Speak directly to the analyst to clarify any post sales queries you may have.

A concise, authoritative introduction to the critical role of Balance of Systems components in enabling resilient and cost-efficient solar PV deployments across all market segments

The Balance of Systems (BOS) for solar photovoltaic installations encompasses the critical hardware, interconnection components, mounting structures, safety and protection devices, and ancillary services that enable reliable generation and delivery of solar energy. While photovoltaic modules garner much of the market attention, BOS elements determine system performance, lifecycle costs, operational resilience, and installation timelines. In turn, procurement strategies for electrical assemblies, inverters, mounting solutions, safety devices, and wiring pathways materially influence project viability across segments.

As project developers, EPC firms, independent power producers, and distributed energy integrators navigate evolving technology, regulatory shifts, and supply chain dynamics, a refined understanding of BOS complexity becomes essential. Stakeholders must weigh trade-offs between standardized, modular electrical systems and bespoke structural solutions that address site-specific constraints. Consequently, decisions around component interoperability, certification pathways, and balance-of-system engineering carry direct implications for project economics and risk allocation. This introduction establishes the foundation for a deeper examination of the disruptive forces reshaping procurement, manufacturing, and deployment choices across commercial, industrial, residential, and utility-scale solar projects.

How rapid innovation in inverters, modular electrical systems, and supply chain diversification is reshaping supplier value propositions and deployment strategies in solar PV Balance of Systems

Over the last several years the solar PV Balance of Systems landscape has experienced transformative shifts driven by rapid component innovation, supply chain realignment, and regulatory momentum toward electrification. Technological advances in power electronics have pushed inverter efficiency, grid-forming capabilities, and smart monitoring functions forward, enabling more compact electrical assemblies and tighter integration between AC and DC domains. Simultaneously, structural engineering has evolved to prioritize ease of installation, standardized interfaces, and reduced material intensity which lowers labor spend and shortens commissioning timelines.

In parallel, buyers and specifiers are demanding higher levels of module-to-BOS compatibility and clearer qualification criteria, which incentivizes suppliers to invest in interoperability testing and certification programs. Supply chain diversification has accelerated as procurement teams hedge geopolitical and raw-material risks by qualifying multiple suppliers across regions. This has encouraged localized manufacturing hubs and aftermarket service networks that shorten lead times and improve warranty servicing. Moreover, investor and lender expectations for performance guarantees and predictable O&M profiles are pushing developers to adopt integrated BOS strategies that emphasize lifecycle performance, predictive analytics, and modular upgradeability. Taken together, these forces are redefining supplier value propositions and creating new opportunities for firms that can combine engineering excellence with supply chain agility and service-based revenue models.

An evidence-based assessment of how 2025 United States tariff measures catalyzed supply chain localization, procurement revalidation, and contractual realignment across Balance of Systems suppliers

The cumulative policy and trade actions implemented by the United States in 2025 had a pronounced effect on procurement strategies, supplier networks, and project timelines for Balance of Systems components. Tariff adjustments and trade remedies shifted cost structures across imported mounting systems, electrical assemblies, and certain sourced subcomponents, prompting stakeholders to reassess sourcing footprints and contract terms. As a direct consequence, many buyers initiated supplier qualification efforts that prioritized manufacturers with diversified footprints or the capacity and certification to supply product domestically.

Transitioning procurement to alternative geographies or to domestic suppliers required lead-time adjustments, supplier audits, and sometimes design revalidation when form-fit-function differences existed. These operational frictions extended procurement cycles and in some instances pushed project owners to renegotiate delivery schedules with EPC partners. At the same time, the policy environment stimulated investments in domestic manufacturing capacity, including assembly lines for inverters, standardized racking, and pre-assembled electrical housings. Financial stakeholders re-evaluated contract risk allocations and construction contingency assumptions to reflect the potential for tariff-related price variability and supply delays. In short, the tariffs acted as a catalyst for supply chain localization and contractual rigor, accelerating structural changes that will influence strategic sourcing and engineering choices into the medium term.

Deep segmentation insights revealing how electrical and structural BOS categories, component specialization, system configuration, and end-user profiles drive distinct procurement and innovation pathways

Segmentation analysis reveals differentiated dynamics across technology type, component specialization, system configuration, and end-user demand profiles. When viewed through the lens of Type the industry separates into Electrical BOS and Structural BOS, each with distinct engineering challenges and supplier ecosystems. Electrical BOS components such as inverters, electrical assemblies, safety devices, and wiring solutions are subject to rapid innovation cycles and software-enabled differentiation, whereas Structural BOS solutions prioritize mechanical resilience, installation efficiency, and material optimization to meet site-specific loading and terrain constraints.

Exploring the Component Type segmentation further clarifies where R&D and capital are directed: electrical assemblies and inverters drive grid integration capabilities while mounting solutions and safety devices address installation speed and compliance requirements; wiring solutions ensure system-level reliability and simplify commissioning. System Configuration segmentation highlights that Hybrid Systems, Off-Grid Systems, and On-Grid Systems impose divergent design and procurement constraints; hybrid and off-grid architectures require integrated energy management and often deeper inverter functionality, while on-grid systems emphasize anti-islanding and utility interconnection standards. End-User segmentation across Commercial, Industrial, Residential, and Utility Scale reveals variation in purchasing behavior, warranty expectations, and service models; commercial and industrial customers increasingly favor service contracts and integrated performance guarantees, residential buyers prioritize cost and aesthetics, and utility-scale projects demand high-volume logistics, warranty fidelity, and long-term O&M planning. By synthesizing these segmentation dimensions, stakeholders can prioritize product development, channel strategies, and aftermarket services that align to the distinct needs of each customer cohort.

Regional contrasts and strategic implications across the Americas, Europe Middle East & Africa, and Asia-Pacific that drive differentiated sourcing, certification, and deployment approaches

Regional dynamics shape supply chains, regulatory environments, and adoption patterns in materially different ways across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, policy frameworks, utility procurement practices, and incentive structures have favored large-scale deployments and vertically integrated project models, which in turn create demand for standardized, high-volume BOS solutions and predictable O&M service offerings. Conversely, the Europe, Middle East & Africa region presents a complex tapestry of regulatory regimes and grid codes, driving demand for adaptable BOS configurations, robust safety devices, and localized certification processes that ensure cross-border project compliance.

Asia-Pacific remains a pivotal manufacturing and innovation hub for BOS components, with dense supplier ecosystems, advanced inverter R&D, and highly efficient mounting production lines. Regional supply chains in Asia-Pacific continue to benefit from scale economies, supplier clustering, and an expanding trade corridor network, while also facing increasing scrutiny over origin, sustainability credentials, and compliance with destination-country procurement rules. Across all regions, trade policy shifts, local content rules, and logistics resilience imperatives are influencing where manufacturers place capacity and how project developers structure procurement partnerships. These regional contrasts affect lead times, component standardization, and the practicalities of warranty management, and they should inform any cross-border expansion or sourcing optimization decision.

Key company-level trends showing how inverter innovation, modular mounting systems, and pre-assembled electrical solutions are redefining competitive advantage in BOS supply chains

Industry participants span a mixture of specialized component manufacturers, integrated EPC providers, and emerging technology entrants that offer differentiated BOS propositions. Leading inverter suppliers have invested heavily in grid-forming capabilities, digital monitoring suites, and lifecycle service offerings that extend beyond hardware sales. Mounting and racking firms are competing on modular designs that reduce installation labor intensity and accelerate commissioning, while electrical assembly providers are focusing on pre-assembled, factory-tested units to minimize on-site wiring risk and accelerate schedules.

Service firms and logistics specialists have become essential ecosystem partners, offering aftermarket O&M platforms, predictive analytics for performance optimization, and extended warranty frameworks that reduce long-term project risk. New entrants are targeting niche opportunities such as lightweight structural materials, integrated DC-coupled architectures for storage pairing, and enhanced safety devices that simplify code compliance. Competitive dynamics favor companies that can demonstrate both technical reliability and the capacity to scale production while maintaining robust quality management systems. For corporate strategy teams, partnership models, joint manufacturing agreements, and selective vertical integration are common approaches to secure supply, reduce lead times, and capture more value across the project lifecycle.

Actionable, high-impact recommendations for BOS industry leaders to fortify supply chains, modernize product design, and capture aftermarket value through strategic partnerships and analytics

To remain competitive and resilient, industry leaders should adopt a set of practical, high-impact actions that align engineering, procurement, and commercial functions. First, invest in supplier qualification programs that emphasize redundancy and cross-geography capacity so procurement can rapidly pivot when tariffs or logistic disruptions occur. Second, prioritize design-for-manufacturability and modularity in product roadmaps to reduce on-site labor intensity and to simplify post-installation upgrades. Third, strengthen digital and warranty ecosystems by embedding monitoring and analytics into products to support performance-based contracting and to increase aftermarket revenue capture.

In addition, executives should cultivate strategic partnerships with logistics and service providers to shorten lead times and enhance warranty responsiveness. Where regulatory environments encourage domestic content, consider capital allocations to regional manufacturing or assembly footprints to improve lead time and compliance positioning. Finally, align contract terms with lenders and offtakers to transparently account for procurement variability and tariff exposure, thereby protecting project cashflows and ensuring bankability. Executing on these recommendations will enable firms to convert current disruptions into structural advantages and to meet rising customer expectations for reliable, service-oriented BOS solutions.

A transparent, multi-method research methodology integrating primary interviews, supply chain mapping, and technical product analysis to validate BOS industry trends and risks

This research employs a multi-method approach combining qualitative interviews, supply chain mapping, technical product analysis, and secondary source synthesis to produce a robust view of the Balance of Systems landscape. Primary insights were derived from discussions with manufacturer engineers, EPC procurement leads, project developers, and independent technical consultants, enabling validation of product-level trends, installation constraints, and sourcing behaviors. Supply chain mapping focused on manufacturing footprints, logistics corridors, and supplier concentration to highlight exposure points and potential relocation levers.

Technical product analysis examined modularity, standardization of interfaces, and factory-assembled electrical units to assess time-to-commissioning and field failure risk. Secondary synthesis drew on regulatory filings, standards body publications, and public company disclosures to corroborate technology roadmaps and capital investment patterns. Wherever applicable, findings were cross-validated across stakeholder types to reduce bias and ensure practical relevance. The methodology places emphasis on transparency of assumptions, traceability of primary sources, and the reproduction of key analytical steps, enabling readers to replicate or extend the analysis for specific geographies, system configurations, or component classes.

A concise conclusion highlighting why integrated engineering, agile sourcing, and service-oriented strategies will determine winners in the evolving solar PV Balance of Systems ecosystem

In summary, Balance of Systems components are increasingly decisive determinants of project performance, schedule certainty, and lifecycle economics in solar PV deployments. Technological progress in inverters and electrical assemblies, combined with modular structural designs, has improved installation efficiency and enabled tighter integration with storage and grid management systems. At the same time, policy actions and trade adjustments have catalyzed supplier diversification and regional manufacturing investments, altering long-term procurement strategies.

The interplay between segmentation dynamics - including distinct requirements across electrical versus structural BOS, component specialization, system configuration, and end-user needs - suggests that successful players will be those who combine technical reliability with agile supply chain and service models. By adopting a strategic focus on interoperability, design modularity, and aftermarket analytics, firms can reduce project risk and unlock new revenue streams. Ultimately, the firms that integrate engineering, procurement, and lifecycle servicing into coherent, customer-oriented offerings will be best positioned to capture opportunity as the solar PV ecosystem evolves.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Solar PV Balance Of Systems Market

Companies Mentioned

The key companies profiled in this Solar PV Balance Of Systems market report include:- ABB Ltd.

- Bentek Corporation

- Eaton Corp. Plc

- First Solar Inc.

- Golden Concord Holdings Ltd.

- HellermannTyton Pte Ltd

- Huawei Technologies Co. Ltd.

- LESSO Solar

- Loom Solar Pvt. Ltd.

- Microtek International Pvt. Ltd.

- Moser Baer Solar Ltd.

- Prysmian S.p.A.

- Renesola Ltd.

- Schneider Electric SE

- SMA Solar Technology AG

- SolarEdge Technologies Inc.

- Solaris Technology Industry Inc

- Sungrow Power Supply Co. Ltd.

- SunPower Corporation

- TE Connectivity Corporation

- Unirac Inc.

Table Information

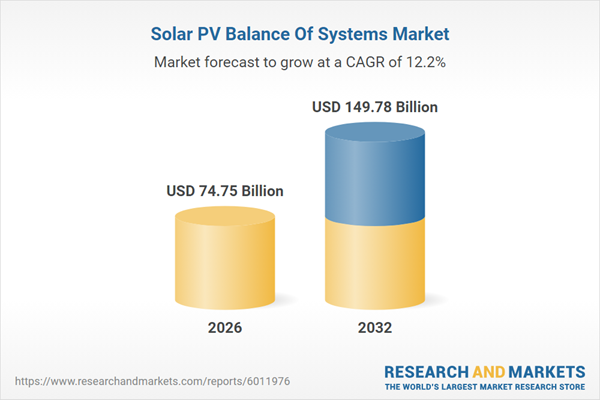

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 74.75 Billion |

| Forecasted Market Value ( USD | $ 149.78 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |