Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry faces substantial hurdles related to the rising costs and technical intricacies of manufacturing semiconductors at advanced process nodes. Data from the 'World Semiconductor Trade Statistics' indicates that the 'Logic integrated circuit category,' which includes application processors, is anticipated to see a growth rate of 16.9 percent in '2024'. This strong financial performance underscores the market's size and resilience, even as manufacturers contend with the formidable barriers to entry created by high fabrication expenses.

Market Drivers

A major technological transformation is being driven by the integration of On-Device Generative AI and Neural Processing Units (NPUs), necessitating a fundamental redesign of chip architectures to support large language models directly on smartphones. Manufacturers are modifying system-on-chip designs to include dedicated AI engines that function separately from the central CPU, thereby improving latency and data privacy for complex tasks. This evolution supports higher average selling prices and production volumes for premium logic chips, as evidenced by Samsung Electronics' goal, reported by CNBC in January 2024, to deploy Galaxy AI features on 100 million devices within the year, a strategy that demands advanced processors capable of sustained neural processing.Concurrently, the rapid global shift toward 5G-enabled smartphones forces semiconductor vendors to embed complex multi-mode 5G modems into their processor architectures. This shift requires application processors to handle vastly increased data throughput and frequency bands, including mmWave and sub-6GHz, without sacrificing thermal efficiency. The scale of this demand is highlighted by the 'Ericsson Mobility Report' from June 2024, which noted a rise of 160 million global 5G subscriptions in the first quarter of 2024 alone. Additionally, the Semiconductor Industry Association reported that global semiconductor sales hit $53.1 billion in August 2024, underscoring the vital economic role of these connectivity and processing components.

Market Challenges

The expansion of the Global Smartphone Application Processor Market is significantly impeded by the escalating costs and technical complexities associated with semiconductor manufacturing at advanced process nodes. As the demand for 5G integration and on-device artificial intelligence intensifies, chipmakers are compelled to use intricate fabrication processes that require massive capital investment. This financial burden restricts the number of capable manufacturers, leading to market consolidation and reduced competition, while the substantial development costs of these high-performance components inevitably raise unit prices, compressing profit margins for device manufacturers and potentially creating price barriers that limit consumer adoption.Recent industry data substantiates this upward trend in production overheads, reflecting the colossal investment required for manufacturing infrastructure. According to 'SEMI', global sales of total semiconductor manufacturing equipment are projected to reach a record $109 billion in '2024'. This figure confirms the severity of the capital intensity facing the sector, demonstrating how high operational costs hamper market growth by raising the barrier to entry and diverting resources that could otherwise support broader innovation or cost-reduction strategies.

Market Trends

The market is witnessing a decisive structural migration toward 3nm and sub-3nm semiconductor process technologies, driven by the imperative to increase transistor density and energy efficiency. As flagship mobile devices require higher computational throughput for multitasking and gaming without increasing power budgets, foundries are ramping up production of these leading-edge nodes to meet OEM specifications. This transition is clearly evidenced by TSMC's 'Third Quarter 2024 Earnings Call' in October 2024, where the company reported that its 3-nanometer process technology contributed 20 percent of total wafer revenue for the quarter, highlighting the rapid industrial scale-up of this advanced node for smartphone and high-performance applications.Simultaneously, there is a widespread adoption of hardware-accelerated ray tracing within mobile graphics processing units, aimed at delivering console-quality visual fidelity on handheld devices. Application processor vendors are redesigning GPU architectures to include specialized cores that calculate light behavior in real-time, moving beyond software-based emulation which significantly drains battery life. This drive for superior graphical realism is exemplified by Qualcomm's October 2024 announcement of the 'Snapdragon 8 Elite Mobile Platform', in which the newly integrated Adreno GPU delivers a 35 percent improvement in ray tracing performance compared to the previous generation, reflecting the intense competition to provide immersive gaming experiences on mobile platforms.

Key Players Profiled in the Smartphone Application Processor Market

- Qualcomm Technologies, Inc.

- MediaTek Inc.

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Texas Instruments Incorporated

- Broadcom Inc.

Report Scope

In this report, the Global Smartphone Application Processor Market has been segmented into the following categories:Smartphone Application Processor Market, by Operating System:

- Android

- iOS

Smartphone Application Processor Market, by Component:

- 5G

- ARM cores

- GPU

- Cache Memories

- Memory Controllers

- Audio

- Video Decoders

Smartphone Application Processor Market, by Application:

- Gaming

- Photo and Video Editing

- Camera

Smartphone Application Processor Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Smartphone Application Processor Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Smartphone Application Processor market report include:- Qualcomm Technologies, Inc.

- MediaTek Inc.

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Texas Instruments Incorporated

- Broadcom Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

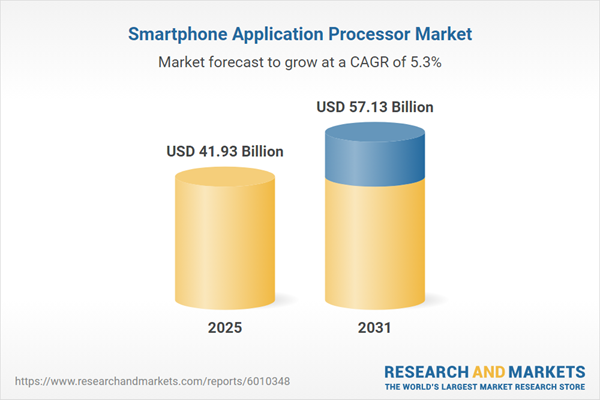

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 41.93 Billion |

| Forecasted Market Value ( USD | $ 57.13 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |