Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key drivers fueling this growth include the urgent need for armed forces to modernize their fleets and the escalation of geopolitical instability, which necessitates enhanced rapid response capabilities. Furthermore, the increasing requirement for versatile aerial assets to support humanitarian aid and disaster relief operations continues to stimulate procurement activities. Data from the Aerospace Industries Association indicates that U.S. aerospace and defense exports reached a total value of $138.7 billion in 2024, underscoring the robust international demand for defense-related technologies.

However, the market faces significant hurdles due to the exorbitant costs associated with the maintenance, repair, and overhaul of these complex machines. The financial burden of sustaining operational readiness, combined with the technical difficulties of integrating advanced avionics into legacy platforms, can strain defense budgets. These factors often lead to delayed acquisition timelines, particularly for cost-sensitive nations attempting to balance modernization with ongoing operational needs.

Market Drivers

A surge in global defense expenditures and procurement budgets acts as a primary catalyst for the military helicopter sector, with governments worldwide allocating increased funding to strengthen national security amid rising geopolitical instability. This financial influx directly supports the acquisition of advanced rotorcraft, the sustainability of existing fleets, and the integration of mission-critical avionics. According to the Stockholm International Peace Research Institute (SIPRI) in its April 2024 'Trends in World Military Expenditure, 2023' Fact Sheet, global military expenditure increased by 6.8 percent in real terms to reach a historic high of $2.44 trillion in 2023. This record level of spending facilitates large-scale procurement contracts and accelerates research into next-generation vertical lift technologies required for future combat scenarios.The acceleration of strategic fleet modernization and replacement programs further propels market activity as nations retire aging platforms in favor of technologically superior models that offer improved range, payload, and survivability. This shift is evident in recent large-scale international agreements aimed at replacing Soviet-era or Vietnam-era legacy systems. For instance, Boeing reported in August 2024 that the Polish government finalized a Foreign Military Sales contract valued at approximately $10 billion to acquire 96 AH-64E Apache attack helicopters. Furthermore, the broader industry continues to see robust activity; according to Airbus, their helicopter division recorded 393 net orders throughout 2023, reflecting sustained demand from military and public service operators.

Market Challenges

The primary challenge hampering the growth of the Global Military Helicopter Market is the exorbitant cost associated with maintenance, repair, and overhaul (MRO), coupled with the technical complexities of upgrading legacy platforms. These financial and technical burdens directly impede market expansion by consuming a disproportionate share of defense budgets that could otherwise be allocated to new procurement. As armed forces strive to maintain operational readiness, the substantial funds required to service complex machinery and integrate modern avionics into older airframes force nations to delay or scale back their acquisition timelines for new rotorcraft.This challenge is further exacerbated by the increasing financial scale of the defense sector, which exerts pressure on national budgets. According to the Aerospace, Security and Defence Industries Association of Europe (ASD), the turnover for the defense sector surged by 17% in 2023, highlighting the rising costs and intense economic activity within the industry. This escalating financial commitment means that cost-sensitive nations often struggle to balance the immediate necessity of sustaining their existing fleets with the long-term goal of modernization. Consequently, the high price of sustainment acts as a significant brake on the market's potential growth, effectively limiting the speed at which new technologies can be deployed globally.

Market Trends

The development of Next-Generation Future Vertical Lift (FVL) architectures represents a fundamental shift in rotorcraft engineering, prioritizing high-speed compound and tiltrotor technologies to meet the range requirements of near-peer conflicts. Defense forces are actively moving beyond traditional helicopter designs to acquire aircraft capable of speeds and combat radii that legacy platforms cannot achieve. This transition is financially prioritized by major military powers as they pivot toward airframes that merge the vertical agility of rotorcraft with the cruise performance of fixed-wing assets. Highlighting this substantial investment, Breaking Defense reported in March 2024 that the U.S. Army requested $1.26 billion in fiscal year 2025 specifically for the research, development, and testing of the Future Long-Range Assault Aircraft (FLRAA).Concurrently, the Integration of Manned-Unmanned Teaming (MUM-T) capabilities is redefining operational concepts by enabling rotorcraft to control subordinate drones or operate with varying degrees of autonomy. This trend focuses on retrofitting fleets with fly-by-wire systems and advanced algorithms that allow for optionally piloted missions, thereby reducing pilot risk during hazardous logistics or reconnaissance operations. This push toward autonomy allows commanders to extend the lethality and survivability of aviation units without increasing the human footprint in contested environments. Underscoring this technological advancement, Lockheed Martin announced in October 2024 that Sikorsky received a $6 million award from DARPA to integrate its autonomous flight system onto an experimental UH-60M helicopter to test scalable autonomy.

Key Players Profiled in the Military Helicopter Market

- Airbus SE

- Hindustan Aeronautics Limited

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD Helicopters, LLC

- Textron Inc.

- The Boeing Company

- Robinson Helicopter Company, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Denel Land Systems

Report Scope

In this report, the Global Military Helicopter Market has been segmented into the following categories:Military Helicopter Market, by Body Type:

- Multi-Mission Helicopter

- Transport Helicopter

- Others

Military Helicopter Market, by Weight Class:

- Light

- Medium

- Heavy

Military Helicopter Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Military Helicopter Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Military Helicopter market report include:- Airbus SE

- Hindustan Aeronautics Limited

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD Helicopters, LLC

- Textron Inc.

- The Boeing Company

- Robinson Helicopter Company, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Denel Land Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

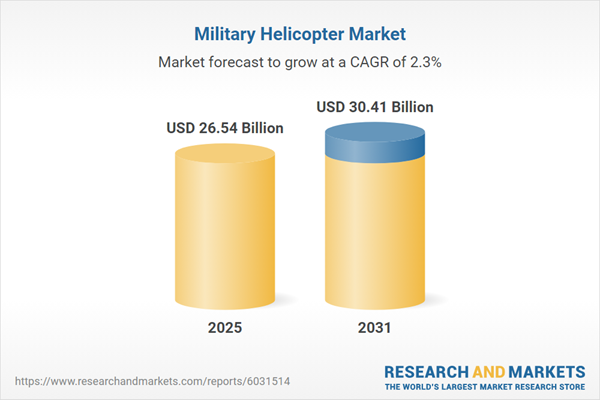

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 26.54 Billion |

| Forecasted Market Value ( USD | $ 30.41 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |