Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive strategic introduction to fluorescent chloride sensor technologies highlighting scientific principles, cross-sector relevance, and near-term priorities

Fluorescent chloride sensors are at the intersection of chemical sensing science and practical application, delivering high sensitivity and selective detection for chloride ions across laboratory and field environments. The underlying mechanism typically leverages fluorophores whose emission responds to chloride concentration shifts, enabling real-time readouts that are both fast and minimally invasive. Across life sciences, environmental monitoring, food safety, industrial process control, and clinical diagnostics, the ability to measure chloride reliably supports experimental fidelity, compliance with safety standards, and process optimization.Transitioning from laboratory prototypes to commercial products requires attention to reproducibility, stability, and integration with data systems. Advances in probe chemistry, ratiometric measurement approaches, and miniaturized optics have reduced barriers to deployment, while rising expectations for portability and connectivity are shaping product requirements. As stakeholders evaluate sensor options, factors such as matrix effects, calibration stability, and user ergonomics become paramount. This introduction frames the technical strengths and practical constraints that will inform segmentation, competitive strategy, and regional adoption trends covered in the remainder of this executive summary.

Emerging transformative shifts redefining fluorescence chloride detection through materials science breakthroughs, miniaturization, and systems-level integration

The landscape for fluorescent chloride detection is undergoing transformative shifts driven by convergent advances in materials science, instrumentation, and digital integration. Novel fluorophores and nanostructured materials have improved sensitivity and selectivity, enabling applications in complex matrices that were previously prohibitive. Concurrently, ratiometric fluorescence and intensity-corrected designs have enhanced reliability across variable environmental conditions, reducing false positives and easing calibration burdens.Miniaturization and portable optical platforms are redefining where chloride sensing can occur, bringing laboratory-grade capabilities closer to point-of-need contexts. Integration with low-power electronics and cloud-enabled data systems has created new value propositions centered on continuous monitoring and remote analytics. At the same time, regulatory shifts and heightened environmental surveillance are expanding demand for robust field-capable sensors. Supply chain realignments and a move toward modular, interoperable systems encourage collaboration between component suppliers and system integrators. Taken together, these shifts are accelerating the practical adoption curve and compelling organizations to reassess product roadmaps and go-to-market approaches.

Assessment of the cumulative operational and commercial impacts triggered by United States tariffs implemented in 2025 on sensor supply chains and sourcing strategies

The introduction of tariffs and trade measures during 2025 has had a compound effect on procurement, sourcing decisions, and operational planning across the sensor ecosystem. Many key components and specialized reagents used in fluorescent chloride platforms are globally sourced, and tariff-driven cost increases have prompted stakeholders to re-evaluate supplier portfolios and component substitution strategies. Manufacturers have responded by reassessing inventory policies, negotiating longer-term agreements, and in some cases accelerating localization of assembly or critical component production to reduce exposure to cross-border trade volatility.These adjustments have practical implications for product roadmaps, as developers balance margin pressure against the need to maintain technical performance and regulatory compliance. For end users, procurement cycles are lengthening as organizations prioritize supplier resilience and total cost of ownership over unit price alone. Moreover, the tariff environment has stimulated strategic collaboration across the value chain, encouraging partnerships that combine technical capabilities with distribution reach. In sum, tariff dynamics are reshaping competitiveness and prompting a shift toward more vertically integrated and resilient supply chain architectures.

In-depth segmentation insights synthesizing application, technology, end user, product type, portability, and distribution channel dynamics shaping adoption pathways

A nuanced examination of market segmentation reveals how demand drivers and technical requirements differ by application, technology, end user, product type, portability, and distribution approach. Within application domains, academic research divides into life sciences and material science, each prioritizing different performance attributes such as temporal resolution for biological assays or chemical durability for materials testing. Environmental monitoring encompasses air monitoring, soil analysis, and water quality; air monitoring bifurcates into indoor and outdoor contexts with distinct sampling regimes, while soil analysis separates agricultural soil from contaminated sites, and water quality differentiates freshwater from seawater analysis. Food testing focuses on chloride content analysis and pathogen detection, where matrix complexity influences sensor selection. Industrial process control covers chemical manufacturing and petrochemicals, and the former further segments into petrochemical refineries and pharmaceutical production while petrochemicals divide into aromatics and olefins. Medical diagnostics centers on blood and urine analysis, which demand rigorous validation and clinical-grade robustness.Technology choices have clear implications for usability and integration: colorimetric approaches, including dipsticks and paper-based assays, offer low-cost, disposable options, while fluorescence-based methods-spanning both intensity-based and ratiometric modalities-deliver higher sensitivity and greater dynamic range. Ion selective electrodes, whether liquid membrane or solid state, provide complementary electrochemical measurement pathways. On the end-user front, food and beverage manufacturers, pharmaceuticals split across branded and generic operations, research institutes, and water treatment facilities each bring unique procurement and validation practices. Product type considerations separate electrochemical and optical sensors, with electrochemical options differentiated by amperometric versus potentiometric techniques and optical choices divided into fiber optic and portable optical formats. Portability stratifies the market into benchtop and portable solutions, and portability further differentiates handheld from wearable form factors. Distribution channels span direct sales, distributors, and online avenues, where distributors segment into retailers and system integrators and online routes bifurcate across ecommerce platforms and manufacturer websites. Understanding these layered segments clarifies where investment in feature sets, regulatory validation, and go-to-market capabilities will yield the strongest returns across distinct adoption pathways.

Regional strategic perspectives on demand drivers, regulatory frameworks, and infrastructure readiness across Americas, Europe Middle East Africa, and Asia-Pacific markets

Regional dynamics are central to strategic planning, as differing regulatory regimes, industrial structures, and research capacities influence demand for fluorescent chloride sensing solutions. In the Americas, robust industrial usage, strong environmental regulatory frameworks, and significant R&D activity drive adoption across both applied and laboratory settings. Transitioning toward more frequent field monitoring and a growing interest in decentralized testing shape product specifications and distribution strategies in this region.Across Europe, the Middle East and Africa, regulatory harmonization in parts of Europe encourages standardization and creates opportunities for validated clinical and environmental products, while regions within the Middle East and Africa show heterogeneous uptake tied to infrastructure investment and local industry needs. In Asia-Pacific, rapid industrialization, expansive agricultural activity, and a strong manufacturing base are creating pronounced demand for in-line process control and field-capable monitoring solutions. Additionally, regions within Asia-Pacific increasingly invest in local innovation ecosystems, which accelerates the development of tailored fluorescence-based sensor technologies suited to regional water quality, food safety, and clinical testing challenges. Recognizing these regional nuances enables suppliers to align product features, compliance strategies, and channel partnerships with localized market requirements.

Competitive and corporate insights into how established firms and agile entrants are differentiating fluorescent chloride sensor portfolios through R&D and partnerships

Competitive dynamics in the fluorescent chloride sensor space are shaped by a mix of established instrument manufacturers, specialized component providers, and nimble startup innovators. Leaders invest heavily in research and development to protect proprietary chemistries and optical designs, while also pursuing strategic partnerships to embed sensors into broader analytical workflows or industrial control systems. New entrants frequently differentiate with application-focused solutions, for example by optimizing form factor for field deployment or by integrating advanced analytics to reduce user interpretation complexity.Strategic positioning often centers on three axes: technical differentiation, channel strength, and service capability. Companies that combine robust validation data with scalable manufacturing and responsive technical support tend to secure long-term relationships with institutional customers. Conversely, smaller vendors can gain traction by solving specific use-case challenges and demonstrating rapid time-to-value. Across the competitive landscape, collaboration between reagent specialists, optical component manufacturers, and system integrators will continue to be an effective route to market, enabling composite offerings that address performance, usability, and total cost of ownership considerations for diverse end users.

Actionable strategic recommendations for industry leaders to accelerate commercialization, manage supply chain risk, and capture cross-industry opportunities with precision

Industry leaders should pursue a coordinated set of actions to capture near-term opportunities and build durable competitive advantage in fluorescent chloride sensing. First, prioritize development efforts that balance sensitivity with robustness; ratiometric and intensity-stabilized fluorescence approaches can reduce calibration burdens and improve field reliability. Next, invest in modularity so that sensor cores can be adapted across benchtop, handheld, and wearable formats in response to application-specific needs. Strategic partnerships with component suppliers and data analytics providers can accelerate time-to-market and add value through integrated monitoring solutions.Operationally, diversifying supply chains and qualifying alternative suppliers for critical components will mitigate trade-related disruptions. Commercially, aligning regulatory strategy with targeted end users-such as water utilities or clinical laboratories-will streamline adoption and reduce time to validation. Finally, enhancing after-sales service and offering data services that deliver actionable insights rather than raw readings will deepen customer relationships and create recurring revenue opportunities. Taken together, these actions form an actionable blueprint for organizations seeking to convert technical capability into sustainable market leadership.

Robust mixed-method research methodology detailing primary and secondary evidence gathering, technical validation, and triangulation approaches underpinning the analysis

The analysis underpinning this executive summary combines primary qualitative engagement with technical validation and comprehensive secondary evidence synthesis. Primary research included structured interviews with domain experts, procurement professionals, and R&D leaders to capture real-world performance expectations, procurement behavior, and validation requirements. Laboratory validation activities and technical performance benchmarking were used to assess comparative strengths of fluorescence modalities and to understand matrix-related interference across application contexts.Secondary research encompassed scientific literature, patent landscape scanning, regulatory guidance, and publicly available technical documentation to triangulate findings. Data triangulation ensured that commercial insights were grounded in reproducible technical observations and real-world procurement trends. Scenario mapping and sensitivity testing were applied to explore the implications of supply chain disruptions and regulatory shifts. Where appropriate, stakeholder validation workshops were used to refine conclusions and prioritize strategic recommendations, thereby ensuring the methodology produced actionable and credible outputs for decision-makers.

Conclusive synthesis underscoring strategic imperatives, innovation trajectories, and the practical implications for stakeholders across research, industry, and public sectors

In conclusion, the fluorescent chloride sensor domain is transitioning from a primarily laboratory-focused technology to a diversified set of application-ready solutions spanning environmental monitoring, food safety, industrial control, and clinical analysis. Technological progress in fluorophore chemistry, optical design, and systems integration is enabling more reliable and portable solutions, while macro factors such as regulatory emphasis on monitoring and trade policy shifts are reshaping procurement and manufacturing approaches. Organizations that align product development with real-world validation needs, manage supply chain resilience, and invest in integrated data capabilities will be best positioned to convert technical advantage into commercial success.As stakeholders chart their next steps, they should focus on demonstrable performance in relevant matrices, partnerships that expand channel reach and technical depth, and service models that deliver ongoing value. Remaining attentive to regional nuances and regulatory trajectories will further refine market entry and expansion strategies. The convergence of improved sensor chemistry, miniaturized optics, and advanced analytics creates a timely opportunity for organizations to deliver meaningful improvements in measurement capability and to establish differentiated positions in multiple end markets.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Fluorescent Chloride Sensor Market

Companies Mentioned

- Abcam plc

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Horiba, Ltd.

- Merck KGaA

- Mettler-Toledo International Inc.

- Nova Biochemical Corp.

- Pepperl+Fuchs Group

- PerkinElmer, Inc.

- Shimadzu Corporation

- SICK AG

- Siemens AG

- Smiths Detection Inc.

- Thermo Fisher Scientific Inc.

Table Information

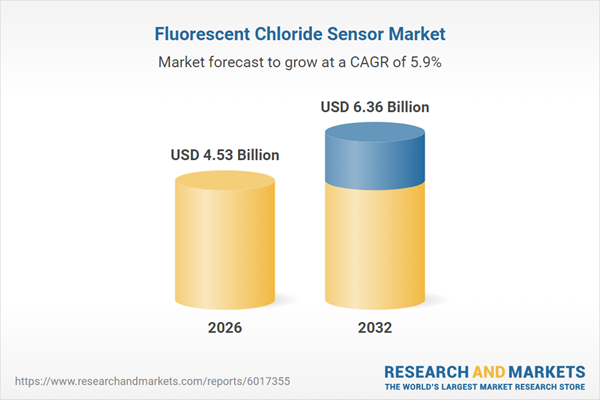

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.53 Billion |

| Forecasted Market Value ( USD | $ 6.36 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |