Aero Structure Equipment - Key Trends and Drivers

Aero structure equipment plays a pivotal role in the construction, maintenance, and operational integrity of aircraft. This category of equipment includes a diverse array of components such as flight control surfaces, fuselage, wings, and landing gear. The equipment is utilized across various sectors, including commercial aviation, military planes, and helicopters, ensuring these aircraft remain operational, safe, and efficient. Aero structure equipment encompasses specialized machinery and tools used in manufacturing and testing processes. As the commercial aviation sector continues to expand, driven by the increasing number of passengers opting for air travel annually, the demand for reliable and advanced aero structure equipment becomes even more pronounced. The aerospace industry is poised to benefit from the development of new materials and manufacturing techniques that promise to enhance the efficiency, performance, and sustainability of aircraft. As demand for air travel increases and the need for more fuel-efficient and environmentally friendly aircraft grows, the aero structure equipment market is set to experience significant growth and innovation.The growth of the aero structure equipment market is significantly influenced by advancements in nanotechnology, particularly the integration of nanocomposites in airframe manufacturing. This technology is transforming the aerospace industry by enabling the production of lighter, stronger, and more fuel-efficient aircraft. The use of nanocomposites aligns with the industry's efforts to address global environmental challenges by reducing carbon emissions and enhancing fuel efficiency. Aerospace stakeholders and airlines are increasingly adopting energy-efficient technologies and lightweight materials to achieve these goals. Since the late 1990s, substantial efforts have been made to diminish fuel consumption during various phases of flight, including takeoff, cruising, landing, and taxiing. Nanotechnology facilitates these improvements by allowing for the replacement of traditional bulk metals with advanced materials that offer high mechanical strength and multifunctional properties. This shift not only supports the production of technologically advanced aircraft but also drives significant investments from Original Equipment Manufacturers (OEMs) and airlines in adopting and integrating nanotechnology into their manufacturing processes.

Emerging trends in the aero structure equipment market highlight the development of adaptive ailerons and the increasing application of morphing techniques in aircraft design. Adaptive ailerons represent a groundbreaking innovation that has the potential to revolutionize next-generation aircraft by enhancing their aerodynamic efficiency and reducing drag. Collaborative efforts between scientists from Italy and Canada have led to the development of this concept, which integrates various morphing techniques into a wing-tip prototype. European Commission-funded projects, such as Clean Sky Joint Technology Initiative (JTI) and SARISTU, have demonstrated that wing trailing edge morphing can achieve significant drag reduction in off-design flight points. This is accomplished through chord-wise camber variations in the aircraft wing's airfoil, leveraging weight reduction and consequently reducing fuel consumption. Researchers are exploring ways to implement these structural adaptations in the flap region without compromising the aileron's primary function of ensuring the aircraft's longitudinal stability.

Report Scope

The report analyzes the Aero Structure Equipment market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Offering (Retrofit Equipment, New Equipment, Services); End-Use (Commercial Aircraft End-Use, Military Aircraft End-Use, Other Aircraft End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Retrofit Equipment segment, which is expected to reach US$554.5 Million by 2030 with a CAGR of a 6.7%. The New Equipment segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $218.6 Million in 2024, and China, forecasted to grow at an impressive 10.3% CAGR to reach $255.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aero Structure Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aero Structure Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aero Structure Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

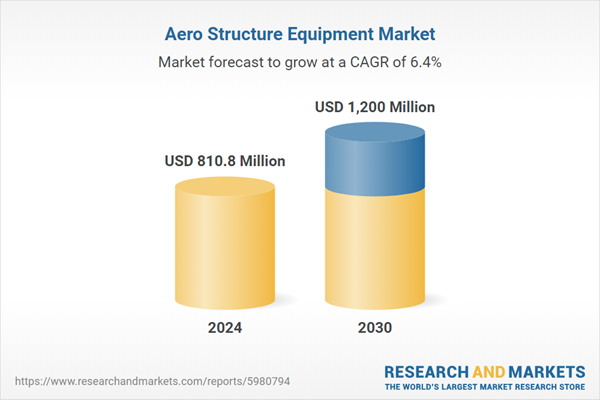

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advance Integration Technologies, Airbus Sas, Ascent Aerospace, LLC, Boeing Company, The, Broetje-Automation GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Aero Structure Equipment market report include:

- Advance Integration Technologies

- Airbus Sas

- Ascent Aerospace, LLC

- Boeing Company, The

- Broetje-Automation GmbH

- Danobat Group

- Electrolmpact, Inc.

- Hyde Group Limited

- Janicki Industries, Inc.

- Lee Aerospace

- LISI Aerospace

- MTorres Diseños Industriales SAU

- RUAG AG

- Spirit Aerosystems, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advance Integration Technologies

- Airbus Sas

- Ascent Aerospace, LLC

- Boeing Company, The

- Broetje-Automation GmbH

- Danobat Group

- Electrolmpact, Inc.

- Hyde Group Limited

- Janicki Industries, Inc.

- Lee Aerospace

- LISI Aerospace

- MTorres Diseños Industriales SAU

- RUAG AG

- Spirit Aerosystems, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 290 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 810.8 Million |

| Forecasted Market Value ( USD | $ 1200 Million |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |