Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, the industry faces significant hurdles due to raw material volatility and dependence on climatic stability, particularly El Niño events that impact fishing quotas and yields. Such environmental unpredictability leads to severe supply shortages and price inflation that burden downstream manufacturers. According to the Global Organization for EPA and DHA Omega-3s, the total global volume of omega-3 ingredients reached 131,183 metric tons in 2024; however, volume growth was limited to 2.5 percent while market value jumped 10.2 percent due to supply constraints. This discrepancy emphasizes the market's susceptibility to ecological factors, which can restrict long-term expansion despite robust consumption needs.

Market Drivers

The rapid expansion of commercial aquaculture and the associated demand for aquafeed serve as the primary structural engine for the Global Fish Oil Market. As the production of carnivorous species like salmon and trout intensifies, the reliance on lipid-rich marine ingredients for essential fatty acids remains acute. Fish oil provides the specific nutritional profile necessary for optimal growth rates and disease resistance in farmed stock, establishing a rigid demand curve that closely mirrors aquaculture output. This industrial dependency is evidenced by trade flows in key hubs; according to the Food and Agriculture Organization (FAO) in its October 2025 'Global Fishmeal and Fish Oil Trade Update', Norway’s fish oil imports climbed to 38,400 tonnes in the first quarter of 2025, a 26 percent year-on-year increase to sustain its massive salmon farming operations.Concurrently, rising global awareness of the cardiovascular and cognitive health benefits of omega-3s is reorienting the market toward high-value human consumption. Consumers are increasingly prioritizing preventative healthcare, fueling the uptake of refined EPA and DHA supplements and functional foods. This trend decouples value from volume, as pharmaceutical-grade oils command premium pricing over feed-grade commodities. The scale of this segment is significant; according to the Global Organization for EPA and DHA Omega-3s in its July 2025 'EPA and DHA Omega-3 Finished Product Report', the global finished product market reached USD 52.4 billion in 2023. Supporting this dual demand, supply conditions have begun to stabilize, with IFFO - The Marine Ingredients Organisation reporting in its October 2025 'Monthly Market Intelligence Report' that cumulative global fish oil output through August 2025 increased by approximately 4 percent year-on-year.

Market Challenges

The Global Fish Oil Market is severely impeded by raw material volatility resulting from its acute reliance on climatic stability. Because the industry depends heavily on wild-caught pelagic species, production is intrinsically linked to oceanographic conditions that determine fish biomass and oil yields. Environmental phenomena such as El Niño disrupt marine ecosystems, leading to lower catch quotas and reduced lipid content in the harvest. This unpredictability undermines the supply chain foundation, making it difficult for refiners to maintain the consistent output levels required by the aquaculture and pharmaceutical sectors.Consequently, these supply shocks create an imbalance between availability and consumption needs, resulting in inventory deficits and market instability. The inability to predict production volumes restricts long-term planning and forces the market to contract during periods of environmental stress. This volatility is illustrated by recent figures; according to the Marine Ingredients Organisation, cumulative global fish oil production declined by approximately 30 percent in the first quarter of 2024 compared to the same period the previous year. This substantial drop underscores how ecological factors directly constrain market growth by physically limiting the raw materials available for processing.

Market Trends

The valorization of seafood processing by-products has emerged as a crucial strategy to decouple lipid production from wild-catch volatility. Manufacturers are increasingly upcycling nutrient-rich heads, viscera, and frames from the filleting industry, effectively transforming waste into a stable supply of omega-3s. This circular economy approach mitigates operational risks associated with fishing quotas and environmental fluctuations by utilizing raw materials that would otherwise be discarded, thus stabilizing the industrial input for feed and refinement. According to IFFO - The Marine Ingredients Organisation's April 2024 'Update on by-product marine ingredients', the share of global fish oil production derived from by-products reached 54 percent of the total output in 2023.Simultaneously, the sector is undergoing a structural shift toward eco-certified and traceable supply chains, driven by stringent demands from aquaculture and premium pet nutrition buyers. Stakeholders are adopting third-party verification standards to guarantee that marine ingredients are sourced from non-IUU fisheries and responsibly managed stocks, converting transparency into a fundamental market-access requirement. This trend compels refiners to implement rigorous auditing systems to secure long-term contracts with major feed producers who mandate sustainability credentials. As noted in MarinTrust's May 2024 'Annual Report', approximately 43 percent of global fishmeal and fish oil production was certified against the MarinTrust Standard in 2024.

Key Players Profiled in the Fish Oil Market

- Hyphens Pharma International Limited

- Croda International PLC

- GC Rieber AS

- Pelagia AS

- BASF SE

- Koninklijke DSM N.V.

- SUrsan S.A.

- Omega Protein Corporation

- TripleNine

- OLVEA Group

Report Scope

In this report, the Global Fish Oil Market has been segmented into the following categories:Fish Oil Market, by Application:

- Human Consumption

- Aquaculture

- Pet Food

- Others

Fish Oil Market, by Species:

- Tuna

- Salmon

- Pangasius

- Tilapia

- Others

Fish Oil Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fish Oil Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Fish Oil market report include:- Hyphens Pharma International Limited

- Croda International PLC

- GC Rieber AS

- Pelagia AS

- BASF SE

- Koninklijke DSM N.V.

- SUrsan S.A.

- Omega Protein Corporation

- TripleNine

- OLVEA Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

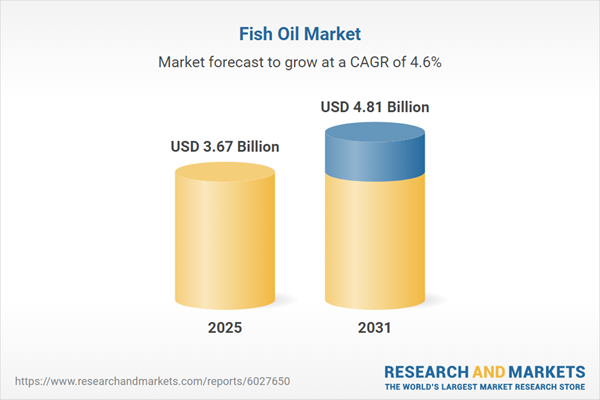

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.67 Billion |

| Forecasted Market Value ( USD | $ 4.81 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |