Speak directly to the analyst to clarify any post sales queries you may have.

A strategic overview of how automation, ruggedized controls, and remote operation are transforming drilling operations and reshaping procurement priorities

Robotic drilling is redefining how heavy industries access subsurface resources and construct complex infrastructure, bringing a synthesis of autonomy, precision, and ruggedized engineering to environments historically dominated by manual operation. Advances in control systems, navigation modules, communication architectures, and powertrain options are enabling rigs to operate with higher repeatability and lower human exposure to risk, while remote operation consoles and telerobotic communication suites extend operational reach into previously inaccessible zones. These technological vectors are converging with growing operational priorities around safety, productivity, and sustainability, creating immediate pressure for enterprises to reassess asset strategies and procurement pipelines.Transitioning from conceptual pilots to integrated field deployments requires alignment across product design, operations, and regulatory compliance. Operators are increasingly evaluating the trade-offs between autonomy and remote control, weighing the modularity of tracked versus wheeled platforms, and reconciling diesel, electric, and hydraulic power choices with onsite logistics. As a result, decision-makers need concise, actionable intelligence that bridges technology capability with operational realities, enabling clearer investment decisions and phased adoption plans that reduce implementation risk and accelerate value realization.

How convergence of AI navigation, edge computing, and modular subsystems is accelerating field-ready autonomy and altering supplier competitiveness

The landscape for drilling operations has shifted dramatically due to rapid improvements in sensing, AI-driven navigation, and resilient communication protocols. Where previously remote monitoring and basic automation were the primary objectives, current deployments emphasize end-to-end autonomy and interoperable subsystems that can function across diverse geology and climates. Edge computing now enables local decision-making on navigation and drilling parameters, reducing latency and limiting dependency on continuous high-bandwidth links. Simultaneously, modular architectures permit faster retrofitting of existing fleets and streamline maintenance cycles through standardized control and navigation modules.Operational expectations have also evolved: stakeholders demand predictable uptime, measurable safety improvements, and demonstrable reductions in lifecycle operating costs. These expectations are driving manufacturers to design platforms with interchangeable propulsion and power modules, tighter integration between control firmware and remote operation consoles, and enhanced diagnostics to support condition-based maintenance. The competitive environment is thus favoring engineering teams that can rapidly prototype, validate, and certify systems across the spectrum of autonomous and telerobotic solutions while sustaining robust supply chain relationships for critical components.

Strategic supply chain reconfiguration and component localization strategies companies are using to mitigate the cumulative impacts of United States tariffs in 2025

The evolving tariff environment in the United States for 2025 introduces new variables into procurement, sourcing, and total cost considerations for capital equipment and critical components. Tariff adjustments increase the importance of geographic sourcing strategy, component localization, and long-term supplier partnerships, particularly for components such as navigation sensors, communication transceivers, and mobility platforms that are often sourced from global supplier networks. Firms are adopting dual-sourcing strategies and re-evaluating bill-of-material configurations to reduce exposure to tariff-driven cost volatility while preserving innovation-led differentiation in control systems and navigation modules.Beyond cost, tariffs influence supply chain lead times and inventory policies. Organizations are responding by expanding qualified supplier lists within tariff-favorable jurisdictions, accelerating the certification of alternate parts, and investing in buffer inventories for high-risk components. These tactical responses are being combined with strategic initiatives such as localized assembly hubs and transfer pricing realignment to insulate operations from recurrent tariff changes. In parallel, manufacturers are enhancing product modularity to permit substitution of components with comparable performance characteristics sourced from different regions, thereby safeguarding product roadmaps and deployment schedules against external trade policy shocks.

Distinct end-user, application, system-type, mobility, and power-source segmentation insights that shape product roadmaps, R&D priorities, and go-to-market strategies

Analyzing demand through diverse segmentation lenses reveals nuanced adoption patterns that should inform product development and commercial strategies. When end users are compared, construction operations prioritize flexible mobility platforms and simplified remote operation consoles to support dense urban and constrained-site workflows, whereas mining practitioners place a higher emphasis on rugged tracked mobility and durable power systems adapted for long-duration cycles; operators in oil and gas emphasize integrated communication modules and compliance-ready control systems suited to complex wellsite protocols. From an application perspective, exploration use cases favor compact, highly portable rigs and enhanced navigation for rapid site characterization; geothermal projects require equipment designed for high-temperature environments and robust power delivery; well drilling applications demand integrated control and telemetry suites that align with stringent regulatory and safety requirements.Differentiation by type reveals divergent engineering and commercial priorities: autonomous systems focus investment on control system sophistication and navigation module redundancy to enable safe, unsupervised operations, while telerobotic platforms concentrate development on communication module resilience and ergonomic remote operation consoles that maximize operator situational awareness. Mobility segmentation underscores platform selection: stationary rigs support fixed infrastructure projects where stability and high-power delivery are paramount, tracked platforms address unstable terrain and steep gradients, and wheeled units deliver faster repositioning across prepared surfaces. Power source choices further shape lifecycle decisions; diesel solutions remain attractive where fuel logistics dominate, electric platforms appeal to operations with access to grid or battery support and sustainability mandates, and hydraulic options balance force density with well-established maintenance frameworks. Integrating these segmentation insights enables clearer product roadmaps, prioritization of R&D investments, and more precise go-to-market messaging tailored to distinct buyer archetypes.

How divergent regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific drive tailored deployment strategies, service models, and compliance requirements

Regional dynamics are creating differentiated adoption curves and operational requirements that influence both product configuration and commercial engagement models. In the Americas, procurement cycles are often driven by infrastructure development and resource extraction projects that require robust field service networks and large-scale deployment capabilities, prompting suppliers to emphasize local service agreements and long-term parts availability. Europe, the Middle East & Africa present a heterogeneous landscape: regulatory intensity varies significantly across countries, creating demand for compliance-focused control systems and adaptable communication architectures that can operate across mixed infrastructure environments; meanwhile, EMEA projects often require solutions engineered for broad climatic ranges and complex logistics.Asia-Pacific is characterized by rapid industrialization and a high appetite for technological adoption, with particular interest in electric powertrain variants and autonomous navigation solutions that can be customized for both dense industrial sites and remote resource operations. Regional financing models, labor availability, and infrastructure maturity also shape procurement preferences, compelling vendors to tailor leasing structures, training programs, and local-partner arrangements to accelerate technology acceptance and support sustainable operations across geographies.

Ecosystem dynamics showing how incumbent manufacturers, robotics specialists, and deep-tech entrants are converging through partnerships to accelerate field adoption and service excellence

Competitive dynamics in the robotic drilling ecosystem are defined by a mix of established industrial equipment manufacturers, specialized robotics integrators, and technology-focused start-ups that are each contributing distinct capabilities. Leading engineering organizations are leveraging decades of heavy-equipment experience to deliver rugged mobility platforms and proven power systems, while specialist robotics firms are differentiating through advanced control algorithms, sensor fusion approaches, and streamlined human-machine interfaces that reduce operator cognitive load. Start-ups and deep-tech companies often accelerate the introduction of novel navigation methods and communication topologies, pushing incumbents to adopt faster development cycles and more open integration frameworks.Collaboration across this landscape is increasing: strategic partnerships, technology licensing, and systems integration agreements enable faster time-to-field and allow firms to combine mechanical reliability with software-driven autonomy. At the same time, service and maintenance ecosystems are emerging as a critical competitive axis, with companies investing in remote diagnostics, predictive maintenance capabilities, and localized support networks to preserve uptime and reduce total operating friction for buyers. Those who succeed will be the organizations that balance engineering excellence with scalable commercial and aftersales models.

Actionable strategic playbook recommending modular design, supplier diversification, and customer-focused commercialization to accelerate safe, scalable deployments

Industry leaders should adopt a three-pronged playbook focused on modular product design, resilient supply chain architecture, and customer-centric deployment models to accelerate adoption and mitigate operational risk. Investing in modular control and navigation modules reduces integration time and allows rapid substitution of components when trade policy or supply interruptions occur. Complementing modularity with expanded supplier qualification programs and dual-sourcing arrangements improves procurement resilience and shortens lead times for mission-critical parts.Commercially, firms must develop flexible commercialization pathways that include outcome-based contracts, phased pilot-to-scale programs, and embedded training curricula for field operators. Embedding advanced diagnostics and remote support features into product offerings will improve uptime and create opportunities for value-added services. Leaders should also prioritize cross-functional teams that align engineering, field operations, and compliance to accelerate certification cycles, reduce deployment friction, and ensure that new systems deliver measurable safety and productivity improvements from first deployment onward.

Methodical synthesis of technical validation, stakeholder interviews, and trade-policy analysis used to derive defensible, operationally focused insights without speculative forecasting

The research methodology underpinning these insights combined a structured review of technology developments, supplier roadmaps, and public policy movements with primary-source interviews across engineering, operations, and procurement stakeholders. Technical validation was achieved through cross-referencing vendor technical dossiers, academic and industry white papers, and field performance case summaries to ensure claims about control system behavior, navigation accuracy, and powertrain suitability were grounded in demonstrable prototypes and pilot deployments. Trade policy analysis incorporated public tariff schedules and historical precedent to model operational responses and sourcing adaptations without relying on proprietary forecasting models.Qualitative inputs were collected from a broad set of practitioners to capture operational constraints, procurement priorities, and maintenance realities. These practitioner perspectives were triangulated with engineering design documentation and serviceability analyses to derive practical recommendations. The methodology emphasized defensible, reproducible insight generation focused on system interoperability, field reliability, and commercial viability rather than on speculative growth projections.

Concluding synthesis emphasizing systems-level integration, service readiness, and procurement adaptability as the primary determinants of scaling robotic drilling technologies

Robotic drilling technologies have moved beyond proof-of-concept and are entering a phase where mission design, integration strategy, and aftersales capability determine success. The interplay between autonomous control sophistication, modular hardware design, and resilient sourcing strategies will be the decisive differentiators for organizations seeking to operationalize these capabilities at scale. As adoption accelerates, companies that align R&D investments with field-service readiness and regional compliance demands will capture the most durable value.Decision-makers should view robotic drilling as a systems challenge rather than a single-product purchase. Prioritizing interoperability, maintainability, and adaptive procurement strategies will reduce deployment risk and create pathways to measurable operational improvement. Ultimately, the winners will be those organizations that pair disciplined engineering execution with commercially pragmatic deployment models, ensuring that technological promise is translated into sustained operational performance.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Robotic Drilling Market

Companies Mentioned

The key companies profiled in this Robotic Drilling market report include:- ABB Ltd

- DENSO Corporation

- FANUC Corporation

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corporation

- Precision Drilling Corporation

- Rigarm Inc.

- Saudi Arabian Oil Company

- Seiko Epson Corporation

- Sekal AS

- Shell group of companies

- Siemens AG

- SKF Group

- Stäubli International AG

- Valero Energy Corporation

- Weatherford International plc

- Yaskawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

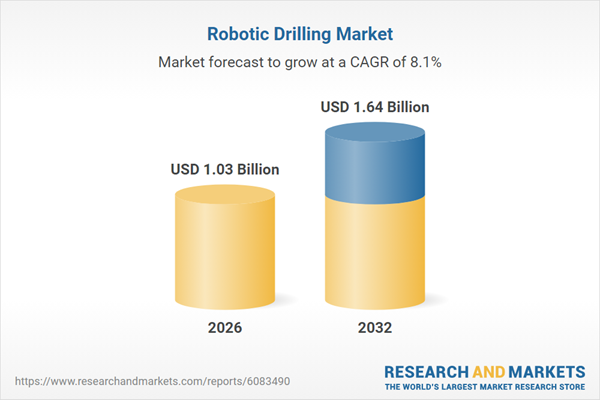

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.03 Billion |

| Forecasted Market Value ( USD | $ 1.64 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |