Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, a major obstacle hindering broader market adoption is the challenge of interoperability with legacy infrastructure. Many existing structures depend on obsolete utility systems that cannot interface with modern digital protocols, requiring costly and complicated retrofitting to enable full automation. This technical and financial hurdle often discourages facility managers from upgrading to next-generation systems, especially in older commercial buildings where the timeline for return on investment is heavily analyzed.

Market Drivers

Stringent government regulations and decarbonization mandates serve as the main catalyst for adopting Next Generation Building Energy Management Systems. As countries aim for net-zero goals, regulatory authorities are implementing strict codes that penalize high emissions while incentivizing efficiency, forcing facility owners to update their infrastructure.The necessity of this shift is highlighted by the built environment's significant environmental footprint; the Global Alliance for Buildings and Construction's 'Global Status Report for Buildings and Construction 2024-2025', released in March 2025, notes that the building sector was responsible for roughly 34 percent of global energy-related CO2 emissions in 2023. Consequently, installing compliant, intelligent management platforms has shifted from an optional capital expense to a crucial operational requirement for maintaining long-term asset viability.

The second major factor driving market growth is the rapid incorporation of artificial intelligence and IoT for predictive analytics. These technologies convert conventional systems into proactive tools that optimize energy usage in real-time by analyzing weather forecasts and occupancy patterns to significantly cut waste. A Honeywell study titled 'AI in Buildings' from February 2025 indicates that 84 percent of commercial building decision-makers intend to expand their use of artificial intelligence in the coming year to enhance security and streamline energy management. This digital shift yields concrete sustainability outcomes; for example, Johnson Controls reported in 2024 that their advanced building automation systems helped lower the Paris Olympics' carbon footprint by 54.6 percent compared to prior games, proving the substantial efficiency improvements possible through modern digitalization.

Market Challenges

A critical structural barrier impeding the Global Next Generation Building Energy Management Systems Market is the lack of interoperability between legacy infrastructure and modern digital platforms. Many standing commercial properties rely on outdated utility frameworks with analog controls that are incompatible with the complex digital protocols essential for AI-driven solutions. As a result, facility managers face the financial strain of extensive retrofits to establish connectivity, rather than simply overlaying intelligent technologies onto existing setups. This need for substantial hardware replacement increases upfront capital expenditures and frequently discourages investment.The elevated integration costs extend the return on investment timeline, prompting stakeholders to postpone or reject upgrades despite the promise of long-term operational savings. This reluctance confines market growth largely to new construction projects, leaving the vast inventory of older facilities untouched. The consequence of these technical obstacles is reflected in recent global performance data; according to the International Energy Agency, the global energy efficiency improvement rate was only 1% in 2024. This stagnant metric underscores the ongoing challenge of modernizing established infrastructure, effectively limiting the addressable market for next-generation management systems.

Market Trends

The adoption of Digital Twin technology is revolutionizing the market by generating dynamic virtual replicas of physical building assets for advanced lifecycle management and simulation. Unlike traditional monitoring methods, this technology enables facility managers to execute complex scenarios to predict system failures and refine performance prior to implementation, thereby reducing operational risks. This capability is becoming essential for meeting ambitious sustainability goals by identifying inefficiencies that standard automation might overlook; according to Hexagon's '2025 Digital Twin Statistics' report from January 2025, utilizing digital twin technology can cut a building's carbon emissions by up to 50 percent, greatly boosting corporate decarbonization initiatives.Furthermore, the integration of microgrid capabilities and Virtual Power Plant (VPP) technology is transforming buildings from passive energy consumers into active grid assets that can generate revenue. This trend involves aggregating distributed energy resources, such as battery storage systems and rooftop solar panels, to help stabilize the main utility grid during times of peak demand. With electrical grids facing rising volatility, building owners are deploying these solutions to ensure energy resilience and monetize excess capacity through demand response programs. As noted by the Alliance to Save Energy in the 'VPP Annual Report 2025' from September 2025, the U.S. Department of Energy has created a strategic roadmap to expand national Virtual Power Plant capacity to between 80 and 160 gigawatts by 2030, highlighting the vital role these systems will play in future energy infrastructure.

Key Players Profiled in the Next Generation Building Energy Management Systems Market

- Johnson Controls International PLC

- Siemens AG

- Honeywell International Inc.

- Schneider Electric SE

- IBM Corporation

- Cisco Systems, Inc.

- ABB Ltd.

- Delta Electronics, Inc.

- Panasonic Corporation

- Trane Technologies PLC

- Aermec S.p.A.

- Enel X S.r.l.

Report Scope

In this report, the Global Next Generation Building Energy Management Systems Market has been segmented into the following categories:Next Generation Building Energy Management Systems Market, by Type:

- Software

- Service

- Hardware

Next Generation Building Energy Management Systems Market, by Application:

- Wired

- Wireless

Next Generation Building Energy Management Systems Market, by Communication Technology:

- Commercial Buildings

- Manufacturing Facilities

- Educational Institutions

- Hospitals

- Government

Next Generation Building Energy Management Systems Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Next Generation Building Energy Management Systems Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Next Generation Building Energy Management Systems market report include:- Johnson Controls International PLC

- Siemens AG

- Honeywell International Inc.

- Schneider Electric SE

- IBM Corporation

- Cisco Systems, Inc.

- ABB Ltd.

- Delta Electronics, Inc.

- Panasonic Corporation

- Trane Technologies PLC

- Aermec S.p.A.

- Enel X S.r.l.

Table Information

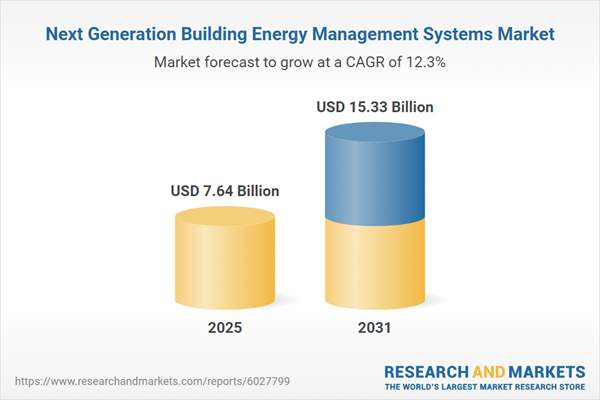

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 7.64 Billion |

| Forecasted Market Value ( USD | $ 15.33 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |