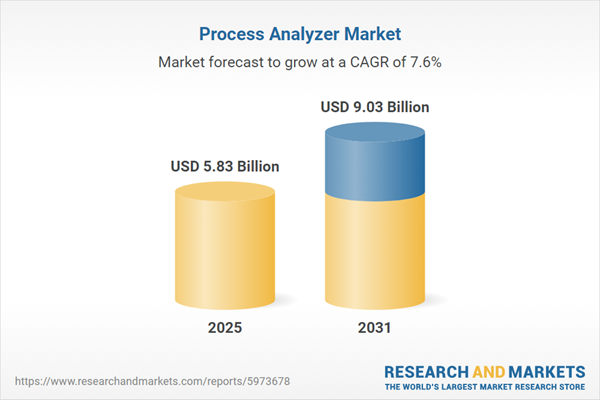

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 5.83 Billion |

| Forecasted Market Value ( USD | $ 9.03 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |