Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market encounters a major hurdle concerning material compatibility between potent cleaning agents and delicate instrument parts. The aggressive chemical formulations needed to effectively remove bioburden can deteriorate sensitive adhesives and polymers used in complex modern medical devices. This incompatibility acts as a barrier to market expansion, as manufacturers are compelled to constantly balance high-level disinfection efficacy against the risk of damaging costly equipment. Consequently, healthcare facilities face complicated procurement decisions, weighing infection control needs against asset preservation.

Market Drivers

The worldwide increase in diagnostic and surgical procedures serves as a primary catalyst for the medical device cleaning market, establishing a direct link between operative volume and the use of reprocessing supplies. As healthcare institutions work to manage patient backlogs and the escalating requirements of aging populations, the throughput of reusable instruments has accelerated, demanding rapid and efficient reprocessing cycles to ensure equipment availability.This relationship between procedural frequency and the demand for cleaning consumables is reflected in the financial results of leading industry players. For example, Steris PLC reported in its 2024 Annual Report that its Healthcare segment achieved a 13% increase in constant currency organic revenue in June 2024, a rise attributed mainly to higher procedure volumes and normalized supply chains. Similarly, Olympus Corporation saw its consolidated fiscal year revenue grow by over 6% to approximately ¥936 billion in 2024, emphasizing the expanding global inventory of surgical and endoscopic equipment necessitating daily high-level disinfection.

Furthermore, the growing prevalence of Hospital-Acquired Infections (HAIs) drives healthcare providers to implement rigorous cleaning protocols, thereby boosting the market for advanced disinfectants and enzymatic detergents. Hospital administrators and regulatory bodies are placing greater emphasis on infection prevention to lower patient morbidity and prevent the heavy financial penalties linked to outbreaks. The impact of enforcing these intensified hygiene strategies is evident in recent national health data.

According to the Centers for Disease Control and Prevention’s '2023 National and State Healthcare-Associated Infections Progress Report' released in November 2024, acute care hospitals observed a 16% reduction in standardized infection ratios for hospital-onset Methicillin-resistant Staphylococcus aureus (MRSA) bacteremia compared to the previous year. This decline underscores the essential, ongoing role of strict medical device cleaning regimens in controlling bioburden and maintaining sterility assurance standards in clinical settings.

Market Challenges

A significant obstacle impeding the Global Medical Device Cleaning Market is the challenge of ensuring material compatibility between powerful cleaning agents and delicate instrument components. As medical devices increasingly utilize complex adhesives and polymers to improve performance, they become more vulnerable to degradation caused by the aggressive chemical formulations necessary for bioburden elimination. This incompatibility poses a significant financial risk for healthcare facilities, as using highly effective disinfectants may unintentionally damage protective coatings or compromise the structural integrity of costly surgical tools. As a result, procurement departments often hesitate to adopt advanced cleaning consumables, concerned that the long-term costs of premature equipment replacement will exceed the immediate advantages of upgraded disinfection protocols, thereby limiting sales volumes and slowing overall market turnover.This operational difficulty is clearly illustrated by recent industry performance metrics related to regulatory compliance. In 2024, The Joint Commission identified the standard governing the sterilization and high-level disinfection of medical equipment as one of the top five most frequently cited non-compliant requirements during surveys of healthcare facilities. This statistic underscores the persistent struggle providers face in reconciling the stringent demands of infection control with the physical constraints of modern medical hardware. As long as this technical disparity persists, facilities will continue to encounter procurement bottlenecks, effectively limiting the revenue potential for the cleaning market.

Market Trends

The shift toward biodegradable and eco-friendly enzymatic detergents is transforming product formulations as healthcare institutions increasingly balance environmental stewardship with clinical efficacy. Manufacturers are moving away from harsh, non-biodegradable chemicals, reformulating agents into sustainable multi-enzyme solutions that operate effectively at lower temperatures and require less water for rinsing. This transition is propelled by hospital mandates aimed at reducing plastic waste and chemical effluents, offering a competitive edge to vendors providing sustainability-oriented reprocessing consumables. For instance, Ecolab Inc.'s '2023 Growth & Impact Report' from May 2024 highlighted that the adoption of their energy-efficient and water-saving hygiene technologies enabled customers to conserve 226 billion gallons of water and prevent 3.8 million metric tons of greenhouse gas emissions worldwide.Concurrently, the adoption of robotic and automated decontamination systems is gaining momentum as facilities aim to reduce human error and mitigate chronic labor shortages in central sterile services departments. By substituting manual pre-cleaning tasks with automated washer-disinfectors and robotic instrument handling, hospitals are standardizing reprocessing cycles and significantly lowering staff exposure to hazardous pathogens. This technological integration guarantees consistent high-level disinfection outcomes regardless of operative volume, driving increased investment in capital equipment. This trend is evidenced by Getinge AB’s 'Interim Report January-June 2024', released in July 2024, which reported a 12.9% rise in net sales for its Surgical Workflows business area during the second quarter, demonstrating strong market demand for modernized sterile processing infrastructure.

Key Players Profiled in the Medical Device Cleaning Market

- Ecolab

- Steris

- Getinge

- Belimed

- 3M

- Miele Professional

- Sterigenics

- STERIS Instrument Management

- Tuttnauer

Report Scope

In this report, the Global Medical Device Cleaning Market has been segmented into the following categories:Medical Device Cleaning Market, by Device:

- Non-critical

- Semi-critical

- Critical

Medical Device Cleaning Market, by Technique:

- Cleaning

- Disinfection

- Sterilization

Medical Device Cleaning Market, by EPA Classification:

- High Level

- Intermediate Level

- Low Level

Medical Device Cleaning Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Medical Device Cleaning Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Medical Device Cleaning market report include:- Ecolab

- Steris

- Getinge

- Belimed

- 3M

- Miele Professional

- Sterigenics

- STERIS Instrument Management

- Tuttnauer

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

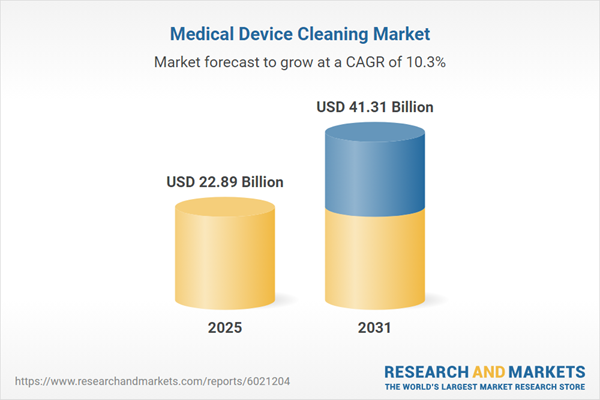

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 22.89 Billion |

| Forecasted Market Value ( USD | $ 41.31 Billion |

| Compound Annual Growth Rate | 10.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |