Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction to evolving product demands and material performance drivers shaping waterproof and moisture-proof gypsum board adoption in modern construction

Waterproof and moisture-proof gypsum board has evolved from a niche specialty product to a foundational material across diverse construction applications due to heightened expectations for durability, indoor environmental quality, and lifecycle performance. Advances in formulations, reinforcement approaches, and surface treatments have expanded use cases beyond traditional wet-area installations to include exterior sheathing and high-performance ceilings. As a result, material selection decisions increasingly hinge on long-term resilience and compatibility with modern building envelopes and HVAC systems.Industry stakeholders are responding to broader shifts in construction practices, regulatory focus on moisture management, and the demand for systems that reduce maintenance burdens. Specifiers, contractors, and building owners are weighing trade-offs between initial cost and total cost of ownership more explicitly, while manufacturers invest in processing technologies and raw material sourcing strategies that enhance water resistance without compromising fire performance or recyclability. These dynamics set the stage for an accelerated reappraisal of product portfolios and go-to-market approaches across markets worldwide.

How material innovation, regulatory pressure, and procurement digitization are reshaping competitive positions and specification pathways across construction markets

The landscape for waterproof and moisture-proof gypsum board is undergoing transformative shifts driven by material innovation, stricter building codes, and the interplay of sustainability and lifecycle economics. Novel fiber reinforcements and polymer-infused facings have improved mechanical resilience, enabling boards to perform under sustained moisture exposure and in exterior sheathing applications where they previously could not compete. At the same time, distribution and procurement models are shifting as digital ordering and project-level specification systems accelerate lead times and transparency.Regulatory emphasis on moisture intrusion prevention and indoor air quality is catalyzing specification changes, particularly in regions prone to extreme weather events. Meanwhile, the push for circularity is encouraging manufacturers to experiment with recycled content and designs that facilitate disassembly. These converging forces are prompting companies to reassess product differentiation, prioritize R&D on hybrid systems, and engage more closely with contractors and architects to shape spec language at earlier stages of project design. Consequently, market participants that align technical innovation with clear specification support will gain the upper hand in competitive tender environments.

An evidence-based assessment of the operational and sourcing disruptions triggered by newly enacted United States tariffs in 2025 and how firms have adapted

United States tariff actions announced in 2025 introduced new cost vectors for imports of construction materials and components, producing downstream effects across raw material sourcing, pricing strategies, and supplier selection. Import tariffs have prompted many manufacturers to revisit regional sourcing strategies and accelerate localization where feasible. This has increased attention on domestic supply chain resilience but has also elevated input-cost volatility for firms reliant on specialized additives and faced raw mineral inputs.As stakeholders adapted, procurement teams placed renewed emphasis on supplier diversity and long-term contracts to buffer against further policy shifts. Contractors and distributors revisited inventory policies to minimize exposure to sudden cost increases while preserving project margins. In parallel, some producers explored formulation adjustments to reduce dependence on tariff-affected inputs, investing in alternative chemistries and process optimizations. These adaptations illustrate a pragmatic industry response: firms that combine flexible sourcing, transparent cost modeling, and collaborative customer communication navigated the disruptive effects with less erosion to commercial momentum.

Segment-driven insights that clarify where product differentiation and channel strategies can generate the greatest specification influence and commercial upside

Understanding commercial opportunities requires a granular reading of segmentation across application, product type, end user, and distribution channels. When analyzed by application, product deployment spans ceilings, exterior sheathing, interior walls, and partitions; within ceilings there is a practical split between direct fix and suspended systems, and partitions are further distinguished by demountable versus fixed installations, affecting lifecycle expectations and replacement cycles. Examining product types highlights distinctions between fiber reinforced options, paper faced boards, and wax coated formulations, each offering different performance profiles, cost structures, and installation considerations that influence specification in moisture-prone environments.From an end-user perspective, demand signals differ among commercial, industrial, and residential sectors; within the commercial segment, healthcare, hospitality, and retail each present unique performance requirements and procurement dynamics that shape product choice and service expectations. Distribution channels also matter, with direct sales relationships, independent distributors, and online retail platforms each enabling different levels of technical support, lead-time management, and volume structuring. Taken together, these segmentation dimensions reveal where margin expansion and specification influence are most achievable, and they point to targeted opportunities for product differentiation and channel-specific value propositions.

Regional dynamics and regulatory contrasts that determine where waterproof and moisture-proof gypsum board solutions will achieve the fastest adoption and greatest commercial traction

Regional dynamics vary significantly in regulatory context, construction typologies, and sourcing economics, creating differentiated demand and competitive patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, adaptation to moisture management in diverse climates and the push for resilient construction have increased interest in boards that combine water resistance with robust fire and acoustic performance. Conversely, Europe, Middle East & Africa demonstrates significant heterogeneity: some markets emphasize sustainability and recycled content, while others prioritize rapid build solutions suitable for commercial and infrastructure projects.In the Asia-Pacific region, high growth in urban construction and increased adoption of modern closed-panel systems have driven rapid uptake of advanced gypsum-based boards, with manufacturers competing on cost-effective scaling and local regulatory certification. Across each geography, success depends on aligning product attributes with local building codes, contractor practices, and distribution models, while also anticipating climate-driven shifts in specification that favor higher-performance moisture management systems.

Competitive landscape analysis showing how formulation expertise, manufacturing scale, and specification support are determining supplier advantage in gypsum-based moisture management

Competitive dynamics are defined by differentiated capabilities in formulation technology, manufacturing scale, and go-to-market support. Leading firms have focused investment on manufacturing process controls and formulation research to deliver consistent moisture-resistant performance while managing cost and supply risk. Strategic partnerships with raw material suppliers and channel intermediaries have been used to secure preferential access to specialized additives and to streamline logistics for large-scale construction programs.At the same time, there is growing evidence that companies emphasizing specification support-such as project-level testing, architect education, and early-stage engagement in design-are seeing stronger adoption in complex commercial and healthcare projects. Innovation is not limited to chemistry; manufacturers that optimize packaging, on-site handling guidance, and warranty frameworks create lower total-installed-cost propositions that resonant with contractors and owners. These combined capabilities are forming new competitive advantage pathways beyond traditional price-based competition.

Actionable strategic priorities for market leaders to synchronize product innovation, sourcing resilience, and channel-specific commercialization to accelerate adoption

Industry leaders should pursue a cohesive strategy that links product innovation with targeted channel execution and specification outreach. First, invest in next-generation formulations that reduce reliance on vulnerable inputs while improving wet-area durability and fire and acoustic performance; pairing these technical advances with independent third-party validation will facilitate quicker acceptance by specifiers. Second, align commercial models with application-specific value propositions, such that offerings for ceilings, exterior sheathing, interior walls, and partitions are clearly positioned with installation guidance for direct fix, suspended, demountable, and fixed scenarios.Third, diversify sourcing and strengthen supplier partnerships to mitigate policy and input-cost shocks, while exploring nearshoring where feasible to shorten lead times. Fourth, develop differentiated channel playbooks for direct sales, distributors, and online retail that reflect the service expectations and purchasing behaviors of commercial, industrial, and residential end users; within commercial accounts, prioritize customized support for healthcare, hospitality, and retail projects. Finally, embed lifecycle and circularity narratives into product communications to capture growing demand for sustainably framed building solutions, and back claims with transparent material disclosures and end-of-life considerations.

A transparent mixed-methods approach blending primary stakeholder interviews, technical validation, and secondary standards analysis to ensure robust and actionable findings

The research methodology combined systematic primary engagement with industry participants and rigorous secondary analysis of technical literature, standards, and policy documents to build a coherent evidence base. Primary research included structured interviews with a cross-section of stakeholders such as specifiers, general contractors, distributors, and manufacturing technologists to capture practical performance expectations, procurement drivers, and on-the-ground installer insights. These conversations were complemented by targeted site visits and factory audits to validate production practices and quality control regimes.Secondary inputs comprised peer-reviewed studies, standards bodies guidance, and published technical evaluations of moisture management systems, which were used to triangulate claims about product performance and to map regulatory influences. Data synthesis emphasized consistency checks across sources and iterative validation with industry experts, ensuring that conclusions reflect practical realities of procurement, installation, and long-term asset management rather than promotional claims. Throughout, transparency in methodology was prioritized to enable replication and to support tailored follow-up inquiries for clients seeking deeper regional or application-specific analysis.

Strategic conclusions emphasizing how technical validation, supply resilience, and specification engagement will shape long-term leadership in moisture-resistant gypsum solutions

In closing, waterproof and moisture-proof gypsum board is at an inflection point where technical capability, regulatory priorities, and procurement behavior converge to reshape product adoption patterns. Manufacturers that integrate resilient formulations with credible validation and that tailor commercial approaches to segmented application and channel needs will command stronger specification influence. Meanwhile, distributors and contractors that offer meaningful on-site support and lifecycle-focused value propositions can elevate the perceived total installed value of higher-performance boards.Looking forward, responsiveness to regional regulatory trends, strategic supply-chain adjustments in response to tariff-related disruptions, and investment in specification-first engagement will determine which organizations capture the most durable commercial gains. The industry is moving toward a model where differentiated technical performance, proven through transparent testing and supported by clear installation guidance, becomes the primary basis for competitive advantage rather than price alone.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Waterproof & Moisture-proof Gypsum Board Market

Companies Mentioned

- American Gypsum Company, LLC

- Armstrong World Industries, Inc.

- Beijing New Building Material Public Limited Company

- China National Building Material (CNBM

- Compagnie de Saint-Gobain

- Eagle Materials Inc.

- Etex Group SA

- Georgia-Pacific LLC by Koch, Inc.

- Gypelite India Private Limited

- Gyplime

- Holcim Ltd.

- James Hardie Industries PLC

- Jason Company

- Jayswal Group

- Knauf Gips KG

- LafargeHolcim Ltd

- National Gypsum Company

- Taiheiyo Cement Corporation

- USG Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

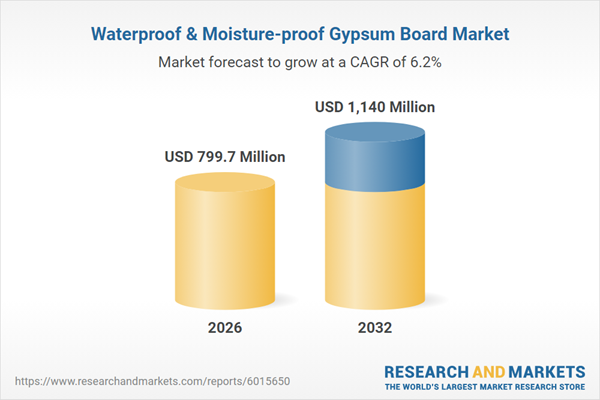

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 799.7 Million |

| Forecasted Market Value ( USD | $ 1140 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |