Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The primary catalysts for this global market include the increasing complexity of software development projects and the critical need for seamless coordination among geographically dispersed teams. Moreover, the demand for regulatory adherence and the widespread implementation of automated deployment workflows have established these tools as fundamental infrastructure components. This deep integration is underscored by recent statistics; according to the Cloud Native Computing Foundation, in 2025, 77% of surveyed organizations had embraced GitOps, a methodology reliant on version control systems, illustrating their central role in modern engineering strategies.

Despite this strong growth trajectory, the market encounters a notable obstacle regarding the steep learning curve linked to complex distributed systems, which can impede broad adoption among non-technical stakeholders. Furthermore, security vulnerabilities associated with the mismanagement of access credentials and the risk of exposing sensitive data within improperly configured repositories persist as major concerns. As enterprises scale, the challenge of maintaining rigorous governance and auditability without suppressing the pace of innovation constitutes a difficult barrier that could restrict the wider deployment of these systems into highly regulated industries.

Market Drivers

The Integration of Artificial Intelligence and Automation in Development Workflows has radically transformed the operational dynamics of version control systems. As organizations utilize AI-powered coding assistants, the rate of code commits has accelerated dramatically, necessitating scalable infrastructure capable of managing rapid iterations without performance degradation.This evolution requires platforms to function as the definitive source of truth for contributions authored by both humans and machines, integrating smoothly with automated pipelines. The magnitude of this resulting activity is depicted by recent figures; according to GitHub, in 2024, developers worldwide generated over 5.2 billion contributions across public and private projects. This trend is further supported by adoption rates; according to Stack Overflow, July 2024, in the '2024 Developer Survey', 76% of respondents were utilizing or planning to utilize AI tools in their development process, fueling the demand for robust versioning tools that support these high-velocity workflows.

Simultaneously, the Rising Demand for Regulatory Compliance and Secure Code Governance has emerged as a crucial market driver. With the software supply chain evolving into a primary target for cyberattacks, version control systems have become indispensable assets for enforcing access policies, code signing, and audit trails. The urgency for such governance is highlighted by the increasingly aggressive threat landscape confronting engineering teams. According to Sonatype, October 2024, in the '10th Annual State of the Software Supply Chain Report', there was a 156% year-over-year increase in the number of malicious packages discovered, emphasizing the severe risks associated with insecure repositories. Consequently, enterprises are prioritizing solutions equipped with advanced security capabilities to mitigate these escalating risks and ensure adherence to strict industry standards.

Market Challenges

Security vulnerabilities stemming from the mismanagement of access credentials and the potential for sensitive data exposure represent a significant barrier to the expansion of the Global Version Control System Market. As development teams increasingly incorporate automated workflows, the risk of inadvertently embedding proprietary secrets, API keys, or compliance-restricted data into shared repositories has intensified. This vulnerability is particularly problematic for enterprises operating within highly regulated sectors such as finance, healthcare, and defense, where data sovereignty and strict access governance are critical. Consequently, risk-averse stakeholders often delay the adoption of modern, distributed version control infrastructures, fearing that the decentralized nature of these tools could compromise their security posture and result in severe audit failures.These concerns are substantiated by recent industry data highlighting the prevalence of such risks. According to the Cloud Native Computing Foundation, in 2024, 25% of surveyed organizations reported that configuration and secrets management issues were a primary source of security breaches within their environments. This high incidence of credential-related incidents compels companies to implement rigid, cumbersome governance layers that can stifle the collaborative speed these systems are designed to enable, thereby directly hampering broader market growth in security-conscious industries.

Market Trends

The Expansion of Version Control into Machine Learning Operations (MLOps) signifies a fundamental structural shift as organizations seek to apply rigorous versioning standards to AI assets. Unlike traditional software, machine learning workflows require the simultaneous tracking of large datasets, model parameters, and training code to ensure reproducibility and compliance. This necessity has driven the market to adapt standard versioning logic to the unique, artifact-heavy requirements of AI lifecycles, effectively merging data engineering with source control. The scale of this adoption is immense; according to Databricks, June 2024, in the 'State of Data + AI Report', the number of AI models registered for production by organizations grew by 1,018% year-over-year, highlighting the explosive demand for systems capable of managing these complex versioned assets.The Consolidation of Toolchains into All-in-One DevOps Platforms is rapidly displacing disparate point solutions to reduce operational overhead and improve developer velocity. As development environments become increasingly fragmented with specialized utilities, enterprises are prioritizing unified platforms that centralize version control, CI/CD pipelines, and security scanning under a single governance model. This approach minimizes context switching and eliminates the friction caused by maintaining fragile integrations between disconnected tools. This preference for unified environments is substantiated by industry feedback; according to GitLab, June 2024, in the '2024 Global DevSecOps Report', 64% of DevOps professionals expressed a desire to consolidate their toolchains to alleviate maintenance burdens and streamline workflows, directly influencing market product strategies.

Key Players Profiled in the Version Control System Market

- Microsoft Corporation

- IBM Corporation

- GitHub, Inc.

- Atlassian Corporation

- Perforce Software, Inc.

- Red Hat, Inc.

- Plutora, Inc.

- Slashdot Media, LLC

- Idera, Inc.

- Unity Software Inc.

Report Scope

In this report, the Global Version Control System Market has been segmented into the following categories:Version Control System Market, by Type:

- Centralized

- Distributed

Version Control System Market, by Deployment Type:

- On-Cloud

- On-Premise

Version Control System Market, by Vertical:

- BFSI

- Healthcare

- Education

- Others

Version Control System Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Version Control System Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Version Control System market report include:- Microsoft Corporation

- IBM Corporation

- GitHub, Inc.

- Atlassian Corporation

- Perforce Software, Inc.

- Red Hat, Inc.

- Plutora, Inc.

- Slashdot Media, LLC

- Idera, Inc.

- Unity Software Inc.

Table Information

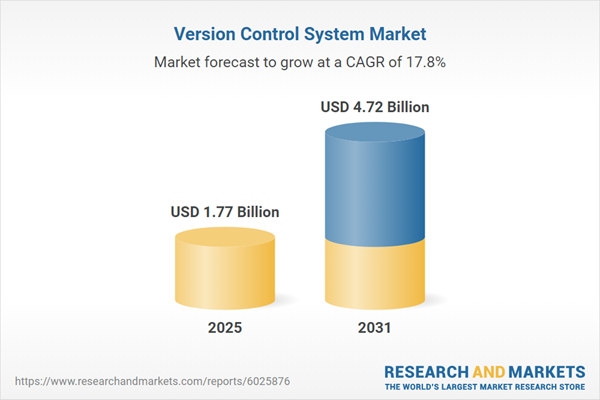

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.77 Billion |

| Forecasted Market Value ( USD | $ 4.72 Billion |

| Compound Annual Growth Rate | 17.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |