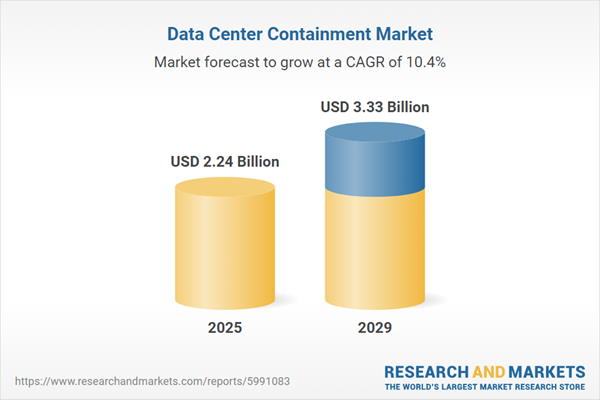

The data center containment market size has grown rapidly in recent years. It will grow from $2.02 billion in 2024 to $2.24 billion in 2025 at a compound annual growth rate (CAGR) of 10.7%. The growth in the historic period can be attributed to increased data demands, energy efficiency regulations, increased energy costs that have put pressure on data center operators, the development of more powerful and densely packed servers, corporate sustainability initiatives, the need to minimize operational costs while maintaining high performance.

The data center containment market size is expected to see rapid growth in the next few years. It will grow to $3.33 billion in 2029 at a compound annual growth rate (CAGR) of 10.4%. The growth in the forecast period can be attributed to increased demand for data storage, energy efficiency regulations, rising cost of energy, the rapid expansion of cloud services, and increased awareness of environmental impact, data center operators are increasingly focusing on reducing operational expenses. Major trends in the forecast period include AI-driven cooling optimization, integration with IoT, green and sustainable containment, hybrid cooling technologies, and virtualization and digital twins.

The expansion of cloud services is expected to drive the growth of the data center containment market in the future. Cloud services involve the delivery of computing resources over the internet on a pay-as-you-go basis, such as storage, processing power, or applications. These services are increasingly popular due to their scalability, flexibility, and cost-effectiveness for both businesses and individuals. Implementing data center containment within cloud services enhances cooling efficiency and reduces energy consumption by segregating hot and cold airflow streams. For example, as reported by Eurostat in December 2023, approximately 45.2% of EU enterprises utilized cloud computing services, marking a notable increase of 4.2% points since 2021. Commonly used cloud services included email hosting, file storage, and operational tasks, underscoring their growing influence on the data center containment market.

Major companies operating in the data center containment market are focusing on developing advanced air conditioning systems to enhance cooling efficiency and operational performance. These air conditioning systems are designed to optimize temperature control in data centers, where cooling is crucial to maintain the performance and reliability of IT infrastructure. For example, in March 2024, Eaton Corporation, an Ireland-based company, launched the SmartRack modular data center solution. This innovative solution combines IT racks, cooling systems, and service enclosures into a single, pre-built unit that significantly reduces deployment time and cost. Available in 13 standard configurations, the SmartRack supports equipment loads of up to 150 kW, making it ideal for edge computing, AI, and machine learning applications. The modular design of the SmartRack allows for easy customization and scalability, addressing the growing demand for efficient data center solutions. This move is aimed at streamlining data center deployment processes, enabling organizations to quickly respond to evolving technological needs.

In December 2023, Vertiv acquired CoolTera Ltd., a UK-based company specializing in data center and digital infrastructure power and cooling. This acquisition, valued but not disclosed, strengthens Vertiv's thermal management portfolio with advanced cooling technologies and expertise. The goal is to enhance service delivery to global data center clients and reinforce Vertiv's position in sectors such as artificial intelligence (AI) and high-performance computing.

Major companies operating in the data center containment market are Dell Technologies Inc., Nucor Corporation, Schneider Electric SE, Eaton Corporation, Legrand SA, Vertiv Holdings, Super Micro Computer Inc., nVent Electric, Rittal GmbH & Co. KG, Panduit Corp., Tate Inc., EAE Inc., Chatsworth Products Inc., DataSpan Inc., Gordon Incorporated, Enconnex LLC, Subzero Engineering, Accelevation LLC, Polargy Inc., 42U, Cosyst Devices, Cool Shield Inc.

North America was the largest region in the data center containment market in 2024. The regions covered in the data center containment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the data center containment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Data center containment refers to the practice of managing airflow within a data center to optimize cooling efficiency and energy usage. This involves segregating hot and cold air streams to prevent them from mixing, typically using physical barriers such as ducts, panels, or enclosures. Effective containment helps maintain proper temperature levels around IT equipment, enhancing overall reliability and reducing operating costs associated with cooling.

The main types of data center containment include chimney systems, curtain systems, hard panel systems, and modular systems. Chimney systems are designed to safely vent smoke, gases, and other byproducts of combustion from devices such as fireplaces, stoves, furnaces, or boilers to the outside atmosphere. In the context of data centers, containment arrangements include chimney systems, curtain systems, hard panel systems, and modular systems, which are used in hyperscale data centers, colocation data centers, enterprise data centers, and others.

The data center containment research report is one of a series of new reports that provides data center containment market statistics, including the data center containment industry's global market size, regional shares, competitors with a data center containment market share, detailed data center containment market segments, market trends and opportunities, and any further data you may need to thrive in the data center containment industry. This data center containment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The data center containment market consists of revenues earned by entities by providing services such as consulting and services, training and education, environmental testing, and certification services. The market value includes the value of related goods sold by the service provider or included within the service offering. The data center containment market also includes sales of air filtration systems, cleaning supplies and equipment, environmental monitoring systems, and fire suppression systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Data Center Containment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on data center containment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for data center containment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The data center containment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Containment Type: Aisle Containment; Chimney Systems; Curtain Systems; Hard Panel Systems; Modular Systems2) By Arrangement: Hybrid Containment; Modular Containment; Rigid Containment; Soft Containment

3) By Data Center Type: Hyperscale Data Center; Colocation Data Center; Enterprise Data Center; Other Data Center Types

Subsegments:

1) By Aisle Containment: Cold Aisle Containment; Hot Aisle Containment2) By Chimney Systems: Hot Air Chimney Systems; Cold Air Chimney Systems

3) By Curtain Systems: Fabric Curtain Systems; Plastic Curtain Systems

4) By Hard Panel Systems: Fixed Panel Containment Systems; Removable Panel Containment Systems

5) By Modular Systems: Pre-Fabricated Modular Containment; Customizable Modular Containment

Key Companies Mentioned: Dell Technologies Inc.; Nucor Corporation; Schneider Electric SE; Eaton Corporation; Legrand SA

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Data Center Containment market report include:- Dell Technologies Inc.

- Nucor Corporation

- Schneider Electric SE

- Eaton Corporation

- Legrand SA

- Vertiv Holdings

- Super Micro Computer Inc.

- nVent Electric

- Rittal GmbH & Co. KG

- Panduit Corp.

- Tate Inc.

- EAE Inc.

- Chatsworth Products Inc.

- DataSpan Inc.

- Gordon Incorporated

- Enconnex LLC

- Subzero Engineering

- Accelevation LLC

- Polargy Inc.

- 42U

- Cosyst Devices

- Cool Shield Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.24 Billion |

| Forecasted Market Value ( USD | $ 3.33 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |