Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative overview framing how evolving operational priorities, hygiene standards, and technology adoption are redefining commercial ice machine value propositions

The commercial ice machine sector sits at the intersection of foodservice operations, healthcare support, institutional infrastructure, and retail convenience. Demand drivers range from hospitality and foodservice needs for consistent, high-quality ice to healthcare and educational facilities that prioritize sanitation and reliability. Supply-side developments span modular and countertop product innovation, while operational priorities increasingly emphasize energy efficiency, water usage, and simplified maintenance. In this context, operators and manufacturers face continual pressure to reconcile performance, regulatory compliance, and total cost of ownership.Over recent years, accelerated adoption of automation, remote monitoring, and hygienic design features has shifted how buyers evaluate purchase decisions and service contracts. Operators now expect transparent lifecycle cost information, predictable service networks, and modular solutions that scale with facility needs. Consequently, manufacturers and distributors that invest in durable components, intuitive controls, and responsive aftermarket services position themselves for long-term relevance. As a result, strategic decision-making must integrate product engineering, channel alignment, and sustainability priorities to capture enduring value across end-user segments.

How energy, hygiene, connectivity, and serviceability imperatives are driving a systemic transformation in commercial ice machine product development and distribution

Several transformative shifts are redefining market dynamics, prompting stakeholders to rethink product roadmaps and go-to-market strategies. First, regulatory and customer expectations around energy efficiency and water conservation have elevated the importance of condenser selection, system controls, and end-to-end serviceability. As a consequence, product designs that reduce lifecycle costs and simplify routine maintenance have captured procurement attention in both private and institutional sectors. Secondly, the maturation of connected equipment ecosystems has enabled remote diagnostics, predictive maintenance, and software-driven warranty services, decreasing downtime and improving equipment utilization.Concurrently, hygiene and food-safety imperatives led to material innovations, sanitation-friendly geometries, and certification-focused design choices that ease compliance burdens for healthcare, education, and foodservice operators. Distribution and sales channels have adapted, with online procurement complementing established dealer and service networks to offer faster lead times and bundled maintenance plans. Finally, workforce constraints and the rising cost of service labor have encouraged modularization and standardized components, which streamline field repairs and reduce mean time to repair. Together, these shifts create new performance benchmarks and compel commercial ice machine stakeholders to adopt integrated product-service strategies that prioritize resilience and operational transparency.

Practical implications of shifting trade barriers and tariff structures on sourcing, service economics, and supply chain resilience for commercial ice machines

Tariff alterations and trade policy developments have introduced new layers of complexity to procurement, sourcing, and pricing strategies within the commercial ice machine ecosystem. Changes in import duties influence decisions about where to locate final assembly, which components to localize, and how to hedge supplier risk across international footprints. Procurement teams react by recalibrating supplier contracts, optimizing bill-of-materials composition, and accelerating qualification of local vendors to preserve margin and delivery reliability.Beyond procurement, tariffs affect aftermarket parts availability and maintenance economics. Service organizations must adapt inventory strategies to ensure rapid parts replenishment while managing carry costs and obsolescence risk. In parallel, manufacturers reassess distribution models and explore contractual arrangements-such as extended lead times, collaborative stocking, and local assembly partnerships-to mitigate tariff volatility. These measures reduce exposure to policy shifts and sustain service levels for critical end users, including healthcare facilities and foodservice operators. Consequently, resilient commercial strategies now emphasize diversified sourcing, longer-term supplier agreements, and closer collaboration between sales, supply chain, and product engineering teams to maintain continuity and competitive positioning amid evolving trade environments.

Deep segmentation insights revealing how type, condenser choice, production capacity, ice style, end-user requirements, and sales channels interact to shape market opportunity

Segment-level nuance shapes competitive dynamics and product prioritization across the industry. Based on Type, manufacturers calibrate designs and feature sets to the distinct needs of countertop ice machines, modular ice machines, and undercounter ice machines, where footprint, capacity, and integration constraints inform engineering trade-offs. Based on Condenser Type, the choice between air cooled and water cooled systems drives specification decisions for installation environments and operational efficiency, influencing lifecycle maintenance and site preparation planning. Based on Ice Production Capacity, differentiation spans small-capacity units suited to compact venues to higher-capacity systems that serve continuous-demand environments, and these capacity tiers guide channel mix and service network expectations.Additionally, Based on Ice Type, preferences for cubed ice, flaked ice, and nugget ice create product feature requirements that affect evaporator design, harvest cycles, and sanitation procedures. Based on End-User, offerings must adapt to the unique operational priorities of corporate offices, educational institutions-further broken down into schools and universities-food service industry settings, healthcare facilities-which include hospitals and nursing homes-retail and vending scenarios, and transportation hubs. Each end-user category imposes specific standards for uptime, sanitation, and footprint. Finally, Based on Sales Channel, the balance between offline and online distribution channels determines lead-time expectations, warranty administration, and the degree of value-added services bundled at point of sale. Integrating these segmentation dimensions enables targeted product roadmaps and channel strategies that align engineering, service, and commercial efforts to distinct buyer personas.

Regional dynamics and infrastructure realities across the Americas, Europe Middle East & Africa, and Asia-Pacific that determine product positioning and service investments

Regional dynamics materially influence where manufacturers prioritize investment, service infrastructure, and compliance resources. In the Americas, demand patterns reflect a wide range of end users from hospitality clusters to large healthcare networks, driving investment in serviceability and localized parts distribution to ensure uptime. Europe, Middle East & Africa presents a combination of stringent efficiency regulations in some markets, varied installation environments, and a need for adaptable product configurations that meet both energy and water-use constraints, which encourages modular and certification-driven product strategies.Asia-Pacific continues to demonstrate diverse market behaviors across mature and emerging economies, where rapid urbanization and expanding foodservice footprints increase demand for both compact countertop units and higher-capacity modular systems. Regional service ecosystems and distribution models vary significantly, so manufacturers often deploy hybrid strategies that combine regional assembly, local partner networks, and standardized component architectures. Across all regions, regulatory and infrastructure differences require a localized approach to product certification, installation support, and aftermarket service models, and companies that invest in regional intelligence and partner ecosystems improve their agility and service reliability.

Competitive positioning and partnership models that prioritize hygienic innovation, energy efficiency, and service reliability to win in diverse channels and end-user segments

Competitive landscapes in the commercial ice machine space reflect ongoing product innovation, service differentiation, and distribution specialization. Leading manufacturers emphasize hygienic design, energy-efficient condensers, and modular architectures that reduce on-site labor requirements. At the same time, independent service networks and specialized distributors compete on responsiveness, parts availability, and bundled maintenance plans that lower total operational disruption for end users.Partnerships between equipment providers and channel specialists have become more common, enabling quicker market access and tailored service coverage. Some companies focus on vertical integration to control component supply and assembly quality, while others emphasize a lighter asset model that leverages local partners for installation and maintenance. Regardless of approach, competitive advantage arises from combining product durability, intuitive controls, and a predictable aftermarket experience. Manufacturers that invest in training, digital diagnostics, and transparent warranties strengthen customer retention and create cross-selling opportunities into adjacent equipment categories. Ultimately, differentiation is no longer solely about ice production performance; it increasingly centers on reliability, ease of ownership, and the ability to deliver consistent service outcomes for diverse end users.

Actionable strategic moves for manufacturers, distributors, and service providers to enhance resilience, reduce operating costs, and increase customer retention

Industry leaders can translate insight into tangible advantage by adopting a set of pragmatic actions. Prioritize modular design choices and standardized serviceable components to reduce mean time to repair and to simplify field training for technicians, thereby protecting uptime for critical end users. Complement product engineering with digital monitoring platforms that enable predictive maintenance and remote diagnostics, which lower service costs and improve customer satisfaction through proactive interventions. Invest in condenser and water-management technologies that address both regulatory requirements and operator demand for lower operational costs.Strengthen regional service footprints by developing hybrid models that combine centralized parts hubs with certified local service partners to ensure rapid response across metropolitan and remote installations. Align sales channel strategies to end-user procurement behaviors by offering configurable warranty and maintenance packages sold online and through established distribution networks. Finally, integrate tariff risk assessments into sourcing strategies, including supplier diversification and localized assembly options, to reduce exposure to policy volatility and preserve margin. These steps create a resilient platform for sustained operational performance and market differentiation.

Rigorous methodology combining primary interviews, operator case studies, and secondary regulatory and technology analysis to produce actionable, validated insights

This research synthesizes primary qualitative interviews with equipment manufacturers, distributors, and end users, combined with systematic secondary analysis of industry standards, certification requirements, and technology adoption trends. The approach blends supplier interviews and operator case studies to illuminate real-world maintenance patterns, procurement decision criteria, and installation constraints. Secondary sources provide context on regulatory trends for energy and water use, prevailing sanitation standards, and distribution channel evolution, while primary feedback validates practical implications for product design and aftermarket strategy.Analytical methods emphasize cross-segmentation triangulation to ensure that insights reflect interactions between product type, condenser selection, ice production capacity, ice style, end-user priorities, and distribution channels. Regional assessments incorporate infrastructure and regulatory considerations to clarify where local adaptation is essential. Throughout, the methodology privileges verifiable industry observations and operator experiences to produce actionable recommendations for engineering, supply chain, and commercial teams.

Final synthesis emphasizing the need for integrated product, service, and supply strategies to achieve durable competitive advantage in the commercial ice machine sector

The commercial ice machine sector requires integrated strategies that combine product engineering, service excellence, and supply chain resilience. Manufacturers and channel partners that design for serviceability, embrace digital maintenance tools, and align condenser and water management choices to installation realities will reduce operational friction for buyers. Similarly, distributors and service providers that offer predictable aftermarket support and flexible warranty options will gain trust among high-reliability end users such as hospitals and large foodservice operators.As trade policies evolve and regional regulations tighten, successful organizations will maintain diversified sourcing strategies and invest in regional service infrastructure to preserve continuity. By focusing on hygiene, energy efficiency, ease of ownership, and transparent lifecycle cost communication, industry players can build durable relationships with a broad set of end users. In short, the winners will be those who combine robust product design with dependable service networks and a customer-centric approach to installation and maintenance.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Commercial Ice Machines Market

Companies Mentioned

The key companies profiled in this Commercial Ice Machines market report include:- Ali Group S.r.l.

- Avantco Refrigeration

- Bluestone Appliance

- Brema Group S.p.A.

- Cornelius, Inc.

- Daikin Industries, Ltd.

- Electrolux Professional AB

- Focusun Refrigeration Corporation

- Follett LLC

- Grant Ice Systems, Inc.

- Guangzhou Icesource Co., Ltd.

- Hoshizaki Corporation

- Icefocustar

- ITV Ice Makers, S.A.

- Koller Refrigeration Equipment Company

- KOYO Corporation

- Manitowoc Ice, Inc.

- Orien USA, Inc.

- Polar Refrigeration GmbH

- Shenzhen Brother Ice System Co., Ltd.

- Snooker Cooking Facilities & Refrigeration Equipment Co., Ltd.

- Snowman Fittings Co., Ltd.

- The Legacy Companies

- The Middleby Corporation

- Twothousand Machinery Co., Ltd.

- U-Line Corporation

- Welbilt, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | January 2026 |

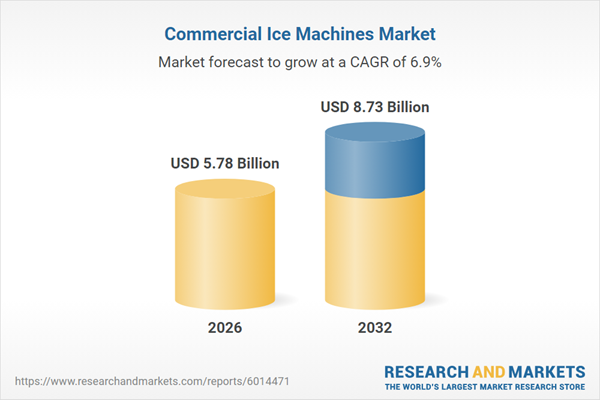

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 5.78 Billion |

| Forecasted Market Value ( USD | $ 8.73 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |