Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive growth factors, the market faces significant hurdles related to the substantial upfront expense of induction technology and the intricate electrical retrofitting needed for installation in aging homes. These economic and technical barriers frequently postpone adoption within price-sensitive consumer segments. However, according to the National Kitchen & Bath Association's '2024 Kitchen Trends Report', 56 percent of industry professionals predict that separate cooktops and wall ovens will maintain popularity over all-in-one ranges, confirming the enduring demand for these specialized units.

Market Drivers

The surge in kitchen renovation and remodeling projects acts as a primary catalyst for the Global Residential Hobs Market. As homeowners upgrade aging residential infrastructure, there is a clear shift away from freestanding ranges toward modular built-in configurations that deliver enhanced aesthetics and spatial efficiency. This renovation trend drives significant market volume, as consumers frequently choose comprehensive appliance updates to align with modern interior designs. According to Houzz’s '2024 U.S. Kitchen Trends Study' from January 2024, 54 percent of homeowners prefer replacing all major appliances during a renovation rather than keeping existing units, generating consistent demand for specialized cooktops. The financial importance of this segment is highlighted by Whirlpool Corporation, which reported in 2024 that the cooking appliances segment contributed 24 percent of their total global net sales, demonstrating the vital revenue role of these fixtures.Additionally, technological progress in smart and connected appliances serves as a secondary major driver, fundamentally transforming how consumers interact with cooking interfaces. Manufacturers are increasingly embedding artificial intelligence and Wi-Fi connectivity into hobs to provide capabilities such as exact temperature regulation, remote monitoring, and automatic safety shut-offs. This shift toward intelligent kitchens appeals to tech-savvy users and promotes the replacement of outdated gas units with advanced induction models. Highlighting this rapid uptake, Samsung Electronics noted in an August 2024 corporate press release regarding sales performance that cumulative global sales of their AI-integrated home appliances hit 1.5 million units by mid-year, illustrating the strong market desire for intelligent culinary solutions that improve user convenience and energy efficiency.

Market Challenges

The considerable financial burden linked to high initial costs and complicated electrical retrofitting acts as a primary restraint on the Global Residential Hobs Market. Although induction technology provides superior efficiency, its purchase price is significantly higher than traditional gas or electric coil options, effectively excluding a segment of the potential market. Moreover, installing these modern hobs in older residential properties often requires extensive electrical panel upgrades and rewiring to meet specific voltage demands. This necessity for specialized labor and extra materials significantly increases total project expenses, leading homeowners to postpone renovations or select less expensive replacements that do not mandate infrastructure changes.This economic friction is directly associated with a slowdown in overall market momentum. When consumers are constrained by tight budgets, the premium nature of advanced cooktops often renders them a discretionary expense that is deprioritized. According to the National Kitchen & Bath Association's '2025 Kitchen & Bath Market Outlook', the industry is expected to see revenue growth of just 0.8 percent in 2025, a figure that reflects the influence of these financial pressures on spending habits. This modest growth rate highlights how installation complexities and cost barriers are actively limiting the widespread adoption of next-generation residential hobs.

Market Trends

The integration of downdraft ventilation systems within hobs is emerging as a defining market trajectory, fueled by growing consumer preference for open-plan layouts that require unobstructed sightlines. By incorporating the extraction mechanism directly into the ceramic glass surface, manufacturers eliminate the need for cumbersome overhead hoods, creating a streamlined solution that combines two essential appliances. This architectural innovation resolves spatial limitations in modern urban apartments while enhancing air quality capture at the source, making it a favored option for premium developments. Underscoring the commercial strength of this niche, Elica S.p.A. reported in its 'H1 2025 Financial Results' from July 2025 that its Cooking division, which focuses on these integrated aspiration systems, achieved sales of 185.4 million Euros in the first half of the year, indicating robust demand despite broader economic volatility.Concurrently, the shift toward sustainable and high-efficiency induction technologies is accelerating as major industry leaders allocate significant capital to eco-friendly innovations and product durability. This trend goes beyond simple energy conservation to embrace circular economy principles, such as enhanced repairability and material reduction, to comply with changing environmental standards. Manufacturers are actively financing research to create next-generation induction coils and power management systems that reduce ecological footprints while optimizing thermal transfer. Demonstrating this sector-wide commitment to future-proof engineering, BSH Home Appliances Group revealed in its 'Annual Press Conference 2025' in April 2025 that the conglomerate invested a record 835 million Euros in research and development during the 2024 fiscal year, specifically targeting pioneering technologies that improve appliance sustainability and technical performance.

Key Players Profiled in the Residential Hobs Market

- Electrolux AB

- Panasonic Corporation

- Whirlpool Corporation

- LG Electronics Inc.

- Koninklijke Philips N.V.

- Robert Bosch GmbH

- Faber SpA

- Hangzhou Robam Appliances Co.,Ltd.

- Glen Dimplex Europe Holdings Limited

- KAFF Appliances (India) Private Limited

Report Scope

In this report, the Global Residential Hobs Market has been segmented into the following categories:Residential Hobs Market, by Type:

- Induction

- Gas

- Mix

Residential Hobs Market, by Size:

- 2 Burner

- 3 Burner

- 4 Burner

- 5 Burner

Residential Hobs Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Residential Hobs Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Residential Hobs market report include:- Electrolux AB

- Panasonic Corporation

- Whirlpool Corporation

- LG Electronics Inc.

- Koninklijke Philips N.V.

- Robert Bosch GmbH

- Faber SpA

- Hangzhou Robam Appliances Co.,Ltd.

- Glen Dimplex Europe Holdings Limited

- KAFF Appliances (India) Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

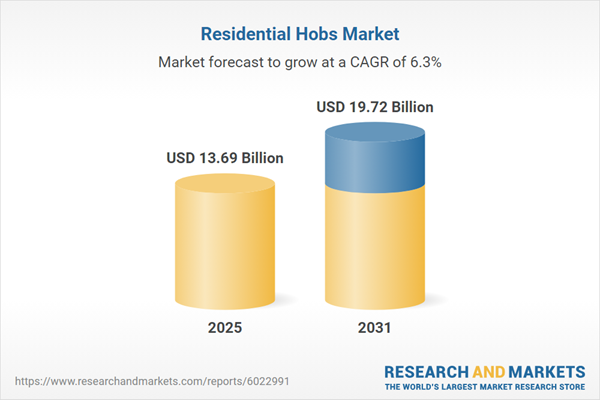

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 13.69 Billion |

| Forecasted Market Value ( USD | $ 19.72 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |