Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this robust expansion, the market faces hurdles regarding the instability of commercial real estate costs and the imperative to sustain high occupancy rates in saturated urban areas. Operators must navigate the complex task of offering competitive pricing while managing substantial lease liabilities and operational overheads. The sector’s resilience in the face of these challenges is evident in data from The Instant Group, which noted that in 2025, demand for flexible workspace in major global business hubs like Dubai maintained a compound annual growth rate of 13%, a trend largely sustained by corporate adoption.

Market Drivers

The rapid integration of hybrid and remote work models serves as a major driver for the industry, fundamentally changing how the workforce engages with physical office infrastructure. As organizations decentralize operations to support employees prioritizing shorter commutes and location flexibility, there is a surging demand for regional workspace hubs. This transition is evident in supply metrics, with operators expanding footprints to address distributed workforce needs; according to CoworkingCafe’s 'Coworking Industry Report Q4 2024' published in January 2025, national coworking space allocations in the United States increased by 3% in the fourth quarter, accumulating to nearly 137 million square feet.Simultaneously, the corporate transition toward agile real estate portfolios is redefining revenue streams, moving focus from individual memberships to enterprise-level agreements. Large companies are actively reducing long-term lease risks by adopting flexible terms that enable them to adjust operations according to economic conditions. Highlighting this trend, CBRE’s 'European Office Occupier Sentiment Survey 2025', released in October 2025, indicates that occupiers aim to hold 29% of their total real estate portfolios in flexible space by 2027 to minimize capital commitments. This strategic shift is further demonstrated by major operators expanding to meet institutional demand, such as IWG PLC, which reported in March 2025 that it added 899 new locations to its global network throughout 2024.

Market Challenges

A primary obstacle to market growth is the volatility of commercial real estate expenses coupled with the constant pressure to maintain occupancy levels. This financial stress creates a structural disconnect between rigid, long-term lease liabilities and the fluid revenue generated from short-term contracts held by freelancers and businesses. Consequently, when operational costs increase or economic uncertainty leads to a temporary decline in demand, operators struggle to adjust fixed expenses quickly, resulting in severe margin compression and reduced capital availability for launching new locations.This instability is particularly severe in dense business districts where an overabundance of office inventory drives aggressive price competition. According to NAIOP, the Commercial Real Estate Development Association, the average vacancy rate for commercial office space climbed to 11.8 percent in late 2024. Such high vacancy levels highlight the saturation within key urban centers, forcing operators to limit membership fees to remain competitive despite facing unpredictable property costs, thereby threatening the financial viability of those unable to balance competitive pricing with heavy real estate commitments.

Market Trends

The industry is currently undergoing a structural transition toward asset-light management agreements, wherein operators partner with property owners instead of committing to capital-intensive long-term leases. By converting fixed rental obligations into revenue-sharing models, this approach aligns landlord incentives with operator performance and mitigates financial risks linked to market volatility. This strategy enables rapid network expansion and protects margins without the heavy balance sheet liabilities that historically constrained the sector; for example, Coworking Europe reported in August 2025 that this capital-light structure drove a 26% revenue increase for IWG's Managed and Franchised division during the first half of the year.Concurrently, there is a significant rise in niche and industry-specific workspaces tailored to meet specialized professional needs beyond standard office requirements. Operators are curating environments with bespoke infrastructure, such as bio-labs for life sciences or recording studios for creative media, to command higher prices and foster stronger community retention. This specialization acts as a defensive measure against commoditization in dense urban markets by attracting tenants who need technical facilities unavailable in home or hybrid settings. According to the 'Coworking Statistics And Key Trends Shaping The 2026 Flexible Workspace Industry' report by Allwork.Space in December 2025, this segment has matured notably, with industry-specific coworking spaces now constituting a US$1.43 billion market globally.

Key Players Profiled in the Coworking Spaces Market

- WeWork Inc.

- Regus Group Ltd.

- Spaces

- Industrious National Management Company LLC

- Knotel Inc.

- Impact Hub GmbH

- Serendipity Labs Inc.

- The Office Group Ltd.

- Mindspace Ltd.

- Venture X Franchising, LLC

Report Scope

In this report, the Global Coworking Spaces Market has been segmented into the following categories:Coworking Spaces Market, by Amenities:

- Private Offices

- Shared Spaces

- Meeting Rooms

- Cafes

- Fitness Centres

- Parking

Coworking Spaces Market, by Target Audience:

- Freelancers

- Startups

- Small Businesses

- Corporations

- Remote workers

Coworking Spaces Market, by Value Added Services:

- Reception Services

- Mail Handling

- Printing & Copying

- Event hosting

- Business Support Services

Coworking Spaces Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Coworking Spaces Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Coworking Spaces market report include:- WeWork Inc.

- Regus Group Ltd.

- Spaces

- Industrious National Management Company LLC

- Knotel Inc.

- Impact Hub GmbH

- Serendipity Labs Inc.

- The Office Group Ltd.

- Mindspace Ltd.

- Venture X Franchising, LLC

Table Information

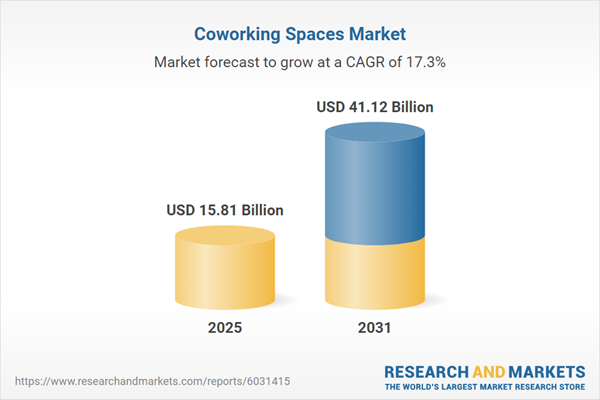

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 15.81 Billion |

| Forecasted Market Value ( USD | $ 41.12 Billion |

| Compound Annual Growth Rate | 17.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |