Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Infrastructure Expansion and Heavy Equipment Demand

The surge in infrastructure development across India is a major catalyst for the off-highway tyre market. Major construction initiatives - including roadways, metro systems, and urban development - require a wide range of heavy machinery such as backhoes, loaders, and excavators. For instance, the National Highway network expanded from 65,569 km in 2004 to 1,46,145 km in 2024, while construction speed increased from 12.1 km/day in 2014-15 to 33.8 km/day in 2023-24. These machines often operate under extreme conditions, accelerating tyre wear and increasing demand for robust, high-performance options.As deadlines tighten and mechanization replaces manual labor, fleet operators are prioritizing tyres that deliver durability, puncture resistance, and operational longevity. The shift toward radial tyres and advanced tread patterns is supported by India’s record infrastructure capital expenditure, which reached USD 36.3 billion in 2023-24, a 5.7x increase from 2013-14. This growing infrastructure footprint continues to fuel the need for heavy-duty OHV tyres.

Key Market Challenges

High Cost of Premium and Radial Tyres

Although radial and premium tyres offer superior durability, fuel efficiency, and performance, their adoption is limited by high initial costs. In sectors such as small-scale construction or marginal farming, budget constraints often prevent investment in these high-end products. Radial tyres can cost up to 40% more than bias alternatives and may require compatible rims or suspension modifications, further increasing total cost. As a result, many operators continue to opt for bias tyres, despite their shorter lifespan, due to affordability. This cost barrier restricts market penetration for premium products and slows the overall transition to advanced tyre technologies in price-sensitive segments.Key Market Trends

Growing Demand for Retreaded and Sustainable Tyres

Environmental awareness and the need for cost efficiency are encouraging broader adoption of retreaded and eco-friendly tyres in the OHV segment. Retreaded tyres allow operators to extend the usable life of tyre casings, significantly reducing lifecycle costs and waste. In industries like mining, construction, and agriculture - where tyre wear is rapid - retreading offers a practical solution without compromising performance. Modern retreading techniques such as pre-cured and mold-cured methods have improved reliability, making retreads more appealing. Concurrently, manufacturers are exploring green materials, including bio-based rubber and recycled compounds, to meet sustainability goals. Tyres with lower rolling resistance and longer tread life are also gaining traction, aligning with the industry’s shift toward environmentally responsible procurement practices.Key Market Players

- Apollo Tyres Limited

- Balkrishna Industries Limited

- Bridgestone Corporation

- CEAT Limited

- Continental AG

- JK Tyre & Industries Limited

- Michelin

- MRF Limited

- The Goodyear Tire & Rubber Company

- Pirelli & C. S.p.A.

Report Scope:

In this report, the India Off Highway Vehicle Tyre Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Off Highway Vehicle Tyre Market, By Tyre Type:

- Tyre Radial

- Bias

India Off Highway Vehicle Tyre Market, By Demand Category:

- OEM

- Replacement

India Off Highway Vehicle Tyre Market, By Vehicle Type:

- Construction Equipment

- Agricultural Vehicles

- Mining Vehicles

- Material Handling Equipment

- Others

India Off Highway Vehicle Tyre Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Off Highway Vehicle Tyre Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Apollo Tyres Limited

- Balkrishna Industries Limited

- Bridgestone Corporation

- CEAT Limited

- Continental AG

- JK Tyre & Industries Limited

- Michelin

- MRF Limited

- The Goodyear Tire & Rubber Company

- Pirelli & C. S.p.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | July 2025 |

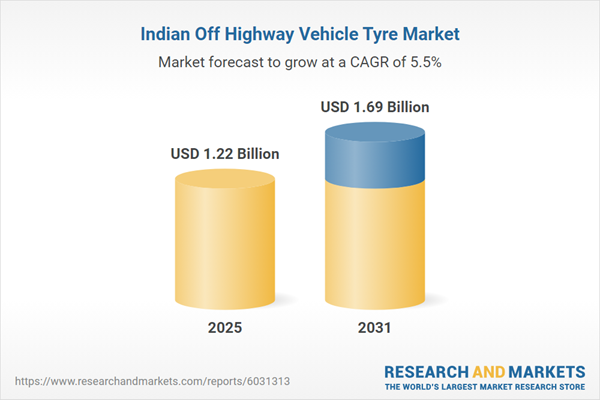

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.22 Billion |

| Forecasted Market Value ( USD | $ 1.69 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |