Speak directly to the analyst to clarify any post sales queries you may have.

How shifting consumer expectations and material innovation are reshaping outdoor pet furniture and shelters across design, channel, and supply dynamics

The outdoor pet house and furniture category is undergoing a period of dynamic change as consumer expectations, material science, and retail economics converge to redefine product design and distribution. Pet owners increasingly treat outdoor spaces as extensions of the home, demanding furniture and shelter that deliver comfort, durability, and aesthetic integration with exterior decor. Concurrently, product developers are responding with a broader array of options across bed types, furniture styles, and shelter formats that cater to climate resilience, portability, and premiumization. As manufacturers refine product portfolios, retailers and channel partners face pressure to curate assortments that balance entry-level affordability with innovative premium offerings, while also managing inventory complexity and seasonality.In addition, the category's evolution is shaped by shifting purchasing behaviors: digital discovery and online retail have accelerated product research and cross-border buying, while specialty channels and direct-to-consumer models emphasize experience, customization, and after-sales service. Material choices such as advanced fabrics, engineered plastics, treated woods, and weather-resistant wicker have become central differentiators, influencing cost structures, lifecycle expectations, and sustainability claims. Taken together, these forces are redefining value propositions across product, channel, and material dimensions, requiring stakeholders to align product roadmaps, supply chain strategies, and merchandising approaches to capture a customer base that prizes both functionality and design.

Fundamental market changes driven by consumer lifestyle expectations, material innovation, channel sophistication, and sustainability pressures reshaping category competition

The landscape for outdoor pet houses and furniture is experiencing transformative shifts driven by a mix of consumer, technological, and regulatory influences that together are elevating competitiveness and reshaping go-to-market strategies. Consumers are increasingly prioritizing multifunctionality and aesthetics; what was once a purely utilitarian purchase is now frequently evaluated for its design language, integration with outdoor living areas, and potential to reflect owner lifestyle. At the same time, innovation in materials and manufacturing-such as weatherproof textiles, molded composites, and insulated assemblies-has expanded product lifespans and enabled new price-performance combinations, prompting manufacturers to rethink product segmentation and warranty positioning.A parallel transition is occurring in distribution: online channels have matured beyond pure transaction platforms into experience-led touchpoints where content, reviews, and comprehensive product information drive conversion. Mass retail and specialty brick-and-mortar continue to matter for tactile evaluation, but omnichannel fulfillment and hybrid retail models are becoming table stakes. Regulatory and trade developments are also prompting supply chain optimization; companies are diversifying sourcing footprints and investing in supply chain visibility to mitigate disruptions. Finally, the sustainability imperative and increased consumer scrutiny around materials, end-of-life reuse, and product transparency are pushing brands to certify claims, adopt circular design principles, and communicate lifecycle benefits, thereby differentiating themselves in a crowded market.

How 2025 tariff shifts have triggered strategic sourcing, product redesign, and pricing adjustments that reshape supply chain resilience and competitive positioning

The cumulative effects of tariff policy changes enacted in 2025 have introduced new costs and operational considerations for industry participants across manufacturing, sourcing, and retail layers. Tariff adjustments have prompted a re-evaluation of global supplier networks, encouraging some companies to accelerate nearshoring initiatives and to prioritize manufacturing partners with closer logistical proximity to end markets. This shift has implications for lead times, transportation costs, and inventory strategies, as supply chains that were once optimized for cost now must balance responsiveness, resilience, and duty exposure.In response, procurement teams are increasingly negotiating long-term supplier agreements that incorporate shared risk mechanisms and explore tariff-mitigation tactics such as product classification reviews, bonded warehousing, and tariff engineering through material or assembly changes. The consequence of these adaptive strategies is a more complex cost-to-serve calculus where landed cost, speed-to-market, and regulatory compliance must be evaluated in tandem. Retail pricing strategies are being adjusted to reflect input cost variability while preserving margin integrity for channel partners. Moreover, the tariff environment has sharpened focus on product redesigns that reduce taxable components or shift to alternative materials, thereby altering product development roadmaps. Ultimately, the tariff dynamics of 2025 act as a catalyst for strategic reorientation across sourcing, product architecture, and inventory management, reinforcing the need for scenario planning and agile commercial responses.

Deep segmentation insights showing how product formats, channel models, material choices, pet types, and end users uniquely influence design, pricing, and operations

Segment-level dynamics demonstrate distinct demand drivers and operational implications across product types, distribution channels, materials, pet types, and end users, each requiring targeted strategies to capture value. Within product categories, beds range from cushion and elevated formats to heated options and outdoor mats, reflecting diverse priorities such as orthopaedic comfort, airflow, thermal regulation, and portability, while furniture offerings span chairs, couches, and tables that bridge pet comfort with outdoor human living standards, and houses include folding, insulated, luxury, and traditional dog house formats tailored to mobility, climate control, premium positioning, and staple shelter needs. These product distinctions affect SKU complexity, warranty policies, and after-sales service requirements, and they suggest differentiated marketing narratives depending on whether the purchase is driven by functionality, design integration, or premium features.On the distribution front, direct sales channels, including manufacturer outlets and veterinary clinic partnerships, emphasize curated experiences and higher touch, mass retail environments such as hypermarkets and supermarkets deliver broad reach and promotional scale, online retail through brand websites and e-commerce platforms-most notably Amazon-offers convenience and discovery, and specialty pet stores, both independent and chains, provide expert advice and niche assortment. Material selection across fabric, metal, plastic, wicker, and wood, with fabric subtypes like canvas and polyester, plastics spanning polypropylene and PVC, and wood choices such as cedar and pine, generates different durability profiles, sustainability narratives, and cost implications that influence design choices and communications. Pet type segmentation between cats and dogs drives ergonomic and behavioral considerations, while end users split between commercial customers-daycare centers, kennels, and pet hotels-and residential buyers creates divergent volume, specification, and servicing expectations. Collectively, these segmentation lenses reveal where innovation, margin expansion, and operational efficiencies can be prioritized to align with distinct customer needs and channel economics.

Regional demand drivers and operational imperatives highlighting how Americas, Europe Middle East & Africa, and Asia-Pacific uniquely shape product strategies and go-to-market execution

Regional patterns reveal differentiated demand drivers, competitive dynamics, and regulatory contexts across the Americas, Europe, Middle East & Africa, and Asia-Pacific, each shaping how companies prioritize product portfolios and market entry strategies. In the Americas, strong owner-driven premiumization and robust direct-to-consumer adoption favor design-centric products and omnichannel fulfillment investments, while wide geographic variance in climate and outdoor living norms drives demand for both insulated shelters and weather-resistant furniture variants. Conversely, in Europe, Middle East & Africa, regulatory focus on material safety and sustainability combined with high urban density in many markets pushes innovation toward compact, modular designs and certified materials that meet cross-border compliance standards. Evolving retail structures in EMEA also create opportunities for collaboration with specialty retailers that can articulate technical benefits to discerning consumers.Meanwhile, Asia-Pacific presents a mix of mature coastal markets and rapidly developing interior regions, where manufacturing ecosystems are strong and domestic demand is bifurcated between value-oriented mass retail channels and aspirational premium buyers seeking designer outdoor pet solutions. The region’s manufacturing capabilities enable product innovation at scale, but rising domestic labor costs and sustainability expectations are encouraging investment in higher-value offerings and automation. Across regions, trade policies, logistics costs, and climatic considerations will continue to influence where companies locate production, how they configure distribution, and which product attributes they emphasize in market communications.

Competitive landscape analysis revealing how design leadership, channel specialization, and sustainability credentials determine winners in outdoor pet housing and furniture

Competitive dynamics in the outdoor pet house and furniture sector are characterized by a mix of established manufacturers, agile design-led newcomers, and vertically integrated players that control combinations of production, distribution, and brand experience. Leading companies differentiate through product innovation that targets durability, comfort, and aesthetic integration with outdoor living spaces, while others compete on channel expertise and service offerings that simplify consumer decision-making. Strategic partnerships between design studios and material innovators have become more common, enabling faster incorporation of weatherproof textiles, engineered composites, and insulated assemblies into marketable products, which in turn accelerates time-to-shelf for novel features.At the same time, commercialization approaches vary: some firms prioritize scale and distribution through mass retail and major e-commerce platforms, leveraging wide assortment and promotional capabilities, whereas others focus on premiumization and direct relationships with veterinary channels, specialty stores, and high-end landscaping or outdoor furnishing partners. Several companies are investing in sustainability credentials and traceability, which helps meet consumer demand and can open doors to institutional procurement in commercial segments. Additionally, competitive differentiation increasingly relies on after-sales support, warranty programs, and modularity that extend product lifetime. Overall, the competitive landscape rewards firms that combine strong product engineering, clear value propositions for specific channels, and operational agility to adapt to changing trade and material environments.

Actionable strategic moves for leaders to build supply resilience, accelerate product modularity, optimize channels, and leverage sustainability as a competitive advantage

Industry leaders can adopt a set of pragmatic, high-impact actions to fortify growth and navigate disruption effectively. First, optimizing sourcing strategies by diversifying supply bases, evaluating nearshoring opportunities, and negotiating supplier agreements that share risk will reduce exposure to tariff volatility and improve lead-time predictability. Second, investing in modular product design and material substitution can lower tariff liabilities and create platform architectures that enable rapid customization for different channels and regions. Third, refining channel strategies to balance reach and experience-deploying omnichannel fulfillment, expanding partnerships with specialty retailers and veterinary outlets, and enhancing direct-to-consumer capabilities-will better match assortment to consumer expectations.Furthermore, strengthening sustainability and transparency initiatives by tracing material origins, adopting recyclable or reusable materials where feasible, and communicating lifecycle benefits will improve brand differentiation and reduce regulatory risk. Companies should also upgrade commercial capabilities with digital commerce, immersive product visualization, and data-driven merchandising to accelerate conversion and reduce returns. Finally, building scenario-based planning into commercial and operational planning-incorporating tariff permutations, logistics disruptions, and demand swings-will enable faster strategic responses. By combining supply chain resilience, product adaptability, channel optimization, sustainability credentials, and data-led commercialization, leaders can create durable competitive advantages in a shifting marketplace.

Mixed-methods research combining primary interviews, retailer audits, consumer surveys, and supply chain analytics to deliver validated intelligence and scenario-tested findings

The research underpinning this analysis employed a mixed-methods approach to ensure robust, triangulated findings that reflect both qualitative insights and quantitative patterns. Primary research included structured interviews with manufacturers, material suppliers, retailers, and selected commercial end users such as kennels and pet hotels to capture first-hand perspectives on sourcing challenges, product innovation, and channel dynamics. Complementing these interviews, retailer audits and product teardown analyses provided granular visibility into materials, assembly techniques, and warranty constructs across a representative range of SKU types. Additionally, consumer sentiment and purchase-behavior surveys were conducted to understand preference drivers for outdoor beds, furniture, and shelters, and to assess trade-offs between price, durability, and design.Secondary research synthesized trade publications, customs and tariff filings, regulatory guidance, and company disclosures to map supply chain flows and identify policy impacts. Data analytics methods were applied to transaction and search behavior datasets to surface emerging demand patterns and seasonality effects, while scenario planning workshops with industry experts were used to stress-test assumptions around tariffs, logistics, and material availability. Throughout, quality controls included source validation, methodological triangulation, and sensitivity checks to ensure findings are actionable and replicable for commercial decision-makers.

Synthesis and forward-looking conclusions emphasizing resilience, modular design, omnichannel excellence, and sustainability as decisive success factors

The outdoor pet house and furniture sector is entering a phase where strategic clarity and operational flexibility will determine market leaders. Consumer demand now prizes a combination of comfort, weather resilience, and aesthetic harmony with outdoor living spaces, and suppliers that can deliver differentiated product experiences while managing the complexity of materials and channels will command stronger loyalty. Tariff changes and trade uncertainties have underscored the importance of supply chain diversification and adaptive product design, prompting many firms to reconsider manufacturing footprints and pursue material innovations that reduce cost exposure and enhance durability.At the same time, the rise of omnichannel purchasing and the maturation of e-commerce platforms mean that excellence in digital presentation, logistics execution, and post-purchase experience is as important as product engineering. Sustainability and transparency have moved from niche differentiators to mainstream expectations, forcing brands to integrate lifecycle thinking into product roadmaps. In conclusion, the companies that invest in resilient sourcing, modular design, channel-aligned assortments, and credible sustainability narratives are best positioned to capture the expanding opportunity set in outdoor pet houses and furniture while mitigating the operational risks posed by trade and material volatility.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Outdoor Pet House & Furniture Market

Companies Mentioned

- AeroMark International, Inc.

- Aspen Pet Products, LLC

- Central Garden & Pet Company

- Coastal Pet Products, Inc.

- Ferplast S.p.A.

- Go Pet Club, Inc.

- Ingka Holding B.V.

- IRIS USA, Inc.

- K & H Manufacturing Co., Inc.

- Merrick Pet Care, Inc.

- Midwest Homes for Pets, Inc.

- North American Pet Products

- PetFusion Holdings, LLC

- Petmate, Inc.

- PetPals Group, Inc.

- Radio Systems Corporation

- Rolf C. Hagen Inc.

- Suncast Corporation

- The KONG Company, Inc.

- Trixie Heimtierbedarf GmbH & Co. KG

- Veehoo Pet Products, Inc.

- Ware Manufacturing, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | January 2026 |

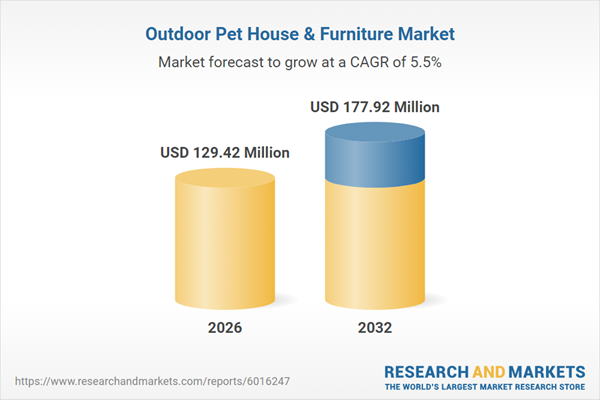

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 129.42 Million |

| Forecasted Market Value ( USD | $ 177.92 Million |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |