Speak directly to the analyst to clarify any post sales queries you may have.

The Faraday isolators market is undergoing significant transformation as senior decision-makers address heightened complexity in procurement, technology obsolescence, and regulatory requirements. This challenging environment demands agile responses, supplier reliability, and innovative approaches to sourcing photonics components.

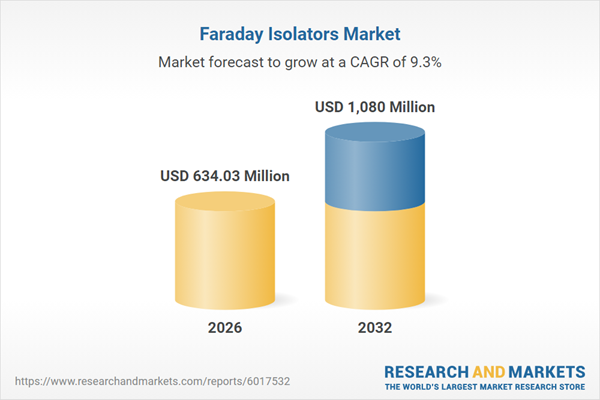

Market Snapshot: Faraday Isolators Market Size and Growth Outlook

The Faraday isolators market grew from USD 581.20 million in 2025 to USD 634.03 million in 2026 and is projected to expand at a CAGR of 9.30%, reaching USD 1.08 billion by 2032. Market expansion is fueled by the adoption of isolators in diverse sectors, including industrial laser processing, ongoing telecommunications upgrades, advanced medical instrumentation, and defense modernization. Organizations across these industries are driving demand for precision and reliability in photonic component selection, reflecting an operational need for high-performance products that align with evolving standards and international competitiveness.

Scope & Segmentation: Mapping Core Market Drivers

- End-Use Applications: Defense and Aerospace, Healthcare, Industrial Manufacturing, Research and Academia, and Telecommunications each prioritize specific design criteria, traceability expectations, and compliance frameworks.

- Device Architecture: Bulk Optical, Fiber Optic, and Integrated Optic isolators address major requirements for power handling, system modularity, and seamless integration into next-generation photonic circuits.

- Wavelength Specialization: C Band, L Band, S Band, and X Band configurations support both established and emerging needs across network, laboratory, and field-deployable applications.

- Power Ratings: High Power and Low Power isolators are central to product development in thermal management, device bonding, and safety protocol innovations.

- Geographical Markets: Americas, Europe, Middle East and Africa, and Asia-Pacific present diverse manufacturing capabilities, compliance landscapes, and supply chain strategies that influence the market's competitive profile.

Faraday Isolators Market: Technical Drivers and Strategic Forces

Faraday isolators are integral to maintaining unidirectional light propagation and safeguarding sensitive photonic systems. Industrial, medical, and research stakeholders now prioritize advanced optical and thermal performance, device miniaturization, and the flexibility to integrate with modular fiber optics. The shift toward integrated photonic solutions requires ongoing product re-engineering for new environments and strict adherence to international compliance standards.

Key Takeaways for Senior Decision-Makers

- Procurement teams are raising expectations around supplier transparency, security protocols, and support throughout the product lifecycle.

- Miniaturization trends are prompting a transition away from legacy bulk formats, with modern magneto-optic materials and advanced manufacturing enhancing durability and power optimization in newer formats.

- Applications in defense require comprehensive traceability and rigorous qualification, whereas healthcare demands focus on regulatory compliance, device sterilization, and integrated safety measures.

- Distinct requirements across industry segments necessitate tailored product strategies and flexible offerings, rather than standardized solutions, resulting in increased emphasis on modularity and application-specific design.

- Shifting regional supply models focus on localized manufacturing, vertically coordinated production, and strong partner networks to address trade, compliance, and delivery risks.

Tariff Impact: United States Policy and Supply Chain Adjustments

Recent tariff policies in the United States have raised the total cost of international materials and components, intensifying scrutiny of supplier qualifications and bill-of-materials analysis. To manage risk, companies are adopting strategies such as tariff classification reviews, nearshoring, and greater contractual flexibility. These approaches have encouraged further investment in North American manufacturing, reinforced supplier partnerships, and driven companies to prioritize inventory management and adaptable delivery terms.

Methodology & Data Sources

This report utilizes a mixed-method research design. Primary data was obtained from structured interviews with engineering, procurement, and R&D leaders in the defense, telecommunications, medical, manufacturing, and academic sectors. Secondary data included review of technical articles, patent documentation, standards references, regulatory guidance, and trade policy documents. Triangulation was used to validate findings through benchmarking and input from subject-matter experts, ensuring the recommendations presented are both accurate and actionable.

Why This Report Matters: Strategic Value for Decision-Makers

- Access insights at the intersection of technology advancements, regulatory shifts, and global supply chain strategies that are essential for informed procurement decisions.

- Understand how miniaturization, market segmentation, and regional differentiation are influencing operational and product development priorities in the Faraday isolators market.

- Apply recommendations for diversifying suppliers, adopting flexible procurement frameworks, and matching product roadmaps with critical end-use requirements.

Conclusion

As the Faraday isolators market evolves, those who embrace targeted product innovation, supported supply strategies, and collaborative partnerships will enhance their competitive positioning and operational agility in a complex global environment.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Faraday Isolators Market

Companies Mentioned

- DK Photonics Technology Limited

- Electro-Optics Technology, Inc.

- Excelitas Technologies Corp.

- Gooch & Housego PLC

- Hamamatsu Photonics K.K.

- II-VI Incorporated

- Jenoptik AG

- Lumentum Holdings Inc.

- MKS Instruments, Inc.

- OptoSigma Corporation

- Thorlabs, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 634.03 Million |

| Forecasted Market Value ( USD | $ 1080 Million |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |