Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to the Manufacturers’ Agents Association for the Foodservice Industry, the equipment and supplies sector projects a sales increase of 2.7% in 2025 as the industry stabilizes. Despite this positive trajectory, market expansion encounters a significant challenge regarding volatile raw material prices and international trade tariffs. These financial pressures elevate the initial capital expenditure required for essential units, thereby compelling budget-conscious operators to defer necessary upgrades and potentially restraining overall market activity.

Market Drivers

The proliferation of Quick Service Restaurants (QSR) and fast-food chains serves as a primary catalyst for the global market, creating sustained demand for durable, high-volume machinery capable of delivering consistent results under rigorous operating conditions. As these establishments prioritize speed and standardization, they require specialized appliances that can withstand continuous usage while minimizing downtime, a necessity reflected in the financial performance of key industry players. For instance, The Middleby Corporation reported annual net sales of $4.04 billion in its 'Fourth Quarter and Fiscal Year 2023 Results' in February 2024, while the National Restaurant Association’s '2024 State of the Restaurant Industry' report projected record foodservice sales of $1.1 trillion, signaling a robust environment for capital investment in kitchen infrastructure.Concurrently, the adoption of energy-efficient and sustainable kitchen technologies has emerged as a critical driver, influencing purchasing decisions as operators seek to reduce utility costs and comply with tightening environmental regulations. Modern catering equipment is increasingly engineered to optimize water and electricity consumption, offering long-term savings that justify higher initial acquisition costs. This market shift is quantifiable in the sales trajectories of manufacturers focused on green innovation; according to Rational AG’s 'Annual Report 2023' released in March 2024, the group generated sales revenues of 1.13 billion euros, a 10% increase attributable to the high global demand for their resource-efficient cooking systems, compelling competitors to accelerate eco-friendly product development.

Market Challenges

The growth of the Global Commercial Catering Equipment Market is continually hampered by volatile raw material prices and international trade tariffs. These financial instabilities directly increase manufacturing costs for essential components such as stainless steel and electronic circuitry. As producers transfer these elevated expenses to the final price of the machinery, the initial capital expenditure required for acquiring new units rises sharply. This price escalation creates a significant barrier to entry and modernization, particularly for small to medium-sized enterprises that operate on thin profit margins.The impact of these rising equipment costs is magnified by the concurrent operational financial strain faced by foodservice providers. According to the National Restaurant Association, in 2024, average food costs had increased by more than 20% and wages by over 30% compared to 2019 levels. Because operators are already allocating vast resources to cover these surging daily operating expenses, their ability to absorb higher capital costs for machinery is severely diminished. Consequently, businesses are compelled to defer necessary equipment upgrades, extending the lifecycle of older units and directly stalling market volume expansion.

Market Trends

The Integration of IoT-Enabled Smart Kitchen Ecosystems is revolutionizing commercial catering operations by shifting focus from standalone appliances to fully connected, data-driven environments. This trend is characterized by the widespread implementation of cloud-based asset management systems that allow operators to remotely monitor equipment performance, automate HACCP compliance logging, and execute predictive maintenance protocols. By centralizing control, kitchens can significantly reduce downtime and optimize utility usage, a critical capability as kitchens become more decentralized and digitized; according to Fishbowl’s January 2025 article '2024 Restaurant Industry Statistics: A Year in Review', 73% of restaurant operators increased their technology investments to secure a competitive operational edge.The Deployment of Robotic Automation for Repetitive Food Preparation Tasks has emerged as a critical solution to persistent labor volatility and the need for standardized product quality. Beyond simple mechanization, this trend involves the adoption of sophisticated robotic makelines and autonomous fry stations capable of executing high-volume tasks with precision, thereby decoupling production capacity from staffing levels. These systems are proving essential for high-throughput fast-casual and quick-service models where consistency and speed are paramount; according to NACS, April 2025, in the article 'Sweetgreen to Expand its Tech-Centric, Automated Kitchens', the chain's Infinite Kitchen locations demonstrate an 800-basis-point margin advantage compared to traditional sites, underscoring the profitability of automated infrastructure.

Key Players Profiled in the Commercial Catering Equipment Market

- Duke Manufacturing

- Electrolux AB

- Dover Corporation

- Illinois Tool Works, Inc.

- Ali Group S.r.l

- Fujimak Corporation

- Eurotec FM Ltd.

- Alto-Shaam, Inc.

- Atosa USA, Inc.

- Comstock-Castle Stove Co., Inc.

Report Scope

In this report, the Global Commercial Catering Equipment Market has been segmented into the following categories:Commercial Catering Equipment Market, by Product Type:

- Ovens

- Steamers

- Kettles

- Others

Commercial Catering Equipment Market, by End User:

- Food Service Sector

- School & Universities

- Hospitals

- Others

Commercial Catering Equipment Market, by Distribution Channel:

- Online

- Offline

Commercial Catering Equipment Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Commercial Catering Equipment Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Commercial Catering Equipment market report include:- Duke Manufacturing

- Electrolux AB

- Dover Corporation

- Illinois Tool Works, Inc.

- Ali Group S.r.l

- Fujimak Corporation

- Eurotec FM Ltd.

- Alto-Shaam, Inc.

- Atosa USA, Inc.

- Comstock-Castle Stove Co., Inc.

Table Information

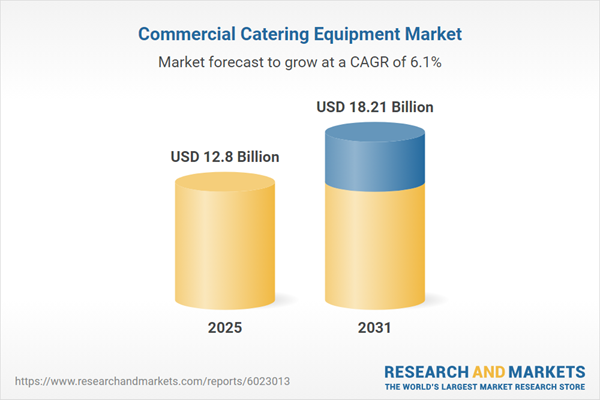

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 12.8 Billion |

| Forecasted Market Value ( USD | $ 18.21 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |