Speak directly to the analyst to clarify any post sales queries you may have.

A strategic orientation to the evolving virtual office ecosystem that highlights priorities for CIOs, security leaders, and workplace transformation executives

The virtual office platform landscape has evolved from a collection of point solutions into an integrated ecosystem that shapes how organizations connect, collaborate, and secure distributed work. This introduction frames the strategic context: digital-first workforces demand fluid collaboration across devices and locations, security architects require granular control and observability, and business leaders expect operational continuity without sacrificing productivity or compliance. Against this backdrop, platforms that blend collaboration functionality with enterprise-grade security and flexible deployment are increasingly central to organizational strategy.Today’s decision-makers must balance competing imperatives. They must enable seamless user experiences across desktop, mobile, and tablet devices while ensuring that data residency, privacy, and regulatory requirements are respected. They must choose between cloud-native agility, hybrid flexibility, and the control of on premises environments such as colocation and local data centers. Each choice influences vendor selection, integration complexity, and long-term operational models. Therefore, executives benefit from frameworks that prioritize interoperability, extensibility, and measurable outcomes, ensuring the chosen virtual office platform supports both current workflows and future innovations.

By setting expectations early-about integration needs, security posture, and user experience priorities-organizations can align stakeholders and accelerate adoption. This introduction establishes the foundation for the deeper analysis that follows, laying out the major forces shaping vendor strategies, buyer requirements, and the competitive dynamics of virtual office platforms.

How converging trends in collaboration capabilities, security posture, deployment flexibility, and user experience are redefining virtual office platform requirements

The virtual office arena is experiencing transformative shifts driven by technological maturation, workforce expectations, and heightened regulatory scrutiny. First, collaboration capabilities have moved beyond mere communication to encompass persistent workspaces, integrated project tooling, and contextualized knowledge management. This shift changes procurement criteria: buyers now evaluate platforms on their ability to host workflows natively and to surface actionable context rather than simply provide video or chat.Second, the security model is shifting from perimeter defense to identity-centric and data-centric approaches. As remote and hybrid work patterns persist, organizations are investing in capabilities that provide continuous device posture assessment, real-time threat detection, and encrypted data channels that persist across cloud and on premises deployments. Consequently, platform providers are embedding security features into the collaboration fabric and partnering with specialist security vendors to provide unified controls.

Third, the deployment spectrum-from public and private cloud to hybrid and on premises-has broadened how organizations architect resilience and compliance. Cloud adoption accelerates speed-to-market and scalability, while private cloud and local data centers address data sovereignty and latency concerns. Hybrid deployments are emerging as the pragmatic middle ground for enterprises that require workload mobility without compromising security or regulatory obligations.

Finally, user expectations and device diversity have pushed user experience design to the forefront. Desktop, mobile, and tablet experiences must be consistent and optimized for specific workflows, whether synchronous meetings, asynchronous collaboration, or task-driven interactions. Together, these shifts are altering buyer roadmaps and prompting platform providers to adopt modular, API-first architectures that prioritize interoperability, extensibility, and measurable business outcomes.

An analysis of how recent tariff dynamics and trade policy shifts are reshaping procurement strategies, regional sourcing, and operational resilience across the platform value chain

Recent tariff adjustments and trade policy measures have introduced new layers of complexity for the virtual office platform value chain, affecting hardware sourcing, data center equipment procurement, and cross-border service delivery. These policy shifts have increased the cost sensitivity of supply chain decisions and encouraged stronger emphasis on supplier diversification and regional sourcing strategies. Organizations reliant on imported servers, networking equipment, and endpoint devices are adapting procurement practices to mitigate tariff-related cost volatility and delivery delays.In response, many platform vendors and enterprise buyers have accelerated localization strategies, favoring regional manufacturing and local data center partnerships to reduce exposure to cross-border tariffs. This approach also aligns with data residency and regulatory compliance objectives in several jurisdictions, enabling organizations to maintain low-latency user experiences while minimizing tariff-related supply chain disruption. Additionally, procurement teams are re-evaluating total cost of ownership with a heightened focus on lifecycle management, repairability, and extended supplier SLAs to buffer against import-related delays.

Operationally, the cumulative impact extends to managed services agreements and professional services engagements. Service delivery models that rely on onshore labor or local supply chains have become more attractive, reducing the need to import hardware or ship replacement parts across high-tariff borders. Vendors that can demonstrate resilient regional delivery capabilities, transparent supply chain traceability, and flexible deployment options are better positioned to reassure enterprise buyers. As a consequence, tariff dynamics are reshaping vendor value propositions, influencing contracting practices, and prompting organizations to embed regulatory and trade-policy considerations into their procurement and deployment roadmaps.

A layered segmentation perspective tying together components, deployment models, organizational scale, industry vertical needs, and device-specific experience considerations

Understanding the market requires a layered view that aligns product architecture, deployment models, organizational needs, industry-specific requirements, and device considerations. The component dimension separates offerings into services and software, with services encompassing managed services and professional services while software divides into application software and platform software; platform software itself differentiates between collaboration platforms and security platforms. This distinction clarifies where value is delivered: managed services often handle operations and SLAs, professional services lead integration and change management, application software focuses on end-user functionality, and platform software provides the underlying frameworks and security primitives.Deployment preferences further shape solution design and vendor selection. Options span cloud, hybrid, and on premises, with cloud choices distinguishing between private cloud and public cloud variants and on premises implementations including colocation and local data centers. These deployment choices influence latency, compliance, and operational control, and they often determine whether organizations prioritize vendor-managed services or internal operational maturity. For example, public cloud deployments favor rapid feature delivery and elasticity, whereas private cloud and local data centers offer greater control over data residency and customization.

Organizational size alters adoption patterns and procurement approaches. Large enterprises typically demand complex integrations, strict compliance controls, and enterprise-grade SLAs, while small and medium enterprises - which include medium enterprises and small enterprises - prioritize cost-effectiveness, ease of deployment, and rapid time-to-value. These differences affect which vendor packaging and pricing models are most attractive and how vendors structure their go-to-market motions.

Industry verticals impose unique functional and regulatory requirements. Banking, financial services, and insurance break down into distinct banking and insurance needs that emphasize auditability, transaction security, and compliance. Education requires scalable collaboration and privacy protections for minors, while healthcare and life sciences-spanning hospitals and pharmaceutical organizations-demand stringent data governance, clinical workflow integration, and validation controls. Information technology and telecom organizations prioritize interoperability and developer extensibility. Manufacturing emphasizes operational continuity and integration with industrial systems, and retail and consumer goods, including brick and mortar and ecommerce channels, focus on omnichannel coordination and customer-facing collaboration.

Finally, device type matters: desktop environments often host full-featured collaboration suites and advanced content creation tools, whereas mobile and tablet devices prioritize lightweight, context-aware experiences that enable on-the-go productivity. Understanding how these segmentation dimensions intersect helps stakeholders craft tailored procurement strategies and prioritize capabilities that deliver the greatest operational impact.

How regional regulatory regimes, infrastructure maturity, and local partner ecosystems are shaping deployment choices and vendor go-to-market strategies globally

Regional dynamics significantly influence vendor strategies, partnership models, and deployment preferences across the virtual office landscape. In the Americas, demand is shaped by strong enterprise adoption of cloud services and a continued emphasis on innovation, driving interest in integrated collaboration and security capabilities. Buyers in this region often favor rapid feature adoption and expansive partner ecosystems that support extensibility and third-party integrations, while also managing regulatory considerations at the national and subnational levels.Europe, Middle East & Africa presents a diverse regulatory environment where data sovereignty and privacy regulations are major drivers of deployment choices. Organizations frequently opt for private cloud or local data center deployments to satisfy compliance needs, and regional vendors and systems integrators play a critical role in enabling localized implementations. Additionally, security and identity controls are prioritized to meet both corporate risk frameworks and evolving legislative requirements.

Asia-Pacific reflects a wide range of maturity levels and infrastructure conditions, with major markets investing heavily in cloud-native platforms and emerging markets adopting hybrid and on premises approaches to balance latency and regulatory needs. The region’s scale and diversity create opportunities for vendors that can offer flexible deployment models, multilingual user experiences, and partnerships with local carriers and data center operators. Across all regions, successful vendor propositions align technical capabilities with regional compliance, localization, and supply chain resilience considerations to deliver consistent user experiences at scale.

Insights into vendor positioning, partnership ecosystems, integration patterns, and service models that determine long-term platform suitability and procurement outcomes

Competitive dynamics in the virtual office platform space are characterized by a mix of established enterprise software vendors, nimble specialist providers, systems integrators, and channel partners. Market leaders differentiate through a combination of product breadth, security posture, integration ecosystems, and service capabilities. Their strategies commonly include expanding platform functionality, forging technology partnerships to close capability gaps, and building robust partner programs to accelerate regional adoption.Specialist vendors carve differentiation through focused capabilities such as advanced meeting experiences, real-time collaboration primitives, or embedded security features. These vendors frequently collaborate with larger ecosystem players to deliver integrated solutions that meet specific industry or technical requirements. Systems integrators and managed service providers play a pivotal role in large-scale rollouts, providing migration expertise, custom integrations, and ongoing operational support that bridge gaps between purchaser expectations and vendor roadmaps.

Strategic M&A and partnership activity continues to influence competitive positioning. Vendors pursue tuck-in acquisitions to accelerate feature delivery or to embed vertical-specific capabilities. At the same time, alliances with identity providers, security specialists, and infrastructure partners enable more complete solutions that align with enterprise procurement policies. For buyers, understanding each vendor’s roadmap, integration checkpoints, and partner ecosystem is critical to assessing long-term fit and minimizing integration risk.

Finally, vendor transparency around support models, SLAs, and third-party dependencies is increasingly important. Organizations value partners who provide clear operational playbooks, secure supply chain practices, and open interfaces that ease migration and multi-vendor interoperability, making these attributes central to vendor selection and relationship management.

Actionable leader guidance to align platform selection, deployment approach, security posture, and partner ecosystems with measurable business outcomes

Leaders seeking to extract strategic value from virtual office platforms should adopt a pragmatic, outcome-oriented approach that aligns technology choices with organizational priorities. Start by defining measurable business outcomes such as productivity improvements, risk reduction, or customer experience enhancements, and use these outcomes to prioritize capabilities and deployment choices. This outcome-first lens anchors procurement conversations and helps to avoid feature-driven purchases that do not deliver measurable value.Adopt a hybrid deployment posture where appropriate, deliberately mapping workloads to public cloud, private cloud, or on premises environments based on data sensitivity, latency requirements, and regulatory constraints. This approach provides flexibility while preserving control over sensitive workloads and reduces exposure to supplier and tariff-driven disruptions. Additionally, embedding security by design-through identity-first controls, data encryption at rest and in transit, and continuous device posture assessment-helps align collaboration initiatives with enterprise risk frameworks.

Invest in vendor and partner ecosystems with a focus on interoperability and open APIs to minimize lock-in and facilitate integration with core enterprise systems. Complement platform investments with professional services and managed services to accelerate adoption and reduce operational friction. Finally, develop a phased migration strategy that prioritizes user experience improvements and change management, using pilot programs to validate assumptions and scale successful patterns across the organization.

A transparent mixed-methods research framework combining primary interviews, technical review, and analytical frameworks to evaluate capability fit and operational readiness

This research approach combines qualitative and quantitative methods to provide a holistic view of the virtual office platform landscape. Primary research includes structured interviews with enterprise buyers, IT and security leaders, and vendor executives to capture real-world priorities, deployment challenges, and criteria used in procurement decisions. These firsthand insights are synthesized with technical assessments of platform architectures and integration models to illuminate functional strengths and operational trade-offs.Secondary research draws on publicly available technical documentation, vendor white papers, regulatory guidance, and case studies to contextualize primary findings and to validate solution attributes. Wherever possible, vendor product documentation and independent third-party technical analyses are referenced to corroborate claims about architecture, feature sets, and supported deployment models while ensuring impartial interpretation. The methodology emphasizes triangulation of multiple data sources to reduce bias and to surface consistent patterns across diverse organizations and industries.

Analytical frameworks used in the research include capability mapping against buyer requirements, deployment-fit matrices that reconcile compliance and latency needs, and operational readiness scoring that evaluates vendor support models and managed service options. These frameworks enable comparative analysis without relying on single-source metrics, and they provide actionable inputs for procurement, security, and deployment planning. The methodology prioritizes transparency and reproducibility, documenting assumptions and interview protocols to support informed decision-making.

A synthesized conclusion highlighting the critical intersections of security, deployment strategy, partner ecosystems, and operational readiness for successful platform adoption

In conclusion, virtual office platforms are maturing into comprehensive ecosystems that must satisfy a complex set of requirements spanning collaboration, security, deployment flexibility, and industry-specific compliance. Organizations that succeed will be those that adopt an outcome-focused procurement approach, align deployment models with regulatory and latency needs, and insist on interoperable architectures that reduce lock-in risk. Security and identity-centric controls should be non-negotiable elements of any platform selection, and operational readiness, including managed service capabilities, often determines the speed and effectiveness of adoption.Regional considerations and supply chain dynamics, including tariff-related impacts, demand that organizations incorporate supplier diversification and local delivery models into procurement strategies. Vendor selection is increasingly influenced by partner ecosystems, integration capabilities, and transparent operational practices, rather than by feature lists alone. By prioritizing pilot-driven deployments, investing in professional and managed services for rollout, and specifying clear success metrics, organizations can de-risk transformation and realize sustained productivity and resilience benefits.

Ultimately, the path forward requires cross-functional collaboration between IT, security, procurement, and business stakeholders to ensure that virtual office platforms deliver measurable outcomes and remain adaptable to evolving business and regulatory conditions.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Virtual Office Platform Market

Companies Mentioned

- Alliance Business Centers LLC

- Awfis, Inc

- Davinci Virtual Office Solutions Inc

- Gather

- Google LLC

- Innov8

- Intelligent Office LLC

- IWG Plc

- Kumospace

- Microsoft Corporation

- MyHQ

- NexGen Virtual Office

- Office Evolution LLC

- Opus Virtual Offices

- Premier Business Centers LLC

- Servcorp Limited

- Smartworks

- SoWork

- TeamflowHQ

- The Executive Centre

- The Instant Group PLC

- The Office Pass

- Vatika Business Centres

- Virtual Office Companies Inc

- WeWork

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

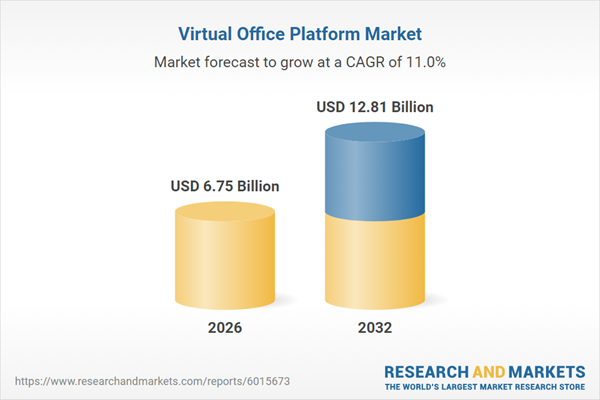

| Estimated Market Value ( USD | $ 6.75 Billion |

| Forecasted Market Value ( USD | $ 12.81 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |