Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is largely driven by a critical need for operational efficiency, as institutions aim to automate resource-heavy tasks such as regulatory reporting, risk modeling, and fraud detection. Furthermore, the push for hyper-personalization fuels market expansion, enabling entities to customize client interactions and investment advice at scale to boost retention. Reinforcing this trend, UK Finance reported in 2024 that financial institutions allocated an average of 12 percent of their total technology budgets specifically to generative AI, indicating a strong commitment to embedding these capabilities into core operations.

Despite this rapid progress, the market encounters significant obstacles related to regulatory compliance and data privacy. The lack of transparency in certain algorithmic models poses challenges in satisfying the strict explainability standards mandated by financial regulators, while the potential for data leakage regarding sensitive client information remains a major concern for institutions. Consequently, the task of navigating a complex and shifting global regulatory landscape without compromising the security and accuracy of financial data presents a formidable barrier that threatens to decelerate widespread adoption across the enterprise sector.

Market Drivers

The growing necessity for advanced risk management and fraud detection is fundamentally transforming the market as financial organizations strive to combat increasingly complex cyber threats. Generative AI models are being utilized to scrutinize immense transaction datasets in real-time, enabling the identification of subtle fraudulent patterns that often escape detection by conventional rule-based systems. This technology not only bolsters security but also enhances operational efficiency by more accurately differentiating between legitimate actions and genuine risks. Highlighting this impact, Mastercard revealed in a May 2024 press release titled "Mastercard accelerates card fraud detection with generative AI technology" that the implementation of these predictive tools allowed the company to double its detection rate of compromised cards across its global network.Concurrently, the surging demand for hyper-personalized customer experiences is fueling the broad integration of these tools to tailor client interactions on a large scale. Financial institutions are leveraging generative models to synthesize behavioral data and individual transaction histories, facilitating the provision of instant, customized investment guidance and responsive virtual support. This capability has become a central priority for firms seeking to strengthen client engagement; according to the NVIDIA "State of AI in Financial Services" report from February 2025, the utilization of generative AI for customer experience and engagement applications increased to 60 percent, more than doubling the previous year's figures. The financial implications are expected to be significant, with Citi Global Perspectives & Solutions stating in their June 2024 report "AI in Finance: Bot, Bank & Beyond" that successfully integrating these technologies could expand the global banking sector's profit pool by roughly 170 billion dollars by 2028.

Market Challenges

The primary obstacle impeding the growth of the Global Generative AI in Fintech Market is the intricate conflict involving algorithmic opacity, regulatory compliance, and data privacy. Financial entities must operate within rigid frameworks that insist on transparency and the rigorous protection of sensitive client data. However, the intrinsic "black box" nature of many generative models complicates the ability to trace how specific financial advice or conclusions are reached, creating a direct friction with the explainability standards enforced by global regulators. This tension forces organizations to limit the deployment of these technologies to lower-risk back-office environments rather than high-value customer-facing channels where the potential for market expansion is greatest.As a result, this regulatory ambiguity serves as a severe constraint on widespread innovation. Concerns regarding non-compliance and data leakage drive firms to maintain a highly cautious strategy, effectively stalling the commercial scalability of these tools. Data from the Institute of International Finance (IIF) in 2024 indicates that 81 percent of financial institutions have restricted their use of Generative AI to internal, non-customer-facing applications to manage these emerging risks. This defensive posture prevents the market from fully realizing the revenue-generating opportunities associated with hyper-personalized financial services.

Market Trends

The adoption of synthetic data for privacy-preserving model training is quickly emerging as a vital solution to the sector's regulatory and data privacy challenges. Financial institutions are increasingly employing generative algorithms to produce artificial datasets that statistically replicate real-world transaction details without including personally identifiable information (PII). This methodology allows banks to develop robust machine learning models based on diverse scenarios, such as economic downturns or rare fraud patterns, while strictly adhering to data residency and privacy laws like GDPR. This trend is fostering a new era of secure collaboration; for instance, Swift announced in a May 2024 press release titled "Swift and global banks launch AI pilots to tackle cross-border payments fraud" that the cooperative had gathered 10 leading financial institutions to test advanced AI on anonymously shared data, signaling a major shift toward collective intelligence that respects data sovereignty.Simultaneously, the automated generation of market insights and financial reports is revolutionizing the operational landscape for compliance officers and analysts. Generative AI tools are advancing beyond simple text processing to independently draft complex documents, such as investment research notes, regulatory filings, and earnings summaries, thereby reducing the manual workload of data synthesis. This functionality enables professionals to concentrate on high-value strategic interpretation instead of routine compilation, which significantly accelerates the time-to-market for advisory services and financial products. The potential impact on workforce productivity is profound; the "2024 Future of Professionals Report" by Thomson Reuters in July 2024 projects that the integration of these AI capabilities will free up approximately 12 hours per week for industry professionals within the next five years, fundamentally reshaping resource allocation in financial firms.

Key Players Profiled in the Generative AI in Fintech Market

- IBM Corporation

- Microsoft Corporation

- Google LLC

- NVIDIA Corporation

- Amazon Web Services, Inc.

- Salesforce, Inc.

- Oracle Corporation

- SAP SE

- Palantir Technologies Inc.

- H2O.ai, Inc.

Report Scope

In this report, the Global Generative AI in Fintech Market has been segmented into the following categories:Generative AI in Fintech Market, by Component:

- Services

- Software

Generative AI in Fintech Market, by Deployment:

- On-premises

- Cloud

Generative AI in Fintech Market, by Application:

- Compliance & Fraud Detection

- Personal Assistants

- Asset Management

- Predictive Analysis

- Insurance

- Business Analytics & Reporting

- Customer Behavioral Analytics

- Others

Generative AI in Fintech Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Generative AI in Fintech Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Generative AI in Fintech market report include:- IBM Corporation

- Microsoft Corporation

- Google LLC

- NVIDIA Corporation

- Amazon Web Services, Inc.

- Salesforce, Inc.

- Oracle Corporation

- SAP SE

- Palantir Technologies Inc.

- H2O.ai, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

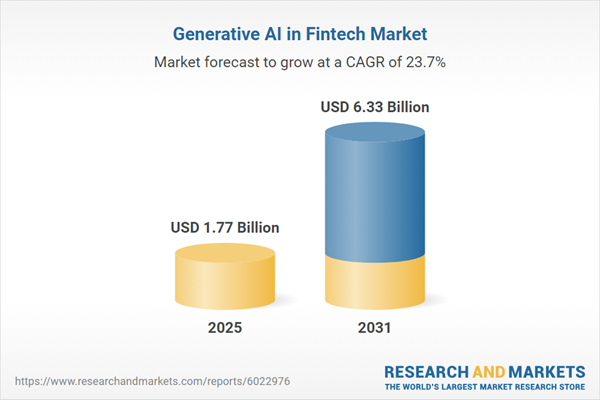

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.77 Billion |

| Forecasted Market Value ( USD | $ 6.33 Billion |

| Compound Annual Growth Rate | 23.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |