Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, rapid market growth is hindered by significant concerns over data privacy and cybersecurity, which cause enterprises to hesitate in adopting cloud-based fleet monitoring systems. Despite these risks, the ongoing cycle of fleet renewal creates a substantial opportunity for the deployment of telematics software and hardware. For instance, the European Automobile Manufacturers' Association reported that new EU van registrations rose by 8.3% in 2024, totaling 1.6 million units. This growth in the physical vehicle base highlights the increasing potential for telematics integration within the logistics and transportation industries.

Market Drivers

The surge in last-mile delivery services and e-commerce acts as a major catalyst for the Global Light Commercial Vehicle Telematics Market, forcing logistics providers to maximize fleet utilization. To satisfy consumer demands for transparency and speed, operators are increasingly adopting telematics systems that provide verifiable proof of delivery, asset tracking, and real-time route optimization. These tools are critical for managing the frequent stops associated with urban delivery while controlling costs. The importance of this technology is highlighted by the Descartes Systems Group's June 2024 survey, where 36% of shippers and logistics providers identified real-time transportation visibility as their primary technology investment priority.In parallel, the transition toward sustainable mobility is driving the integration of telematics in electric LCV fleets, where data on battery status, range, and charging availability is essential to prevent downtime. Connectivity allows managers to monitor energy consumption and schedule charging during off-peak hours, ensuring electric vehicles remain practical for commercial routes. This segment is growing rapidly; the International Energy Agency noted in April 2024 that global electric light commercial vehicle sales rose by over 50% in 2023. Furthermore, Ford Motor Company reported in October 2024 that paid subscriptions to its Ford Pro Intelligence platform increased by 30% year-over-year, reaching nearly 630,000 users.

Market Challenges

Cybersecurity vulnerabilities and data privacy concerns constitute a significant barrier to the growth of the Global Light Commercial Vehicle Telematics Market. As fleet operators increasingly rely on integrated systems to transmit sensitive information, such as real-time vehicle tracking and engine diagnostics, the risk of cyber threats rises. This digital exposure creates hesitation among enterprise decision-makers, who often delay the acquisition of advanced telematics solutions due to fears that cloud-based monitoring could leave their operations open to data breaches or ransomware attacks, leading them to prioritize asset security over the benefits of connectivity.The severity of this issue is underscored by the prevalence of specific attack vectors within the logistics sector. According to the National Motor Freight Traffic Association in 2024, approximately 90% of hacks in the industry resulted from phishing attempts and misconfigured devices or networks. This high frequency of security lapses reveals vulnerabilities in the foundational infrastructure necessary for telematics. Consequently, fleet managers are compelled to scrutinize vendors more rigorously to prevent unauthorized access, which results in prolonged sales cycles and slows the overall rate of market expansion.

Market Trends

The widespread adoption of video telematics and dashcams marks a pivotal shift in fleet risk management, evolving beyond basic location tracking to include comprehensive behavioral coaching. These integrated video solutions provide fleet managers with visual context for critical events, aiding in the exoneration of drivers during not-at-fault accidents and identifying dangerous habits such as distracted driving. This visual intelligence is crucial for lowering insurance premiums and fostering a safety-oriented culture, as evidenced by Verizon Connect's November 2024 report, where 75% of respondents indicated that utilizing video technology helped improve driver safety.Concurrently, the integration of AI-driven predictive analytics is transforming operational efficiency and maintenance strategies for LCV fleets. By using machine learning algorithms to analyze performance data, modern telematics platforms can forecast mechanical failures and optimize asset utilization, enabling a shift from reactive repairs to predictive maintenance models that minimize downtime. The momentum behind this technology is strong; according to Samsara's June 2024 report, 51% of physical operations leaders are already employing artificial intelligence, with 94% of respondents believing that investment in AI is necessary to maintain a competitive edge.

Key Players Profiled in the Light Commercial Vehicle Telematics Market

- Verizon Communications Inc.

- Geotab Inc.

- Samsara Inc.

- Trimble Inc.

- Omnitracs LLC

- Bosch

- Continental AG

- Teletrac Navman US Ltd.

- TomTom International BV

- Powerfleet Inc.

Report Scope

In this report, the Global Light Commercial Vehicle Telematics Market has been segmented into the following categories:Light Commercial Vehicle Telematics Market, by Solution Type:

- OEM

- Aftermarket

Light Commercial Vehicle Telematics Market, by Application:

- Solutions

- Services

Light Commercial Vehicle Telematics Market, by End-User:

- Transportation & Logistics

- Insurers

- Healthcare

- Media & Entertainment

- Vehicle Manufacturers/Dealers

- Others

Light Commercial Vehicle Telematics Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Light Commercial Vehicle Telematics Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Light Commercial Vehicle Telematics market report include:- Verizon Communications Inc.

- Geotab Inc.

- Samsara Inc.

- Trimble Inc.

- Omnitracs LLC

- Bosch

- Continental AG

- Teletrac Navman US Ltd.

- TomTom International BV

- Powerfleet Inc.

Table Information

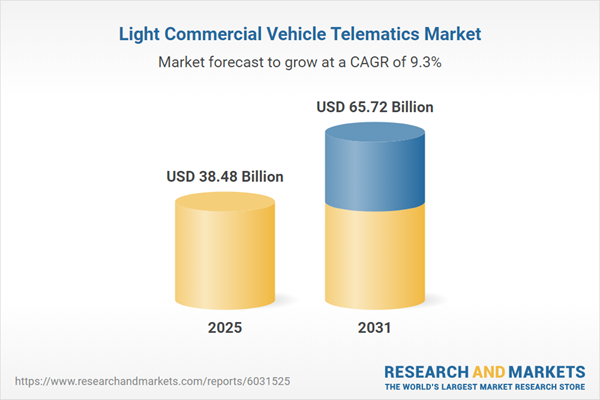

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 38.48 Billion |

| Forecasted Market Value ( USD | $ 65.72 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |