Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the substantial capital investment needed to acquire picosecond laser platforms constitutes a major barrier to wider market growth, restricting accessibility for independent practitioners and smaller clinics. Despite this financial hurdle, patient demand for laser-based treatments remains robust. According to the American Society of Plastic Surgeons, in 2024, skin treatments utilizing lasers - including tattoo and hair removal - accounted for 3,112,056 procedures. This significant volume underscores the enduring resilience of the aesthetic laser sector and confirms the continued necessity of advanced laser technologies in addressing patient needs.

Market Drivers

The increasing global demand for laser tattoo removal and modification acts as a primary catalyst for the picosecond lasers market, fueled by the technology's ability to pulverize ink particles more effectively than older systems. By delivering energy in trillionths of a second, picosecond pulses create a photomechanical impact that shatters pigment into dust-like fragments which the body eliminates more easily, establishing it as the standard for clearing resistant ink colors while minimizing thermal injury. This growing need for effective removal solutions aligns with consumer trends regarding body art regret. According to NAAMA Studios' March 2024 press release, 'Discover Safe Tattoo Removal Solutions at NAAMA Studios NYC', research indicates that one in four tattooed Americans regrets at least one piece of body art, representing a large and expanding patient base for these advanced interventions.Concurrently, the rising popularity of non-invasive aesthetic and skin resurfacing procedures is significantly driving market expansion, as patients increasingly seek treatments for acne scarring and pigmentation that offer minimal downtime. Picosecond technology has evolved beyond tattoo removal to become a versatile tool for skin revitalization, stimulating collagen and elastin production without compromising the skin barrier.

This shift toward non-surgical options is reflected in global procedure volumes. According to the International Society of Aesthetic Plastic Surgery (ISAPS) in its June 2024 'Global Survey on Aesthetic/Cosmetic Procedures Performed in 2023', a total of 19.1 million non-surgical procedures were conducted worldwide, highlighting the massive scale of this sector. To further emphasize the financial strength of the energy-based device market, Sisram Medical reported in 2024 that its Energy Based Devices segment generated US$149.3 million in revenue during the first half of the year alone.

Market Challenges

The high capital expenditure required to purchase picosecond laser platforms stands as the primary challenge impeding the growth of the Global Picosecond Lasers Market. This significant financial barrier limits the adoption of these devices to well-funded medical facilities, effectively excluding a large portion of the potential customer base, particularly smaller clinics and independent practitioners. As a result, many providers are compelled to rely on less expensive, legacy nanosecond systems, which slows the rate at which superior picosecond technology achieves market penetration.This economic constraint is especially detrimental considering the structure of the aesthetic provider landscape. According to the American Med Spa Association, single-location practices accounted for 81% of the medical aesthetics industry in 2024. Since the vast majority of the market is comprised of these smaller, independent businesses rather than large corporate chains with substantial capital reserves, the high acquisition cost creates a bottleneck. This discrepancy between the premium pricing of the equipment and the purchasing power of the core market segment directly restricts sales volume and hampers the broader expansion of the sector.

Market Trends

The expansion into high-precision industrial micromachining and wafer dicing is fundamentally reshaping the market as manufacturers increasingly utilize the "cold ablation" capabilities of picosecond pulses. Unlike traditional thermal lasers, picosecond technology delivers energy so rapidly that it vaporizes material without creating heat-affected zones, a critical requirement for processing sensitive semiconductors, display panels, and solar cells. This shift is driving the development of higher-power ultra-short pulse (USP) systems designed to maintain this precision while significantly increasing industrial throughput for large-area applications. According to Trumpf's June 2025 press release, 'TRUMPF presents ultra-short pulse lasers for processing large surfaces', the company introduced the TruMicro 9010, a new ultra-short pulse laser with a 1-kilowatt output, enabling industrial customers to process large surfaces with unprecedented productivity and precision.Simultaneously, the growth in adoption by specialized "Med Spas" over traditional hospital settings is decentralizing the aesthetic laser economy and altering device purchasing patterns. Independent clinics and medical spas are prioritizing versatile, high-throughput systems that allow for rapid patient turnover and a quick return on investment, moving away from the specialized, lower-volume equipment typical of hospital environments. This channel shift is fueling revenue growth for energy-based aesthetic device manufacturers who are tailoring their portfolios to meet the operational demands of these commercialized settings. According to Bausch Health's February 2025 report, 'Fourth Quarter and Full Year 2024 Results', the Solta Medical segment achieved revenues of $138 million for the fourth quarter of 2024, a 34% increase compared to the prior year, underscoring the robust expansion of the non-invasive aesthetic sector driven by these specialized providers.

Key Players Profiled in the Picosecond Lasers Market

- Cynosure Inc.

- Cutera, Inc.

- Candela Corporation.

- Rohrer Aesthetics, Inc.

- Beijing ADSS Development Co., Ltd.

- Fotona d.o.o

- Lutronic Corporation

- El.En. Group

- Alma Laser Ltd.

- Rohrer Aesthetics, Inc.

Report Scope

In this report, the Global Picosecond Lasers Market has been segmented into the following categories:Picosecond Lasers Market, by Technology:

- ND: YAG

- Alexandrite

Picosecond Lasers Market, by Application:

- Tattoo Removal

- Pigmented Lesions

- Skin Rejuvenation

- Melasma

- Others

Picosecond Lasers Market, by End-use:

- Dermatology Clinics

- Med Spas & Aesthetic Centers

- Others

Picosecond Lasers Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Picosecond Lasers Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Picosecond Lasers market report include:- Cynosure Inc.

- Cutera, Inc.

- Candela Corporation.

- Rohrer Aesthetics, Inc.

- Beijing ADSS Development Co., Ltd

- Fotona d.o.o

- Lutronic Corporation

- El.En. Group

- Alma Laser Ltd.

- Rohrer Aesthetics, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

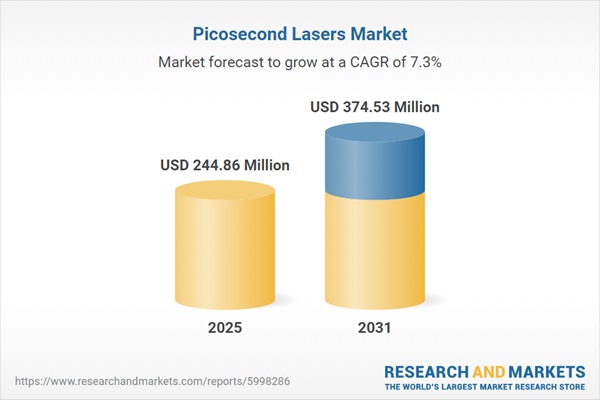

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 244.86 Million |

| Forecasted Market Value ( USD | $ 374.53 Million |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |