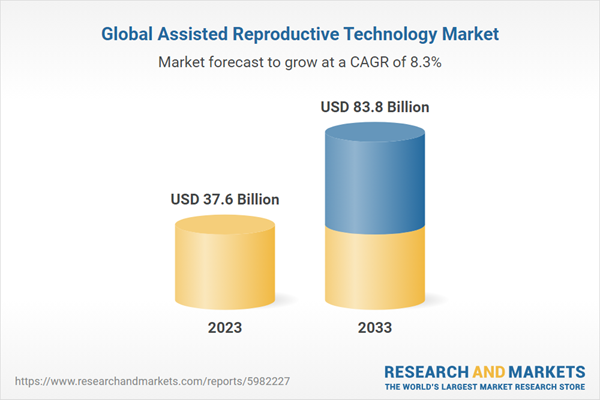

The global assisted reproductive technology market reached a value of nearly $37.6 billion in 2023, having grown at a compound annual growth rate (CAGR) of 5.6% since 2018. The market is expected to grow from $37.6 billion in 2023 to $55.91 billion in 2028 at a rate of 8.3%. The market is then expected to grow at a CAGR of 8.4% from 2028 and reach $83.8 billion in 2033.

Growth in the historic period resulted from the increasing prevalence of PCOS (polycystic ovary syndrome), growing trend of late parenthood, increase in same-sex couples, rise in male infertility and increased healthcare expenditure. Factors that negatively affected growth in the historic period were high cost of fertility services and low success rates of IVF.

Going forward, the technological developments, growing prevalence of obesity, rising number of infertility cases, increasing government initiatives and funding and rise in disposable income will drive the market. Factors that could hinder the growth of the assisted reproductive technology market in the future include stringent government policies and high cost of treatment.

The assisted reproductive technology (ART) market is segmented by technology into in vitro-fertilization (IVF), artificial insemination (AI-IUI) and other technologies. The in vitro-fertilization (IVF) market was the largest segment of the assisted reproductive technology (ART) market segmented by technology, accounting for 83.2% or $26.12 billion of the total in 2023. Going forward, the artificial insemination (AI-IUI) segment is expected to be the fastest growing segment in the assisted reproductive technology (ART) market segmented by technology, at a CAGR of 10.4% during 2023-2028.

The assisted reproductive technology (ART) market is segmented by procedure type into fresh non-donor, fresh donor, frozen donor, frozen non-donor and embryo or egg banking. The fresh non-donor market was the largest segment of the assisted reproductive technology (ART) market segmented by procedure type, accounting for 48.5% or $15.22 billion of the total in 2023. Going forward, the embryo or egg banking segment is expected to be the fastest growing segment in the assisted reproductive technology (ART) market segmented by procedure type, at a CAGR of 10.7% during 2023-2028.

The assisted reproductive technology market is segmented by end-user into hospitals, fertility clinics and other end-users. The fertility clinics market was the largest segment of the assisted reproductive technology market segmented by end-user, accounting for 48% or $18.06 billion of the total in 2023. Going forward, the fertility clinics segment is expected to be the fastest growing segment in the assisted reproductive technology market segmented by end-user, at a CAGR of 9% during 2023-2028.

The assisted reproductive technology (ART) testing market is segmented by ART testing/diagnosis into in ovulation testing, hysterosalpingography, ovarian reserve testing, genetic testing and other tests. The other tests market was the largest segment of the assisted reproductive technology (ART) testing market segmented by ART testing/diagnosis, accounting for 33.3% or $2.07 billion of the total in 2023. Going forward, the other tests segment is expected to be the fastest growing segment in the assisted reproductive technology (ART) testing market segmented by ART testing/diagnosis, at a CAGR of 6.6% during 2023-2028.

The other tests market is segmented by ART diagnosis/testing into in computer assisted semen analysis (CASA), sperm penetration assay, microscopic examination and others testing/diagnosis. The computer assisted semen analysis (CASA) market was the largest segment of the assisted reproductive technology market segmented by ART testing/diagnosis, accounting for 52.4% or $1.08 billion of the total in 2023. Going forward, the sperm penetration assay segment is expected to be the fastest growing segment in the assisted reproductive technology market segmented by ART testing/diagnosis, at a CAGR of 8.5% during 2023-2028.

North America was the largest region in the assisted reproductive technology market, accounting for 34.9% or $10.95 billion of the total in 2023. It was followed by Western Europe, Asia-Pacific and then the other regions. Going forward, the fastest-growing regions in the assisted reproductive technology market will be Asia-Pacific and North America, where growth will be at CAGRs of 6.4% and 6.1% respectively. These will be followed by Western Europe and South America, where the markets are expected to grow at CAGRs of 5.6% and 5.3% respectively.

The global assisted reproductive technology market is fairly fragmented, with a large number of players operating in the market. The top ten competitors in the market made up to 17.9% of the total market in 2022. Vitrolife was the largest competitor with a 9.8% share of the market, followed by Ferring B.V. with 3.7%, Progyny Inc. with 1.5%, CooperSurgical Inc. with 1.2%, FUJIFILM Irvine Scientific, Inc. with 1.1%, Monash IVF Group with 0.4%, Hamilton Thorne Inc. with 0.2%, Genea Limited with 0.1%, IVI-RMA with 0.01% and Bloom IVF Centre with 0.01%.

The top opportunities in the assisted reproductive technology (ART) market segmented by technology will arise in the in vitro-fertilization (IVF) segment, which will gain $13.22 billion of global annual sales by 2028. The top opportunities in the assisted reproductive (ART) technology market segmented by procedure type will arise in the fresh non-donor segment, which will gain $8.01 billion of global annual sales by 2028. The top opportunities in the assisted reproductive technology market segmented by end-user will arise in the fertility clinics segment, which will gain $9.73 billion of global annual sales by 2028. The top opportunities in the assisted reproductive technology (ART) testing market segmented by ART testing/diagnosis will arise in the other tests segment, which will gain $785.5 million of global annual sales by 2028. The top opportunities in the other tests market segmented by ART testing/diagnosis will arise in the computer assisted semen analysis (CASA) segment, which will gain $430.6 million of global annual sales by 2028. The assisted reproductive technology market size will gain the most in the USA at $4.55 billion.

Market-trend-based strategies for the assisted reproductive technology market include key players launching innovative programs to promote art and support sustainability, impact of artificial intelligence on assisted reproductive technology, advanced technological solutions in assisted reproductive technology, blockchain integration in assisted reproductive technology, strategic collaborations driving innovation in assisted reproductive technology and innovative fertility treatment options to enhance access to care.

Player-adopted strategies in the assisted reproductive technology market include focus on expanding business expertise through strategic acquisitions and strategic partnerships, strengthening business capabilities through new product platforms, enhancing business operations through new product developments and strengthening business capabilities through new product launches.

To take advantage of the opportunities, the analyst recommends the assisted reproductive technology companies to focus on tailored organoid solutions for biotherapeutic research, focus on advanced technological solutions for enhanced fertility, focus on integrating ai for enhanced IVF treatment, focus on innovative fertility treatment options, focus on IVF (in vitro-fertilization) and AI-IUI (artificial insemination) segments, focus on fresh non-donor and embryo or egg banking segments, expand in emerging markets, continue to focus on developed markets, focus on strategic collaborations for enhanced IVF processes, provide competitively priced offerings, continue to use B2B promotions, focus on innovative patient-centric initiatives and focus on fertility clinics segment.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Assisted Reproductive Technology Global Market Opportunities and Strategies to 2033 provides the strategists; marketers and senior management with the critical information they need to assess the global assisted reproductive technology market as it emerges from the COVID-19 shut down.Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description

Where is the largest and fastest-growing market for assisted reproductive technology? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The assisted reproductive technology market global report answers all these questions and many more.The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider assisted reproductive technology market; and compares it with other markets.

The report covers the following chapters:

- Introduction and Market Characteristics - Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by technology, by diagnosis/testing, by procedure type and by end-user.

- Key Trends - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario - The report provides an analysis of the impact of the COVID-19 pandemic, impact of the Russia-Ukraine war and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the assisted reproductive technology market.

- Global Market Size and Growth - Global historic (2018-2023) and forecast (2023-2028, 2033F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional and Country Analysis - Historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison by region and country.

- Market Segmentation - Contains the market values (2018-2023) (2023-2028, 2033F) and analysis for each segment by technology, by diagnosis/testing, by procedure type and by end-user in the market. Historic (2018-2023) and forecast (2023-2028) and (2028-2033) market values and growth and market share comparison by region market.

- Regional Market Size and Growth - Regional market size (2023), historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape - Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Competitive Benchmarking - Briefs on the financials comparison between major players in the market.

- Competitive Dashboard - Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions - Information on recent mergers and acquisitions in the market is covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Market Opportunities and Strategies - Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions and Recommendations - This section includes recommendations for assisted reproductive technology providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

1) by Technology: in Vitro-Fertilization (IVF); Artificial Insemination (AI-IUI); Other Technologies2) by Procedure Type: Fresh Non-Donor; Fresh Donor; Frozen Donor; Frozen Non-Donor; Embryo or Egg Banking

3) by End-User: Hospitals; Fertility Clinics; Other End-Users

4) by Testing/Diagnosis: in Ovulation Testing; Hysterosalpingography; Ovarian Reserve Testing; Genetic Testing; Other Tests

Key Companies Mentioned: Vitrolife; Ferring B.V.; Progyny Inc.; CooperSurgical Inc.; FUJIFILM Irvine Scientific, Inc.

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; Italy; Spain; UK; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; assisted reproductive technology indicators comparison.

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- Vitrolife

- Ferring B.V.

- Progyny Inc.

- CooperSurgical Inc.

- FUJIFILM Irvine Scientific, Inc.

- Monash IVF Group

- Hamilton Thorne Inc.

- Genea Limited

- IVI-RMA

- Bloom IVF Centre

- Jinxin Fertility Group Limited

- Amcare

- Beijing United Family Hospital

- Reproductive & Genetic Hospital CITIC-XIANGYA

- OvaScience Shanghai

- Shanghai Ji Ai Genetics & IVF Institute

- Guangzhou Women and Children's Medical Center

- Shenzhen Zhongshan Urology Hospital

- Shanghai Ninth People's Hospital

- Nova IVI Fertility

- Manipal Fertility

- Indira IVF

- Milann

- Origio Japan K.K

- Eizai

- Konica Minolta Healthcare

- Fuso Pharmaceutical Industries, Ltd

- Tokai Hit

- IVF Korea

- CHA Fertility Center

- Fertility Center of CHA Gangnam Medical Center

- Virtus Health

- Fertility First

- Queensland Fertility Group

- Morula IVF

- PrimaNest

- Hermina IVF Center

- Fertility Clinic Jakarta

- EUGIN Group

- Clinique de la Muette

- FIV Paris-Nord

- IVI Clinic

- Groupe NATEC Medical

- Medistim

- Medfem Clinic

- StorkKlinik

- Fertility Center Berlin

- Barcelona IVF

- Instituto Bernabeu

- Ginemed

- Livio Fertilitetscentrum

- Stockholm IVF

- Gothenburg University Hospital

- Västerås Hospital

- Uppsala University Hospital

- Fertility Clinic GENEVA

- Swiss Fertility Center

- Kinderwunschzentrum Zürich

- Basel Fertility Clinic

- Lausanne Fertility Clinic

- Reprogenetics Italia

- Bologna Fertility Center

- Roma Fertility Clinic

- Naples Fertility Clinic

- Milan Fertility Clinic

- Care Fertility Group

- The Lister Fertility Clinic

- Create Fertility

- London Women's Clinic

- Manchester Fertility

- European Medical Center (EMC)

- Nova Clinic

- IVI Russia

- MD Medical Group

- Mother and Child

- MedLife

- Regina Maria

- Fertilia Clinic

- Biogenis Clinic

- Genesys Fertility Center

- INVICTA Fertility Clinics

- InviMed

- Gyncentrum

- VitroLive

- Fertility Clinic AVA

- IVF Cube

- Prague Fertility Centre

- IVF Zlin

- IVF ReproGenesis

- Fertimed

- Future Fertility

- IVI RMA

- US Fertility LLC

- Ovation Fertility

- INVO Bioscience Inc.

- Wisconsin Fertility Institute

- Alife Health

- Cook Medical

- Shady Grove Fertility

- Cooper Surgical Inc.

- FertGroup

- Huntington Medicina Reprodutiva

- San Isidro Medicina

- Fertipraxis

- Oya Care

- AIVF

- Gargash Hospital

- Medfem Fertility Clinic

- VitaLab Fertility Clinic

- Cape Fertility Clinic

- Fertility Clinic Johannesburg

- Sandton Fertility Clinic

- The Bridge Clinic

- George's Memorial Medical Centre

- Mart Life Detox Clinic

- Rivers State University Teaching Hospital (RSUTH)

- St. Ives Specialist Hospital

- Nairobi IVF Centre

- Avenue Healthcare Fertility Centre

- Mediheal Group of Hospitals

- The Nairobi Hospital

- Family Fertility Centre

- Fertility Options

- IVF Uganda

- Women's Hospital International and Fertility Centre

- Dr. Salah Dawood Clinic

- Cairo Fertility Clinic

- Nile Fertility Center

- Assiut University Hospital

- Alfa Medical Centre

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 393 |

| Published | July 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 37.6 Billion |

| Forecasted Market Value ( USD | $ 83.8 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 130 |