Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry encounters a major obstacle regarding data integrity and cybersecurity. As financial organizations transfer sensitive operations to digital environments, they become prime targets for fraud and sophisticated cyberattacks. Establishing stringent security measures to meet evolving regulations while ensuring user convenience presents a complex operational challenge. Consequently, the persistent risk of data breaches threatens to diminish consumer confidence and result in heavy regulatory fines, potentially retarding the continued growth of the global digital banking market.

Market Drivers

The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) serves as a major catalyst for the market, fundamentally reshaping how institutions engage with customers through hyper-personalization. Banks are increasingly utilizing generative AI to examine spending behaviors and transaction histories, allowing them to provide customized financial guidance and predictive product suggestions that bolster user retention. This technological drive is supported by significant capital investment aimed at automating intricate processes and refining decision-making. According to NVIDIA's 'State of AI in Financial Services: 2025 Trends' report from September 2025, 98% of financial services management teams intend to boost their AI infrastructure investments during the year, emphasizing the industry's reliance on automated intelligence for efficiency and service differentiation.Concurrently, the market is propelled by a distinct consumer shift towards remote and contactless banking, reducing the need for physical branch infrastructure. This behavioral change has empowered digital-only neobanks to capture considerable market share by delivering mobile-first experiences that meet modern lifestyle demands for immediate access. Chase's 'Digital Banking Attitudes' survey from June 2025 indicates that 78% of consumers use banking apps weekly, illustrating the deep integration of mobile platforms in daily financial management. This rise in adoption has facilitated rapid scaling for challengers; for example, Nu Holdings reported in 2025 that Nubank attained 127 million customers across Brazil, Mexico, and Colombia, demonstrating the extensive reach of branchless banking models.

Market Challenges

A critical hurdle obstructing the Global Digital Banking Market is the enduring threat to data integrity and cybersecurity. As financial entities move sensitive processes to digital platforms, they inadvertently widen the attack surface for sophisticated cybercriminals. This vulnerability compels banks to navigate a difficult environment where the need for strict security protocols often conflicts with user expectations for seamless, instant access. As a result, the fear of data breaches weakens the consumer trust necessary for mass adoption, while the reputational and financial costs associated with fraud incidents redirect capital away from growth-oriented innovations.The magnitude of this impediment is underscored by recent industry statistics regarding the prevalence of these threats. The Association for Financial Professionals noted in 2024 that 79% of organizations reported being victims of actual or attempted payment fraud. This figure highlights the severity of the operational environment, where a continuous stream of attacks leads to substantial regulatory pressure and liability. These factors collectively hinder market expansion, as prospective users remain cautious of digital channels and institutions struggle to maintain a balance between protection and performance.

Market Trends

The integration of embedded finance into non-financial platforms is fundamentally changing the distribution of banking services, extending beyond consumer payments to complex business-to-business applications. Financial institutions are increasingly inserting treasury management, procurement, and lending capabilities directly into supply chain interfaces and Enterprise Resource Planning (ERP) systems, enabling businesses to execute financial tasks without exiting their primary workflows. This seamless integration notably improves liquidity management and operational efficiency for corporate clients. Validating this shift, Mastercard's November 2025 'Embedded Finance Affects Cash Flow' report found that 84% of organizations integrating payments into procurement platforms saw measurable gains in cash flow management.Simultaneously, the move toward cloud-native core banking infrastructure has accelerated as institutions aim to replace rigid legacy systems with agile, scalable architectures. This transition is driven not only by cost reduction but by the strategic necessity to support rapid product deployment and integration with third-party ecosystems. By adopting containerized environments and microservices, banks can independently update specific components, ensuring continuous service delivery and faster adaptation to market changes. According to the London Stock Exchange Group's 'Financial Services Cloud Adoption' survey in July 2025, 87% of firms increased their cloud spending over the previous two years to drive innovation and scalability, confirming the industry-wide departure from on-premise data centers.

Key Players Profiled in the Digital Banking Market

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Temenos Headquarters SA

- Worldline S.A.

- Citigroup Inc.

- Deutsche Bank AG

- UBS Group AG

Report Scope

In this report, the Global Digital Banking Market has been segmented into the following categories:Digital Banking Market, by Banking:

- Retail

- Corporate

- Investment

Digital Banking Market, by Service:

- Transactional

- Non-Transactional

Digital Banking Market, by Mode:

- Online Banking Platforms

- Mobile Banking Apps

Digital Banking Market, by End-User:

- Individuals

- Government Organizations

- Corporate

Digital Banking Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Digital Banking Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Digital Banking market report include:- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Temenos Headquarters SA

- Worldline S.A.

- Citigroup Inc.

- Deutsche Bank AG

- UBS Group AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

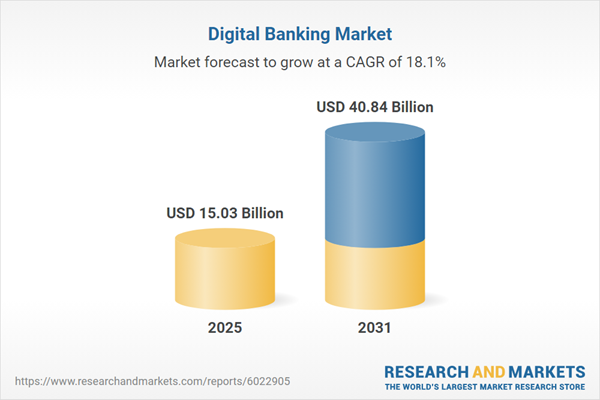

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 15.03 Billion |

| Forecasted Market Value ( USD | $ 40.84 Billion |

| Compound Annual Growth Rate | 18.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |