Retrofitting of Older Aircraft Fleet Fuels South & Central America Aircraft MRO Market

Retrofitting, which refers to the installation or addition of newer technologies on older aircraft fleets, helps increase passenger comfort and safety and facilitates the airlines in maintaining their older fleets. Continuous advancements in aircraft technologies are resulting in the upgrade of MRO capabilities.MRO service providers are constantly seeking upgrades and procurement of newer technologies in order to service the newer aircraft as well as retrofit the upgraded technologies on the older aircraft fleets. In the current scenario, global commercial airlines are holding on to their older aircraft fleet owing to the drop in fuel prices. This factor is compelling the airlines to opt for MRO activities frequently, which is facilitating the MRO service providers to offer the airlines to retrofit the aircraft fleet with newer technologies. The retrofitting trend is soaring among the MRO service providers. Thus, the integration of advanced and modern technologies into older aircraft fleets is expected to change the aircraft MRO market landscape as well as the face of the aviation industry.

South & Central America Aircraft MRO Market Overview

The South America aircraft MRO market is undergoing rapid transformations, and the region has immense potential to increase its trade activities worldwide. Despite the slight recession in the region and economic crisis in countries such as Venezuela and Brazil in recent times, the overall South American region is likely to exhibit a positive outlook toward its global business in the coming years. The IATA has directed the governments of South American countries to implement smart industry regulations to ensure the right infrastructure for the growth of the aviation sector. Achieving profitability through services is a major challenge faced by airline service providers in South America. The profit earned per passenger by the South American airlines is insufficient compared with the global average.According to the publisher analysis, in 2023, South America had a fleet of more than 1,500 operational commercial aircraft, which is expected to surpass 2,100 by the end of 2033. Such trends of increasing aircraft feet are anticipated to generate the demand for MRO services in the region. Moreover, an increase in the number of aircraft fleet across South America is expected to catalyze the requirement of MRO for major aircraft components such as engines and airframes.

The future of South American aviation sector is prominent owing to the forecast and analysis showcased by the aircraft manufacturing giants, namely Boeing, Airbus, and Embraer. Additionally, the Brazilian defense is substantially monetizing in the procurement of a newer aircraft fleet, which demands enhanced MRO activities owing to the complexity of the newer fleet. Also, the older fleet in the Brazilian defense force requires upgradation and retrofitting activities of advanced technologies, which is expected to catalyze the growth of the aircraft MRO market in the region.

South America is also a home to a few of the world's aviation megacities that include Santiago de Chile, Panama City, Cancun, Rio de Janeiro, Bogota, and Lima. For instance, in December 2020, JetBlue airline started a new flight service between Georgetown, Guyana's Cheddi Jagan International Airport (GEO), and New York John F. Kennedy International Airport (JFK). The increasing count of aircraft at the airports is expected to surge the demand for aircraft MRO services to ensure safe operations. These factors are expected to contribute to the aircraft MRO market growth in the region during the forecast period.

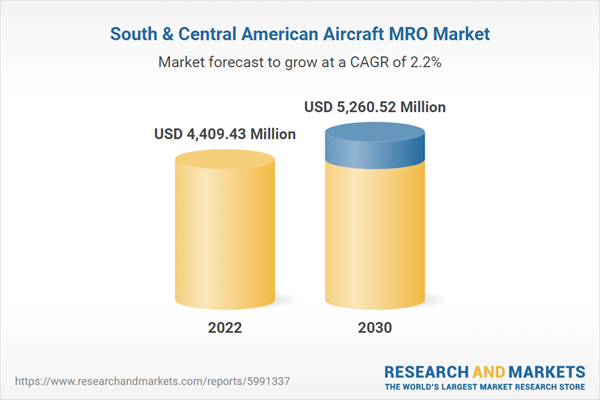

South & Central America Aircraft MRO Market Revenue and Forecast to 2030 (US$ Million)

South & Central America Aircraft MRO Market Segmentation

The South & Central America aircraft MRO market is categorized into components, aircraft type, end users, and country.Based on components, the South & Central America aircraft MRO market is segmented into engine MRO, avionics MRO, airframe MRO, cabin MRO, landing gear MRO, and others. The engine MRO segment held the largest market share in 2022.

In terms of aircraft type, the South & Central America aircraft MRO market is bifurcated into fixed wing aircraft and rotary wing aircraft. The fixed wing aircraft segment held a larger market share in 2022.

By end users, the South & Central America aircraft MRO market is bifurcated into commercial and military. The commercial segment held a larger market share in 2022.

By country, the South & Central America aircraft MRO market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America aircraft MRO market share in 2022.

AAR CORP, Barnes Group Inc, Collins Aerospace, Delta TechOps, GE Aviation, Lufthansa Technik, Rolls-Royce plc, Singapore Technologies Engineering Ltd, and Turkish Technic Inc. are among the leading companies operating in the South & Central America aircraft MRO market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the South & Central America aircraft MRO market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the South & Central America aircraft MRO market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth South & Central America market trends and outlook coupled with the factors driving the South & Central America aircraft MRO market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- AAR CORP

- Barnes Group Inc

- Collins Aerospace

- Delta TechOps

- GE Aviation

- Lufthansa Technik

- Rolls-Royce Holdings Plc

- Singapore Technologies Engineering Ltd

- Turkish Technic Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | June 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 4409.43 Million |

| Forecasted Market Value ( USD | $ 5260.52 Million |

| Compound Annual Growth Rate | 2.2% |

| No. of Companies Mentioned | 9 |