The market for platinum group metals (PGMs) is dominated by industrial consumption, especially in the automotive, electronics, and chemical industries. Demand for PGMs in catalytic converters continues to be a major driver, with stricter emission controls around the world fueling demand for platinum, palladium, and rhodium in exhaust systems for vehicles.

PGMs are also vital in the production of hydrogen as key catalysts in electrolysis, which gains from the increasing drive towards clean energy. Technological innovation in fuel cells and applications of renewable energy further boosts PGMs' market demand. Additionally, increasing significance of PGMs in jewelry and investment portfolios is driving demand, as these metals are viewed as a store of value in times of economic uncertainty.

In the United States, the market for PGMs mirrors international trends but is also subject to local influences like government policy regarding environmental regulations and energy transition programs. The U.S. is a major user of PGMs, especially in automotive manufacturing, where platinum and palladium play a critical role in complying with emission requirements. For instance, as per industry reports, in 2024, more than 80% of consumers in the United States who were considering purchasing an electric vehicle (EV) preferred a plug-in hybrid electric vehicle (PHEV) over a fully electric model.

This shift in preference could lead to increased demand for platinum group metals (PGMs), as PHEVs require 10-15% more platinum than conventional petrol vehicles, which is driving further increased platinum demand. Additionally, the country’s increasing focus on green technologies and hydrogen fuel cells offers new growth opportunities for PGMs, positioning the U.S. as a critical player in shaping global demand.

Platinum Group Metals Market Trends:

Increasing Demand for Electric Vehicles (EVs)The transition to electric vehicles (EVs) is among the most significant drivers of growth in demand for platinum group metals, particularly platinum and palladium. They are predominantly utilized in catalytic converters by the automotive industry to manage exhaust emissions in fossil fuel engines like gasoline and diesel. Based on the data by International Energy Agency (IEA), global EV sales were 10.5 million units in 2022, a 55% rise compared to the last year. Hybrid cars are still required for nations with stricter emission controls that hold incentives dangling to prompt customers to transition to EVs.

Besides, though pure electric vehicles do not use PGMs in the drivetrain themselves, hybrid and plug-in hybrid electric vehicles (PHEVs) still have space for catalytic converters that use platinum and palladium. Because of worldwide demands for sustainability, the automotive sector is becoming electrified, thus making PGMs more sought after. In the future, this type of trend can be anticipated to expand as EVs keep on gaining popularity, mainly in the key marketplaces of Europe, China, and North America, all of which are placing a strong emphasis on emissions reduction and greener technology adoption.

Technological Advancements in Hydrogen Fuel Cells

Hydrogen fuel cells are considered to be among the technological advancement that will massively create a demand for platinum group metals, mainly for platinum. According to the Hydrogen Council, the hydrogen economy could generate USD 2.5 trillion in revenue by 2050, with the global hydrogen market projected to expand at a compound annual growth rate (CAGR) of 14.1% from 2023 to 2030. Hydrogen fuel cells, utilizing platinum as a catalyst, are fast emerging as the 'clean energy' for the future. Even residential power generation, industrial energy production, and transportation sectors may depend on it.Hydrogen provides a cleaner option for fossil fuels, as it produces no emissions except for water vapor, making it an attractive proposition to reduce carbon footprints. Platinum's features make it essential for the catalyst in fuel cells to produce and utilize hydrogen efficiently. As countries and businesses move ahead to achieve carbon-neutrality, hydrogen-powered vehicles and various industrial applications are also on the rising edge. Major investments in the technology of green hydrogen have lately been seen, especially in Europe, Japan, and the U.S. Its huge demand is expected to boost the platinum market substantially. Hydrogen fuel cell technology is one of the most crucial reasons for driving the future growth of the platinum group metals market.

Supply Constraints and Geopolitical Risks

Supply risks in the PGM market are very high as geopolitical factors considerably influence the metal's availability. Key producing countries are South Africa, Russia, and Zimbabwe and produce a lot of platinum and palladium around the world. Any form of tension between geopolitics, political instability, or labor strikes could affect the availability of supply. The shortages experienced in the markets could result in price volatility. For example, mining operations in South Africa account for about 70% of the world's platinum and have experienced labor unrest and regulatory issues, as per reports.Russia, which is one of the significant suppliers of palladium, has been subject to increased international sanctions and trade restrictions, which only added to supply stress. Such supply disruptions are bound to send shockwaves around the world and cause upward pressure on PGM prices and create uncertainty. That means that companies that use PGMs for production, such as automotive producers and electronics manufacturers, may pay more for it and market conditions will be more volatile.

Platinum Group MetalsIndustry Segmentation:

The research provides an analysis of the key trends in each segment of the global platinum group metals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on metal type and application.Analysis by Metal Type:

- Platinum

- Palladium

- Rhodium

- Iridium

- Ruthenium

- Osmium

Analysis by Application:

- Auto Catalysts

- Electrical and Electronics

- Fuel Cells

- Glass, Ceramics and Pigments

- Jewellery

- Medical (Dental and Pharmaceuticals)

- Chemicals

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Additionally, Asia Pacific’s growing commitment to environmental regulations and clean energy solutions supports the increasing adoption of PGMs in green technologies. For instance, as per s 2023 report by UN ESCAP, renewable energy investment in Asia-Pacific surged to over USD 335 billion in 2022, representing approximately 55% of global funding. As a result, the region remains the largest consumer and a key driver of global PGM market growth.

Key Regional Takeaways:

United States Platinum Group Metal Market Analysis

The demand from automotive, electronics, and jewellery sectors dominates the U.S. Platinum Group Metals (PGM). According to the World Bank International Trade Statistics, in 2023, the U.S. imported about 56,244 kg of platinum and 62,220 kilograms of palladium. Then again, the automotive sector is the biggest consumer, using platinum and palladium in catalytic converters. The rising demand for electric vehicles (EVs) has seen a shift in demand dynamics; with palladium gradually being replaced by platinum in fuel cells as traditional vehicle applications are substituted. In addition, the U.S.government is investing in clean energy technologies and, as such, the demand for PGMs is anticipated to rise significantly, particularly platinum. Among market players, major contributors are Johnson Matthey and Anglo-American Platinum with significant presence in the United States and the benefit of utilization on both sides-domestic and exports. Innovations in the area of technologies relating to battery and hydrogen fuel cell are further set to improve growth in this market.

North America Platinum Group Metal Market Analysis

The North America platinum group metals (PGMs) market is driven by strong demand from the automotive and industrial sectors. The automotive industry relies on PGMs, particularly platinum, palladium, and rhodium, for catalytic converters to meet stringent emission regulations. The growing focus on clean energy technologies, such as hydrogen fuel cells, also supports PGM demand. Furthermore, PGMs are vital in electronics, chemical production, and jewelry. The U.S. and Canada’s commitment to environmental standards and green energy initiatives accelerates the adoption of PGMs in various applications.For instance, in June 2024, four leading North American catalytic converter recyclers - PGM of Texas, Legend Smelting and Recycling, Daniel Ball Converter Recycling, and Maryland Core, Inc. - rebranded as Elemental North America. This consolidation reflects their expanded capabilities in recovering and refining strategic metals, including PGMs, to support green initiatives and sustainable development. Despite supply challenges, including limited mining activity and geopolitical factors, North America’s market remains a key contributor to global PGM consumption.

Europe Platinum Group Metal Market Analysis

Europe's PGM market is booming with the growing automotive production. The increasing growth in the industry is further influenced by the increasing shift towards electric vehicles (EVs) and hydrogen fuel cells. According to recent data published by the European Commission, the EU has offered around €800 million (around USD 874 million) for the "European Hydrogen Bank" auction as the first investment in green hydrogen projects in the bloc. Germany, another major producer, has also significantly invested in clean automotive technologies. In 2023, €6 billion (USD 6.5 billion) was dedicated to hydrogen development, as per reports. Platinum and palladium are used in both automotive emissions reduction technologies and industrial applications.In addition, Europe's jewellery and electronics industries drive demand, using platinum in high-end items and semiconductor manufacturing. The region's strict environmental laws are forcing the automobile manufacturers to opt for cleaner technologies, thus increasing the demand for PGMs. Large players like Impala Platinum and Norilsk Nickel are active in Europe and supply both the automotive and industrial sectors.

Asia Pacific Platinum Group Metal Market Analysis

The Asia Pacific PGM market is growing steadily, mainly influenced by the vibrant automotive sector that has been registering high growths in China and India. Indeed, China has produced 26.3 million vehicles in the year 2023, bringing in a phenomenal demand for both palladium and platinum in their catalytic converters, as per reports. India's automobile sector is also following an upward trend, with a proposed defense budget for 2023-2024 estimated at USD 72.6 billion as per an industrial report, further driving up consumption of PGM in defense related applications. Electronics manufacturing leadership in Japan continues to expand platinum demand in semiconductor applications.Increased push toward FCEVs by China has driven platinum demand and plays a significant role in the consumption of PGM at the global level. Regional investments in hydrogen fuel cells and renewable energy technologies, such as in South Korea, are expected to support further demand growth. Market leaders like Sumitomo Metal Mining and Anglo-American Platinum are well-positioned to capitalize on these trends.

Latin America Platinum Group Metal Market Analysis

In Latin America, the market for PGM can be supported by steady growth in automotive production and mining. According to a report from the Brazilian Mining Institute, some of the platinum reserves in the region are among the largest in the world, thus making for steady domestic supply. Industrial report has indicated that Brazil's automobile sector is thriving. In the country, there will be production of 2.2 million vehicles in 2023, as per reports. Palladium usage in catalytic converters will also increase due to such demand. Demand for platinum has also risen lately in jewellery-making industries due to increased interests from countries such as Colombia and Argentina.Some mining companies within the country include Vale, whose local extraction can support both national and international supplies. Brazil is bound to increase investment in cleaner technologies and sustainable mining practices, further boosting demand for PGM, especially platinum for hydrogen fuel cells. Government policies targeting the strengthening of local mining activities and curtailing imports will further cement this region's presence in the international PGM market.

Middle East and Africa Platinum Group Metal Market Analysis

The Middle East and Africa region has a mixed demand for PGMs. Growth in this region is being influenced by automotive, jewellery, and industrial sectors. South Africa is a leading player in the PGM market, holding some of the largest platinum reserves worldwide, contributing highly to exports. In 2022, South Africa was the source of around 70% of the global platinum produced, according to the International Platinum Group Metals Association. The automotive segment in the region, especially from countries like UAE and Saudi, is driving a demand for these metals in their catalytic converter applications.A rise in the investment in the clean energy segment and hydrogen-related technologies, predominantly in Saudi and UAE, may increase platinum-based fuel cell requirements. The investments in electronics and jewellery sectors add to the requirements of PGMs in this region. Anglo American Platinum and Impala Platinum are the biggest players in the region, still capitalizing on both local and global demand.

Competitive Landscape:

The platinum group metals (PGMs) market is highly competitive, with a few key players dominating production and refining activities. These major producers control the majority of global PGM supply, primarily from regions such as South Africa and Russia. For instance, according to industry reports, South Africa produced 120,000 kg of platinum in 2023, becoming the world’s leading producer. Alongside mining, the market includes companies focused on refining, recycling, and trading PGMs, which helps stabilize supply amid disruptions.Competition is further shaped by technological advancements, particularly in recycling and catalytic applications, which drive demand. Additionally, fluctuating metal prices, geopolitical factors, and strict environmental regulations play crucial roles in influencing market dynamics, requiring companies to adapt quickly to shifting supply and demand conditions.

The report provides a comprehensive analysis of the competitive landscape in the platinum group metals market with detailed profiles of all major companies, including:

- African Rainbow Minerals Limited

- Anglo American Platinum Limited

- Eastern Platinum Limited

- Glencore plc

- Impala Platinum Holdings Limited

- Johnson Matthey

- Northam Platinum Limited

- Royal Bafokeng Platinum Ltd.

- Sibanye-Stillwater

Table of Contents

Companies Mentioned

- African Rainbow Minerals Limited

- Anglo American Platinum Limited

- Eastern Platinum Limited

- Glencore plc

- Impala Platinum Holdings Limited

- Johnson Matthey

- Northam Platinum Limited

- Royal Bafokeng Platinum Ltd.

- Sibanye-Stillwater

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | June 2025 |

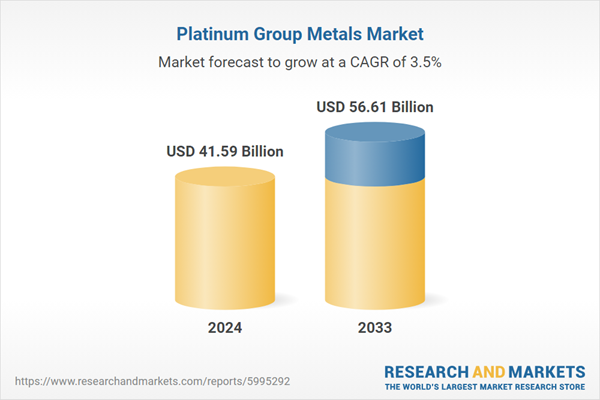

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 41.59 Billion |

| Forecasted Market Value ( USD | $ 56.61 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |