Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry faces a significant obstacle regarding the scalability of biomanufacturing, as moving from laboratory settings to commercial production presents intricate technical and economic difficulties. Despite these constraints, investment activity remains robust, underscoring strong stakeholder confidence in the sector's commercial possibilities. Data from SynBioBeta indicates that in 2024, global venture capital investment in synthetic biology reached $12.2 billion, signaling renewed financial confidence and an ongoing dedication to advancing these technologies toward market maturity.

Market Drivers

The integration of artificial intelligence and machine learning acts as a transformative driver for the global synthetic biology market, fundamentally changing the pace and precision of biological engineering. These computational tools facilitate the predictive modeling of intricate biological systems, enabling researchers to design new proteins and interactions without the need for extensive trial-and-error experimentation. This technological convergence notably accelerates applications in drug discovery and material science by interpreting biological data previously considered too complex for efficient analysis. For instance, Google DeepMind reported in a May 2024 blog post that its AlphaFold 3 model achieved at least a 50% increase in prediction accuracy for protein interactions compared to earlier methods, a level of precision that lowers development costs and timelines, thus promoting wider industrial adoption.Furthermore, rising government funding and private investment are accelerating market growth by supplying the capital needed to scale innovations from the laboratory to commercial viability. Public sector initiatives are increasingly prioritizing engineering biology to bolster national supply chain resilience and biosecurity, while private capital targets companies demonstrating revenue potential and operational scalability. As an example, UK Research and Innovation announced a £5.8 million investment in November 2024 to support seed and proof-of-concept projects for commercializing engineering biology breakthroughs. This financial momentum drives the sector's expansion, as demonstrated by Twist Bioscience, which reported a record fiscal year revenue of $313.0 million in 2024, emphasizing the growing global demand for synthetic DNA and genomic tools.

Market Challenges

Scalability in biomanufacturing constitutes the most significant structural barrier to the expansion of the Global Synthetic Biology Market. The transition from laboratory-scale experiments to industrial-grade commercialization creates complex technical hurdles, as biological systems often demonstrate unstable behaviors and diminished yields when scaled up to larger volumes. This technical unpredictability makes it difficult for companies to attain the unit economics required to compete with established petrochemical products. Additionally, the global supply chain faces a shortage of fit-for-purpose infrastructure, compelling innovators to depend on aging pharmaceutical facilities that are ill-suited for the low-margin cost structures necessary for industrial chemicals or food ingredients.This infrastructure deficit has resulted in a measurable gap in the market's capacity to satisfy commercial requirements. According to SynBioBeta, the industry faced a critical shortfall in 2024, with global demand for fermentation capacity outstripping available supply by approximately 10 to 100 times, depending on the scale of production. This scarcity of manufacturing bandwidth causes significant delays in product launches and limits the industry's revenue-generating capability, thereby directly impeding the wider market adoption of synthetic biology technologies.

Market Trends

The shift toward Enzymatic DNA Synthesis Technologies is reshaping the market by replacing traditional chemical phosphoramidite methods with efficient, enzyme-based manufacturing. This transition meets the critical demand for longer, more complex DNA sequences essential for metabolic engineering and genomic research while simultaneously removing the need for hazardous organic solvents. The rapid maturation of this technology is driving significant capital allocation toward companies capable of delivering commercial-scale solutions, validating the industry's move away from legacy chemical processes. For instance, Ansa Biotechnologies announced in an October 2025 press release that it secured an oversubscribed $54.4 million Series B funding round to expand its proprietary enzymatic synthesis platform, underscoring the sector's pivot to this sustainable production standard.Additionally, the commercialization of synthetic biology within cellular agriculture is advancing beyond the research phase, with companies securing substantial funding to scale operations and penetrate global food markets. This trend reflects a strategic focus on establishing unit economics that rival conventional meat production, supported by specialized investment banking partnerships designed to expedite market entry. This progression is evident as leading players transition from pilot facilities to industrial-grade output to meet consumer demand for sustainable protein sources. In November 2025, Meatable announced a partnership with an investment bank to place €30 million of capital, aiming to establish the firm as a global leader in the cultivated meat sector.

Key Players Profiled in the Synthetic Biology Market

- Bota Biosciences Inc.

- Codexis, Inc.

- Enbiotix, Inc.

- Illumina, Inc.

- Merck Kgaa (Sigma-Aldrich Co. Llc)

- Pareto Bio, Inc.

- Scarab Genomics, Llc

- Synthego Corporation

- Synthetic Genomics Inc.

- Thermo Fisher Scientific, Inc.

Report Scope

In this report, the Global Synthetic Biology Market has been segmented into the following categories:Synthetic Biology Market, by Technology:

- NGS Technology

- PCR Technology

- Genome Editing Technology

- Bioprocessing Technology

- Other Technologies

Synthetic Biology Market, by Product:

- Oligonucleotide/Oligo Pools and Synthetic DNA

- Enzymes

- Cloning Technologies Kits

- Xeno-Nucleic Acids

- Chassis Organism

Synthetic Biology Market, by End user:

- Biotechnology and Pharmaceutical Companies

- Academic and Government Research Institutes

- Others

Synthetic Biology Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Synthetic Biology Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Synthetic Biology market report include:- Bota Biosciences Inc.

- Codexis, Inc.

- Enbiotix, Inc.

- Illumina, Inc.

- Merck Kgaa (Sigma-Aldrich Co. Llc)

- Pareto Bio, Inc.

- Scarab Genomics, Llc

- Synthego Corporation

- Synthetic Genomics Inc.

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

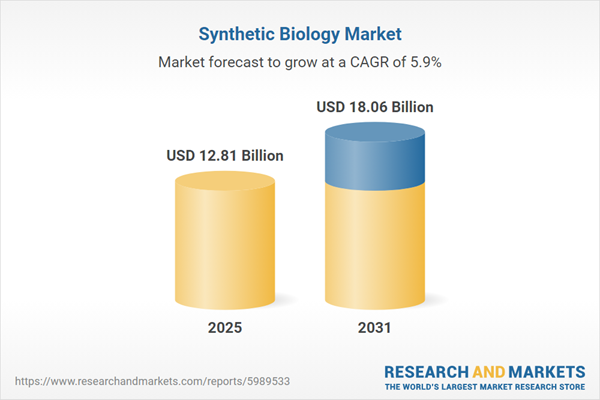

| Estimated Market Value ( USD | $ 12.81 Billion |

| Forecasted Market Value ( USD | $ 18.06 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |