Global Water Quality Sensors Market - Key Trends & Drivers Summarized

Why Are Water Quality Sensors Critical for Environmental Monitoring?

Water quality sensors are indispensable tools for monitoring the health of aquatic environments, ensuring the safety of drinking water, and managing wastewater treatment processes. These sensors measure various parameters, such as pH, dissolved oxygen, turbidity, conductivity, and the presence of specific contaminants like nitrates and heavy metals. The data collected from water quality sensors help in assessing the condition of water bodies, detecting pollution, and ensuring that water meets regulatory standards for human consumption, agriculture, and industrial use. As environmental concerns and the need for sustainable water management grow, the importance of accurate and reliable water quality monitoring is more critical than ever.How Has the Market for Water Quality Sensors Evolved?

The water quality sensors market has seen significant growth over the past few decades, driven by increasing awareness of environmental issues, stricter regulations, and advances in sensor technology. Initially, water quality monitoring was limited to basic parameters, often conducted manually with periodic sampling and laboratory analysis. However, as sensor technology has evolved, real-time monitoring has become possible, enabling more precise and immediate responses to changes in water quality. The development of smart sensors and IoT-enabled monitoring systems has further expanded the market, allowing for continuous, automated data collection and analysis. These advancements have broadened the use of water quality sensors across various industries, including agriculture, aquaculture, and industrial water treatment, as well as in municipal water management and environmental protection efforts.What Are the Latest Innovations and Applications in Water Quality Sensors?

Several emerging trends and innovations are driving the evolution of the water quality sensors market, offering new capabilities for monitoring and managing water resources. One significant trend is the development of multi-parameter sensors that can simultaneously measure a range of water quality indicators, providing a more comprehensive assessment of water conditions. These sensors are increasingly being integrated with wireless communication technologies, enabling remote monitoring and data transmission in real-time. The use of AI and machine learning algorithms to analyze sensor data is another important innovation, allowing for predictive analytics and early detection of water quality issues. Additionally, the miniaturization of sensors and the development of portable, handheld devices are making water quality monitoring more accessible and affordable, particularly in remote or resource-constrained areas. These innovations are expanding the use of water quality sensors in diverse applications, from monitoring drinking water supplies and natural water bodies to managing industrial effluents and agricultural runoff.What Factors Are Driving the Growth of the Water Quality Sensors Market?

The growth in the water quality sensors market is driven by several key factors, reflecting the increasing demand for accurate and reliable water monitoring solutions. One of the primary drivers is the growing global concern about water pollution and the need to protect freshwater resources from contamination. Stricter environmental regulations and standards for water quality are also driving the adoption of advanced monitoring technologies. The expansion of industrial activities, particularly in emerging economies, is another significant factor, as industries require reliable water quality monitoring to comply with environmental regulations and optimize their water use. The rising demand for smart water management solutions in agriculture, driven by the need to optimize irrigation and reduce water waste, is also contributing to market growth. Additionally, the ongoing advancements in sensor technology, including the development of more robust, accurate, and cost-effective sensors, are expected to sustain the growth of the water quality sensors market in the coming years.Report Scope

The report analyzes the Water Quality Sensors market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (pH Sensors, Residual Chlorine Sensors, Total Organic Carbon (TOC) Sensors, Oxidation-Reduction Potential (ORP) Sensors, Other Types); Application (Groundwater Application, Drinking Water Application, Wastewater Application, Aquaculture Application, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the pH Sensors segment, which is expected to reach US$2.4 Billion by 2030 with a CAGR of a 4.7%. The Residual Chlorine Sensors segment is also set to grow at 3.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $1.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Water Quality Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Water Quality Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Water Quality Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Campbell Scientific, Inc., Cole-Parmer, an Antylia Scientific Company, Endress+Hauser AG, Hach Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Water Quality Sensors market report include:

- ABB Ltd.

- Campbell Scientific, Inc.

- Cole-Parmer, an Antylia Scientific Company

- Endress+Hauser AG

- Hach Company

- Hunan Rika Electronic Tech Co.,Ltd.

- KROHNE Messtechnik GmbH

- Libelium Comunicaciones Distribuidas SL

- OTT Hydromet

- Sensorex, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Campbell Scientific, Inc.

- Cole-Parmer, an Antylia Scientific Company

- Endress+Hauser AG

- Hach Company

- Hunan Rika Electronic Tech Co.,Ltd.

- KROHNE Messtechnik GmbH

- Libelium Comunicaciones Distribuidas SL

- OTT Hydromet

- Sensorex, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 301 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

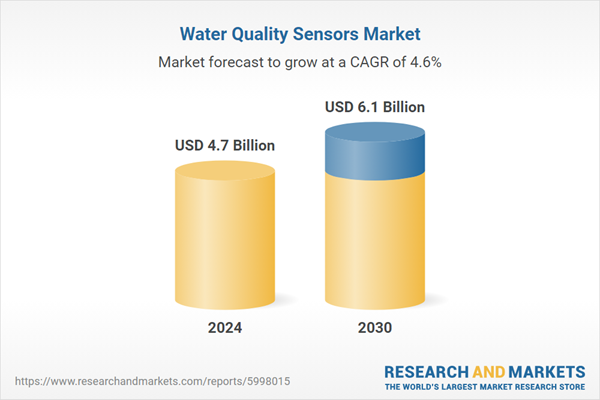

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |