Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative introduction outlining how technological innovation, regulatory pressure, and operational imperatives are reshaping radiography equipment procurement and deployment

The radiography test equipment landscape is experiencing an accelerated period of structural change driven by technological innovation, shifting regulatory priorities, and evolving end-user expectations. This introduction frames the broader forces that influence procurement decisions, operational protocols, and capital allocation across inspection and nondestructive testing environments. It situates radiography within an industrial context where uptime, inspection fidelity, and data traceability are increasingly decisive for asset integrity and safety outcomes.

Against this backdrop, technological transitions from analog film to digital detection platforms are reducing cycle times and improving defect detectability, while at the same time introducing new demands for data management and cybersecurity. Moreover, supply chain resilience and localization pressures are prompting strategic sourcing decisions that affect lead times and service models. Regulatory scrutiny and standards updates amplify the need for compliant workflows and validated processes, and as a result, purchasing organizations are balancing performance requirements with lifecycle support considerations. In sum, this introduction prepares the reader to interpret subsequent sections through the lens of operational impact, technological differentiation, and procurement pragmatism

How detector advances, digital workflows, and service innovation are jointly transforming inspection practices, procurement choices, and lifecycle strategies across industries

There are transformative shifts underway that are redefining how organizations think about radiography test equipment, spanning advances in detector technologies, software-enabled inspection workflows, and broader digitalization of asset inspection. Transitioning detection modalities and enhanced image processing capabilities are enabling higher throughput and finer defect resolution, which in turn reframe inspection protocols and qualification criteria. As a consequence, lifecycle service models are evolving from reactive maintenance to proactive, condition-based approaches supported by richer diagnostic data.

In parallel, the proliferation of portable and modular systems is affecting deployment strategies across field and shop-floor environments. Portable units offer flexibility for in-situ inspections while stationary installations continue to serve high-volume, high-precision needs. Additionally, software integration and analytics are emerging as differentiators; inspection data is increasingly used not only for pass/fail decisions but also for predictive maintenance, trend analysis, and compliance documentation. Finally, the competitive landscape is responding with partnerships, vertical integration, and solution bundles that combine hardware, software, and service to meet increasingly specific customer requirements

Evaluating the compound operational, sourcing, and contractual consequences of recent tariff measures on radiography equipment procurement and supplier strategies

Recent tariff actions affecting imported goods have produced a cumulative set of operational and strategic effects for radiography test equipment stakeholders, with implications for sourcing, pricing strategies, and supplier relationships. For many buyers and suppliers, increased duties and trade restrictions prompt a reassessment of vendor selection criteria and total landed cost calculations, encouraging diversification of supply sources and closer collaboration with domestic manufacturers where feasible. In response, original equipment manufacturers and distributors may pursue localized assembly, alternate component sourcing, or revised channel strategies to mitigate exposure to tariff volatility.

Consequently, procurement teams are adjusting lead-time expectations and incorporating tariff risk into contractual terms and service-level agreements. Capital planning cycles are also affected as organizations weigh the trade-offs between immediate equipment upgrades and deferred replacement driven by altered cost structures. Moreover, tariffs often accelerate conversations around retrofit solutions and software-centric upgrades that can extend equipment utility without requiring full hardware replacement. Together, these dynamics are reshaping procurement rationales and encouraging market participants to focus on supply chain transparency, dual sourcing, and contractual protections to reduce exposure to future policy shifts

Detailed segmentation-driven analysis explaining how technology, application, industry context, and product form factors collectively determine equipment selection and operational strategy

Key segmentation insights reveal how technology choices, application needs, industry context, and product form factors drive distinct purchasing behaviors and operational priorities. Based on Technology, the landscape includes Computed Radiography, Digital Radiography, and Film Radiography, with Computed Radiography centered on Photostimulable Phosphor Plate implementations and Digital Radiography encompassing Charge Coupled Device, Complementary Metal Oxide Semiconductor, and Flat Panel Detector architectures; each technology pathway creates different trade-offs among image quality, throughput, cost of ownership, and integration complexity. Based on Application, inspection requirements are organized around Casting Inspection, Forging Inspection, and Weld Inspection, and each use case imposes specific resolution requirements, geometric constraints, and environmental considerations that influence detector selection and workflow design. Based on End User Industry, demand profiles differ across Aerospace, Automotive, Infrastructure, Oil And Gas, and Power Generation, where regulatory regimes, acceptable risk levels, and production cadences shape priorities for automation, traceability, and service response. Based on Product Type, the choice between Portable and Stationary systems reflects operational modality: portable systems prioritize mobility, ruggedization, and field serviceability, while stationary systems emphasize repeatability, throughput, and integration with fixed line processes.

Taken together, these segmentation lenses make clear that a single procurement playbook cannot meet the diverse needs across use cases. Rather, suppliers and buyers must map technology capabilities to inspection objectives, industry requirements, and operational constraints. For example, high-volume automotive inspection environments may prioritize flat panel detectors for cycle-time efficiency, whereas aerospace and power generation contexts might favor imaging systems and workflows that provide the highest possible fidelity and traceability. Transitional approaches, such as deploying portable units for initial triage and routing critical components to stationary, high-resolution facilities, are increasingly common as organizations optimize for both cost and compliance

How regional regulatory regimes, industrial concentration, and supply chain configurations are shaping procurement priorities and service network investments across global markets

Regional dynamics exert a strong influence on procurement practices, service networks, and regulatory compliance for radiography test equipment, producing distinct strategic priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, demand is shaped by a concentration of end users in aerospace and automotive, a focus on rapid turnaround for production environments, and a trend toward nearshoring and domestic supplier engagement to reduce exposure to international logistics risks. These factors encourage investment in solutions that balance throughput with robust service agreements and regional spare part availability.

Across Europe, Middle East & Africa, regulatory harmonization, stringent safety standards, and aging infrastructure needs drive a preference for high-fidelity inspection systems and lifecycle support models that emphasize long-term compliance and traceable records. Procurement decisions frequently consider the interoperability of inspection data with national and industry-specific compliance frameworks. In the Asia-Pacific region, rapid industrialization, diverse regulatory landscapes, and a mix of high-volume manufacturing hubs foster widespread adoption of digital radiography solutions and a vigorous aftermarket for retrofit and service innovations. As a result, suppliers prioritize scalable distribution models and local technical services to meet heterogeneous demand profiles. Collectively, these regional trends shape where firms invest in manufacturing footprints, service centers, and strategic partnerships to meet customer expectations for uptime and regulatory compliance

Insights into how suppliers differentiate through detector performance, service ecosystems, software integration, and channel strategies to win long-term customer commitment

Company-level considerations center on differentiation through technology specialization, after-sales service, and integrated solution offerings that marry hardware with software and analytics. Leading suppliers tend to segment their propositions by emphasizing detector performance metrics, modularity for upgrades, and robust calibration and certification services that support traceability and auditability. Additionally, there is a clear competitive advantage for firms that invest in digital platforms enabling inspection data management, annotation, and automated reporting, because these capabilities reduce inspection cycle times and improve decision consistency across distributed sites.

From a commercial perspective, channel strategy and partner networks play a critical role in market reach, particularly for portable and field service products. Companies that cultivate strong distribution relationships and localized technical support are better positioned to capture replacement demand and service contracts. At the same time, suppliers that offer lifecycle financing, subscription-based software, and performance guarantees can lower adoption barriers and build stickier customer relationships. Strategic alliances between hardware manufacturers and software providers are increasingly common as firms seek to deliver turnkey solutions that address both imaging performance and enterprise data integration needs

Practical recommendations for buyers and suppliers focused on modular procurement, supply chain resilience, workforce upskilling, and contractual safeguards to protect operational continuity

Actionable recommendations for industry leaders emphasize aligning procurement decisions with long-term operational resilience, prioritizing modularity and interoperability, and strengthening supply chain transparency. Leaders should evaluate equipment not just on immediate capital cost but on maintainability, upgrade pathways, and the ease with which inspection data can be integrated into enterprise systems. Making procurement decisions that favor modular detector architectures and standardized interfaces reduces obsolescence risk and simplifies future technology transitions. In addition, organizations should negotiate contracts that include clear performance metrics, spare part guarantees, and provisions for software updates to preserve system value over the lifecycle.

Moreover, companies should invest in workforce upskilling and digital competencies so that technicians and quality engineers can fully leverage advanced imaging and analytics tools. Supplier diversification and dual-sourcing strategies will mitigate tariff exposure and supply chain disruptions, while localized service hubs can materially improve uptime and responsiveness. Finally, managers should adopt pilot programs to validate retrofit and software-driven enhancements before committing to widespread rollouts, using these pilots to quantify operational benefits and to refine integration plans across inspection workflows

A transparent and practitioner-validated research methodology combining technical assessments, operator interviews, and standards analysis to ensure actionable and credible insights

The research methodology underpinning this executive summary combines primary engagement with industry practitioners, technical validation of inspection technologies, and secondary analysis of publicly available standards and regulatory guidance. Primary inputs include interviews with procurement leaders, inspection engineers, and service managers who provided firsthand perspectives on operational constraints, supplier performance, and technology preferences. These conversations were complemented by technical assessments of detector capabilities and software functionalities to ensure that capability claims align with real-world performance requirements.

Secondary sources included standards documentation, regulatory briefings, and manufacturer technical specifications to triangulate claims and to contextualize how compliance obligations influence purchasing choices. The approach also incorporated comparative analysis across product types and end-use sectors to surface recurring patterns and divergent use cases. Throughout, the methodology emphasized transparency in assumptions, traceability of qualitative inputs, and an iterative validation process to reconcile practitioner insight with technical realities and regional regulatory frameworks

A conclusive synthesis highlighting the interplay of technology, service models, and procurement resilience that determines successful radiography inspection outcomes

In conclusion, the radiography test equipment landscape is being redefined by technology migration toward digital detection, the rising importance of software-enabled workflows, and heightened attention to supply chain and regulatory risk. These forces are creating differentiated value propositions for portable versus stationary systems, for photostimulable phosphor and flat panel detector pathways, and for service models that bundle hardware with analytics and lifecycle support. Consequently, procurement strategies that integrate technology fit, operational workflows, and supplier resilience are positioned to deliver the strongest outcomes in terms of inspection fidelity and operational uptime.

Looking ahead, organizations that proactively address workforce capability, contractual protections, and data interoperability will be better equipped to capture the benefits of new inspection technologies while managing cost and compliance pressures. By aligning technology investments with specific application needs-whether casting, forging, or weld inspection-and by calibrating supplier relationships to regional service requirements, stakeholders can convert technological advances into measurable improvements in asset integrity and process assurance.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Radiography Test Equipment Market

Companies Mentioned

The key companies profiled in this Radiography Test Equipment market report include:- Anritsu Corporation

- Baker Hughes Company

- Blue Star Limited

- Comet Holding AG

- Fujifilm Holdings Corporation

- Mettler-Toledo International Inc.

- Nikon Corporation

- Olympus Corporation

- Pexray Oy

- Shimadzu Corporation

- Teledyne Technologies Incorporated

- Varex Imaging Corporation

Table Information

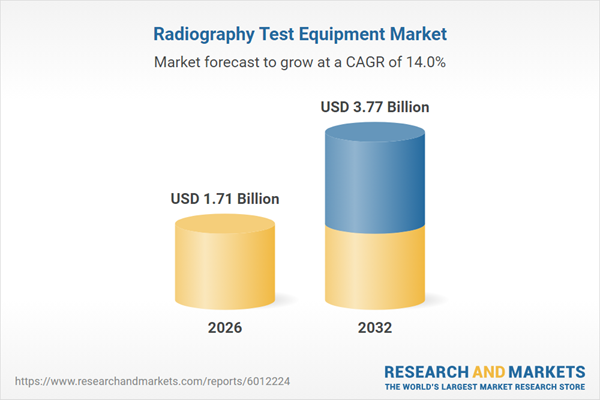

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.71 Billion |

| Forecasted Market Value ( USD | $ 3.77 Billion |

| Compound Annual Growth Rate | 14.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |