Speak directly to the analyst to clarify any post sales queries you may have.

Framing the evolving significance of generator-derived gallium-68 in modern nuclear medicine and the operational variables that determine clinical and research access

Germanium-68/gallium-68 generator systems have become indispensable tools in contemporary nuclear medicine, enabling decentralized access to the positron-emitting isotope gallium-68 for PET imaging and radiopharmaceutical production. These generators deliver a pragmatic alternative to cyclotron-produced gallium-68, allowing clinical and research sites to perform on-demand labeling of peptide- and small-molecule tracers without the need for in-house particle accelerators. As tracer portfolios broaden, the role of robust generator supply and reliable elution performance grows increasingly central to sustaining diagnostic workflows and investigational programs.Across clinical specialties, the ability to source gallium-68 efficiently influences scheduling flexibility, tracer diversity, and patient throughput. In parallel, manufacturers and service providers have responded with greater variability in generator technologies, from traditional column-based formats to more integrated systems designed to streamline elution, synthesis, and QC. Regulatory expectations for sterility, radiochemical purity, and traceability have matured, prompting tighter process controls and more comprehensive documentation across the value chain.

Transitioning from a predominantly centralized production model toward distributed supply and on-site synthesis requires coordination among clinical, manufacturing, and regulatory stakeholders. Supply chain resiliency, capacity planning, and technical training are now central to operational continuity. This introductory overview sets the stage for deeper analysis of technological shifts, tariff-driven supply impacts, segmentation dynamics, and regional variation that together shape strategic decision-making for organizations engaged with generator-based gallium-68 solutions.

How rapid innovation in automation, system integration, and supply chain design is reshaping access to gallium-68 and redefining clinical operational models

Recent years have witnessed transformative shifts in how generator-derived gallium-68 is produced, delivered, and consumed across clinical and research settings. Technological progress has accelerated the transition from manually operated column-based generators toward automated and integrated platforms that reduce variability, shorten preparation times, and lower the operator skill threshold. These innovations enable sites to expand tracer offerings and increase procedural throughput while enforcing stricter quality controls that align with regulatory expectations.Simultaneously, the market landscape has evolved as manufacturers refine generator chemistries and containerization to extend shelf life, improve eluate quality, and simplify logistics. The adoption of multi-channel integrated systems introduces new operational models where a single instrument supports concurrent syntheses, improving utilization for high-volume centers. At the same time, single-channel and low-capacity solutions remain attractive for smaller or research-focused sites that prioritize flexibility and lower capital expenditure.

Supply chain configuration is another axis of transformation. Stakeholders are reallocating investments toward regional production hubs, local distribution partnerships, and risk-mitigation strategies that reduce reliance on long-distance shipments of sensitive radiochemical components. Regulatory harmonization efforts and clearer guidance around generator validation for clinical use have also reshaped go-to-market approaches, prompting manufacturers to codify compliance into device design and documentation. Collectively, these shifts are redefining competitive differentiation around technology integration, capacity flexibility, and the ability to support complex clinical workflows across oncology, neurology, and cardiology applications.

Assessing how the 2025 United States tariff measures reshaped sourcing economics, supplier strategies, and operational resilience across the generator supply chain

The tariff measures implemented in the United States in 2025 introduced a new layer of complexity for the generator ecosystem by affecting the cost structure and movement of generator components and finished units. Increased import duties on certain components and assemblies have elevated landed costs for some suppliers that rely on transnational manufacturing networks, thereby prompting a reassessment of sourcing strategies and inventory policies. In response, some manufacturers accelerated regionalization of production or shifted higher-value assembly stages to lower-tariff jurisdictions, which in turn has implications for lead times and supplier qualification.For clinical stakeholders, the immediate consequence has been pressure on procurement budgets and a renewed emphasis on total cost of ownership rather than unit price alone. The tariffs have sharpened attention on operational efficiencies, including the selection of generator capacities that reduce per-dose cost and the adoption of automated systems that shorten synthesis cycles and limit waste. From a regulatory and compliance perspective, the tariffs have not altered clinical quality requirements, but they have increased the salience of supplier audits and documentation as hospitals and diagnostic centers evaluate alternate vendors.

Strategically, the tariff environment has incentivized diversification across suppliers and geographies. Organizations have accelerated bilateral agreements with regional producers and strengthened collaborative relationships with contract manufacturing partners to insulate supply continuity. Additionally, some entities have explored internal investments in high-capacity or multi-channel integrated platforms to reduce reliance on imported consumables. While these adjustments entail short-term implementation challenges, they also catalyze structural resilience by encouraging multi-sourcing, onshore value capture, and tighter integration between procurement, clinical operations, and regulatory affairs.

Dissecting the interplay between application needs, end-user priorities, technology formats, and capacity tiers to reveal targeted strategic opportunities for each segment

Understanding segmentation across application, end user, technology, and generator capacity clarifies where demand dynamics and operational requirements differ and where targeted investments will deliver the greatest returns. When viewed through the lens of application, the generator ecosystem supports both PET imaging and radiopharmaceutical production. Within PET imaging, clinical demand is concentrated in cardiology, neurology, and oncology, each with distinct tracer portfolios and scheduling patterns that influence preferred generator throughput and elution frequency. Radiopharmaceutical production encompasses commercial production, where scale, repeatability, and regulatory documentation are paramount, and research production, where flexibility, rapid protocol iteration, and bespoke synthesis pathways are valued.Considering end users, diagnostic centers, hospitals, pharmaceutical companies, and research institutes present different procurement behaviors and operational constraints. Diagnostic centers and hospitals prioritize uptime, standardized workflows, and predictable supply, often favoring automated solutions paired with service agreements. Pharmaceutical companies tend to demand higher reproducibility, stringent batch documentation, and scalability to support late-stage clinical programs or commercial launches. Research institutes prioritize experimental flexibility and may opt for lower-capacity or manual column formats that facilitate method development and rapid changeovers.

Technology segmentation reveals divergent value propositions. Column-based generators remain widely used, and within that category automated column-based systems reduce operator burden and support compliance, whereas manual column-based units offer lower capital cost and hands-on control for specialized workflows. Integrated systems introduce another set of options, with multi-channel variants enabling parallel syntheses for high-volume or multi-tracer sites and single-channel configurations delivering focused, compact workflows suitable for smaller clinical departments or pilot programs.

Generator capacity segmentation also influences strategic choices, as high-capacity units serve centralized production or high-throughput hospitals seeking to maximize daily elution volumes, medium-capacity generators fit mid-size clinical operations balancing flexibility and throughput, and low-capacity generators meet the needs of research labs or smaller clinics where intermittent use and lower capital intensity are priorities. Altogether, segmentation clarifies where technological adoption, service models, and sourcing strategies should align to meet distinct clinical, research, and commercial objectives.

Mapping regional variances in regulatory frameworks, manufacturing presence, and clinical demand that determine strategic positioning across Americas, EMEA, and Asia-Pacific

Regional dynamics shape how generator systems are adopted, where investment flows, and how stakeholders manage regulatory and logistical constraints. In the Americas, a mature clinical market and sizable network of diagnostic centers and hospitals supports both commercial and research use cases; however, recent trade policy shifts have increased focus on regional manufacturing capacity and supply redundancy. This has prompted some organizations in the Americas to emphasize domestic partnerships and to accelerate integration of multi-channel systems in high-volume centers to mitigate cross-border disruption.Across Europe, the Middle East & Africa, regulatory harmonization and well-established clinical networks create a heterogeneous but sophisticated demand environment. Western European jurisdictions often lead in formalized guidance for generator validation and radiopharmaceutical quality, which encourages vendors to embed compliance features into their systems. In contrast, parts of the Middle East and Africa are characterized by growth-oriented investments in clinical infrastructure and strategic procurement partnerships that prioritize reliable, easy-to-operate solutions and end-to-end service offerings.

The Asia-Pacific region exhibits a combination of rapid adoption and localized manufacturing expansion, driven by strong growth in oncology diagnostics, expanding nuclear medicine programs, and government support for domestic production capabilities. Regional manufacturers and contract partners increasingly cater to the need for scalable solutions tailored to diverse healthcare settings, from metropolitan tertiary centers to regional hospitals. Taken together, these regional patterns imply that supply strategies, product design, and commercial models must be adapted to local regulatory expectations, clinical use cases, and logistical realities to achieve sustainable penetration and operational reliability.

How innovation, service excellence, and strategic partnerships determine competitive advantage and influence adoption across clinical and commercial stakeholders

Competitive dynamics within the generator landscape are increasingly defined by the ability to combine technical reliability with regulatory readiness and service excellence. Manufacturers that differentiate on consistent eluate quality, robust documentation packages, and validated workflows gain preference among clinical and pharmaceutical buyers who must meet strict reproducibility and compliance requirements. Equally important is the capacity to support customers with training, preventive maintenance, and rapid technical response, as uptime and predictable performance directly affect clinical throughput and trial timelines.Strategic partnerships and vertical integration have emerged as common approaches to expanding reach and capability. Organizations that invest in integrated platform development or that secure long-term agreements with clinical networks position themselves to capture recurring demand for consumables and service. At the same time, contract manufacturers and regional assemblers play a growing role in providing localized supply and tailored solutions that reduce lead times and lower logistical risk. These commercial models influence how companies prioritize R&D, regulatory submissions, and the development of multi-channel versus single-channel offerings.

Innovation pipelines emphasize automation, digital traceability, and modular designs that facilitate upgrades without wholesale equipment replacement. Companies that effectively combine product innovation with regulatory intelligence and customer-centric service models are best placed to support the widening clinical adoption of gallium-68 tracers while navigating tariff and supply-chain complexities.

Practical strategic actions for stakeholders to bolster resilience, optimize operations, and align procurement with clinical and regulatory imperatives

Industry leaders should adopt a proactive posture that balances immediate operational imperatives with longer-term strategic resilience. First, diversify supplier relationships and regional sourcing to reduce reliance on single origins for critical components and to shorten delivery lead times. Establishing preferred agreements with multiple qualified suppliers and exploring local assembly or contract manufacturing arrangements will minimize exposure to policy shocks and logistical bottlenecks. Second, invest selectively in automation and integrated systems for sites with predictable high throughput to lower per-dose operational costs and reduce human error, while retaining lower-capacity or manual alternatives for research and low-volume settings.Third, align procurement decisions with rigorous quality and compliance criteria, ensuring that device selection includes comprehensive documentation, traceability features, and support for validation activities. Strengthen internal capability through targeted training programs that raise operator competence in elution handling, radiochemistry, and quality control. Fourth, embed scenario planning into procurement and capacity strategies to simulate tariff changes, supply interruptions, and demand surges; use these scenarios to stress-test inventory policies and service-level agreements.

Fifth, collaborate proactively with regulators and clinical partners to streamline adoption pathways and to co-develop validation protocols that accelerate clinical roll-out. Finally, integrate data-driven monitoring across operations to track key performance indicators such as uptime, elution yield consistency, and reagent consumption, using those insights to refine supplier selection, maintenance schedules, and capital allocation. These steps will enhance operational continuity and make strategic investments more resilient to external shocks.

Rigorous mixed-methods approach integrating primary stakeholder engagement, technical literature review, and scenario analysis to produce actionable operational insights

The research underpinning this report combined structured primary engagement with domain stakeholders and a systematic review of technical, regulatory, and operational literature to ensure robust, actionable findings. Primary inputs included in-depth interviews with clinical directors, radiopharmacy managers, procurement leads, and technical specialists responsible for generator operations, providing firsthand perspectives on performance priorities, service expectations, and supply constraints. Interview data were complemented by facility-level observations and anonymized operational metrics where available to ground qualitative insights in practical experience.Secondary analysis incorporated publicly available regulatory guidance, technical specifications from manufacturers, and peer-reviewed literature on radiochemistry and generator technologies to map technical differentiators and compliance requirements. Supply chain mapping identified common sourcing routes, logistical dependencies, and potential vulnerability points. Where possible, comparative assessments of column-based and integrated systems drew upon validated performance data and documented user experiences to assess trade-offs between automation, flexibility, and cost of operation.

Results were triangulated across data streams to reduce bias and to validate key themes. Scenario analysis was employed to examine the implications of tariff shocks and capacity constraints under alternative procurement and operational strategies. Throughout the process, emphasis was placed on translating technical findings into pragmatic recommendations for procurement, clinical operations, and corporate strategy teams.

Synthesis of strategic conclusions that connect technological innovation, supply resilience, and operational readiness to support sustainable clinical adoption of generator-derived radiochemistry

The collective evidence points to a generator ecosystem in flux, driven by technological innovation, evolving regulatory expectations, and strategic responses to policy-driven supply challenges. Automation and integrated system designs are reshaping clinical workflows, enabling higher throughput and more consistent tracer production in high-volume environments while leaving room for manual and lower-capacity solutions where flexibility is paramount. At the same time, tariff measures and geopolitical factors have highlighted the necessity of diversified sourcing, regional capacity, and tighter coordination between procurement and clinical operations.For clinical leaders and manufacturers alike, success will hinge on aligning product choices with operational realities, investing in compliance-ready systems, and fostering resilient supplier networks. Organizations that adopt a thoughtful mix of high-capacity integrated platforms and adaptable lower-capacity units, while building strong regional partnerships and rigorous validation pathways, will be best positioned to support expanding clinical indications and the broader adoption of gallium-68 radiopharmaceuticals. The strategic actions recommended in this summary provide a roadmap for reducing risk, optimizing performance, and unlocking the clinical potential of generator-derived gallium-68.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Germanium-68 Gallium-68 Generators Market

Companies Mentioned

- Advanced Accelerator Applications

- Anderson Publishing, Ltd.

- B. J. Madan & Co

- BWX Technologies. Inc.

- Cardinal Health.

- Curium Pharma

- Cyclotron Co. Ltd.

- Eckert & Ziegler Radiopharma GmbH

- Eckert & Ziegler Strahlen- und Medizintechnik AG

- EDH Nuclear Medicine & Healtcare Services Ltd.

- IBA Worldwide

- Isotope JSC

- Isotopia Molecular Imaging Ltd.

- Kompass International SA

- Lemer Pax

- RadioMedix Inc.

- Telix Pharmaceuticals Limited.

- TEMA Sinergie

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

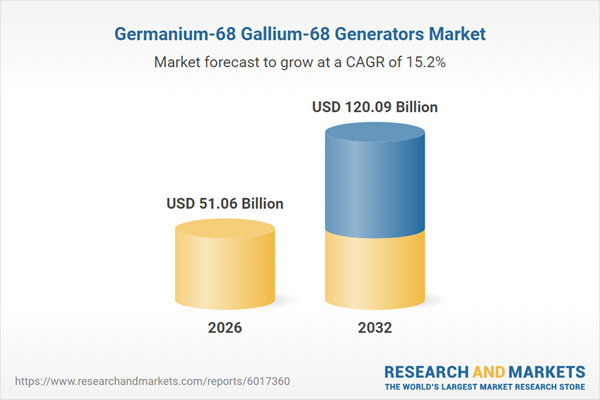

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 51.06 Billion |

| Forecasted Market Value ( USD | $ 120.09 Billion |

| Compound Annual Growth Rate | 15.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |