Strategic Developments Through Acquisitions and Partnerships Fuel South & Central America Surgical Navigation Systems Market

Mergers and acquisitions have become popular growth strategies for businesses. Strategic acquisitions allow companies to diversify their products and services, expand their market share, reach new markets, gain competitive advantage, and so on. A few strategic developments by companies in the surgical navigation systems market are mentioned below.In September 2021, GE Healthcare acquired BK Medical for US$ 1.4 billion. The acquisition would enable GE Healthcare to expand its US$ 3 billion business from diagnostics to surgical and therapeutic interventions, along with reinforcing its surgical navigation capabilities with the help of BK Medical's strong product portfolio. This acquisition would help GE Healthcare simplify decision-making for clinicians, equipping them with lucrative insights to deliver fast and more personalized care for patients undergoing surgery.

In September 2020, Intersect ENT, Inc. announced the acquisition of Fiagon AG, a pioneer in electromagnetic surgical navigation solutions, for US$ 60 million in cash. With this acquisition, Intersect ENT intends to expand its portfolio and geographic reach.

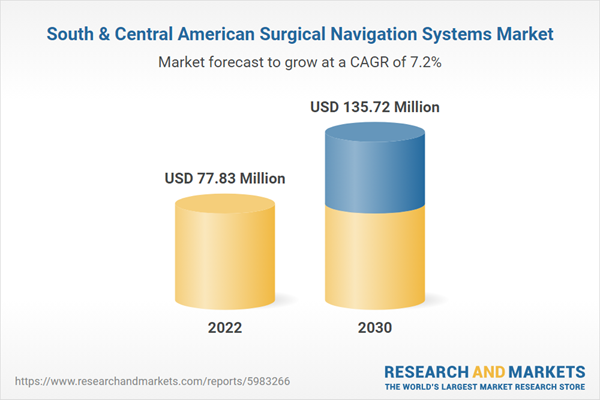

South & Central America Surgical Navigation Systems Market Overview

The South & Central America surgical navigation systems market has been segmented into the Brazil, Argentina, and Rest of South & Central America. The market growth in South & Central America is high attributed to the rising bone-associated disorders.According to the Brazilian Institute of Geography and Statistics (IBGE) report, common orthopedic complications-such as bone wear and weakening among the elderly population-are increasing in Brazil. Therefore, several top companies are launching innovative products related to surgical navigation systems in Brazil. Johnson & Johnson MedTech company is one such example. In August 2022, Johnson & Johnson MedTech launched the"VELYS" Hip Navigation System in Brazil. The newly launched product is a digital solution intended for simplifying hip arthroplasty surgeries that can reduce the procedure time by 40 minutes.

Around 2,000 liver transplants are annually performed in Brazil due to hepatocellular carcinoma (HCC) or decompensated cirrhosis. In 2022, 2,118 liver transplants were performed in Brazil, as per the American Society of Clinical Oncology 2023 report. Therefore, with the rising liver surgery in Brazil, the demand for surgical navigation systems is high. While performing liver surgery, the incorporation of a hepatic navigation system assists surgeons in performing better and safer operations, with fewer surgery-related complications, less risk of bleeding, and chances of cure at a lower cost. Such factors mentioned above are responsible for the influential growth of the surgical navigation system in Brazil.

South & Central America Surgical Navigation Systems Market Segmentation

The South & Central America Surgical Navigation Systems Market is segmented based on type, application, end user, and country.Based on type, the South & Central America surgical navigation systems market is segmented into optical navigation system, electromagnetic navigation system, hybrid navigation system, fluoroscopy navigation system, CT-based navigation system, and other navigation system. The electromagnetic navigation system segment held the largest South & Central America surgical navigation systems market share in 2022.

In terms of application, the South & Central America surgical navigation systems market is categorized into orthopedic, ENT, neurology, dental, and others. The orthopedic segment held the largest South & Central America surgical navigation systems market share in 2022.

By end-user, the South & Central America surgical navigation systems market is bifurcated into hospitals and ASCs. The hospitals segment held a larger South & Central America surgical navigation systems market share in 2022.

Based on country, the South & Central America surgical navigation systems market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America surgical navigation systems market in 2022.

B Braun SE, Medtronic Plc, Siemens Healthineers AG, Stryker Corp, Zimmer Biomet Holdings Inc, Corin Group, and GE HealthCare Technologies Inc are some of the leading companies operating in the South & Central America surgical navigation systems market.

Table of Contents

Companies Mentioned

- B Braun SE

- Corin Group

- GE HealthCare Technologies Inc

- Medtronic Plc

- Siemens Healthineers AG

- Stryker Corp

- Zimmer Biomet Holdings Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | May 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 77.83 Million |

| Forecasted Market Value ( USD | $ 135.72 Million |

| Compound Annual Growth Rate | 7.2% |

| No. of Companies Mentioned | 7 |