Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market confronts a major obstacle due to the instability of raw material costs. Manufacturers rely heavily on agricultural yields for natural rubber and petrochemical feedstocks for synthetic rubber, leaving them vulnerable to unpredictable price fluctuations that disrupt procurement strategies. This financial volatility creates difficulties in long-term planning and reduces profit margins, effectively establishing a barrier that limits investment in material innovation and hinders broader market growth.

Market Drivers

The accelerating production of electric vehicles (EVs) acts as a major driver for the evolution of the global automotive elastomers sector. In contrast to internal combustion engine vehicles, EVs demand specialized elastomeric parts that offer electrical insulation, superior thermal management, and flame retardancy to guarantee battery safety and efficiency. Consequently, manufacturers are shifting toward advanced materials such as ethylene-propylene-diene monomer (EPDM) and silicone for cooling system seals and high-voltage cable insulation. This industry shift is underscored by rapid adoption rates; the International Energy Agency's 'Global EV Outlook 2024' reported that global electric car sales neared 14 million in 2023, signaling a lasting demand for elastomers designed for electrified platforms.Concurrently, strict global emission regulations are forcing the industry to adopt fuel-efficient, lightweight materials. Automakers are actively substituting metal parts with elastomeric equivalents to lower vehicle weight and developing low-rolling-resistance tires to satisfy rigorous fuel economy standards. This regulatory push fosters the creation of high-performance synthetic rubbers that maintain durability despite reduced energy usage. The market scale responding to these trends is vast; the China Association of Automobile Manufacturers reported in January 2024 that vehicle production in China hit a record 30.16 million units in 2023. Additionally, the U.S. Tire Manufacturers Association projected in August 2024 that total U.S. tire shipments would reach 337.4 million units for the year, confirming massive aftermarket demand.

Market Challenges

Fluctuating raw material prices constitute a significant hurdle for the expansion of the Global Automotive Elastomers Market. Producers depend extensively on agricultural harvests for natural rubber and petrochemical inputs for synthetic rubber, rendering the supply chain highly susceptible to environmental conditions and economic changes. When input costs vary unpredictably, companies struggle to establish stable pricing or accurately predict procurement expenditures. This financial unpredictability compels manufacturers to proceed cautiously, frequently postponing investments in facility expansion or new material development.As a result, this volatility compresses profit margins and limits the capacity of suppliers to manage market shocks without transferring costs to original equipment manufacturers. Data from the Association of Natural Rubber Producing Countries reveals that in 2024, global natural rubber consumption hit 15.8 million tons, whereas production only reached about 14.5 million tons. This supply-demand gap highlights the resource constraints that intensify price instability. Such disparities restrict the ability of elastomer producers to scale their operations efficiently and satisfy the consistent volume demands required for continued market advancement.

Market Trends

The increasing use of renewable and bio-based elastomer materials is transforming the supply chain as companies aim to meet circular economy objectives and reduce reliance on petrochemicals. Distinct from lightweighting initiatives, this trend emphasizes raw material sourcing, promoting the inclusion of sustainable inputs like recycled polymers, rice husk silica, and dandelion-derived rubber in sealing and tire formulations. This transition is moving beyond the experimental phase to mass operation, driven by consumer demand for green mobility and strict environmental standards. The magnitude of this shift is reflected in supplier data; Continental AG’s June 2025 press release noted that renewable and recycled materials accounted for an average of 26% of their tire production in 2024.At the same time, the industry is seeing a rapid shift from traditional thermoset rubber to Thermoplastic Elastomers (TPEs), motivated by the desire for recyclability and improved processing efficiency. Unlike thermosets, which need time-intensive vulcanization, TPEs support overmolding and rapid injection molding, thereby cutting energy use and manufacturing cycle times. Additionally, TPE waste can be remelted and repurposed, providing a significant benefit in minimizing industrial waste and meeting end-of-life component regulations. The commercial impact of this trend is significant; Celanese Corporation reported in February 2025 that its Engineered Materials segment, housing its automotive elastomer business, achieved net sales of $5.6 billion in 2024.

Key Players Profiled in the Automotive Elastomers Market

- The Dow Chemical Company

- LANXESS AG

- DuPont de Nemours, Inc.

- ExxonMobil Corporation

- BASF SE

- Saudi Basic Industries Corporation

- Huntsman International LLC

- Continental AG

- INEOS AG

- Solvay SA

Report Scope

In this report, the Global Automotive Elastomers Market has been segmented into the following categories:Automotive Elastomers Market, by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Automotive Elastomers Market, by Type:

- Thermoset

- Thermoplastic

Automotive Elastomers Market, by Application Type:

- Tire

- Interior

- Exterior

- Under the Hood

Automotive Elastomers Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Elastomers Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Elastomers market report include:- The Dow Chemical Company

- LANXESS AG

- DuPont de Nemours, Inc.

- ExxonMobil Corporation

- BASF SE

- Saudi Basic Industries Corporation

- Huntsman International LLC

- Continental AG

- INEOS AG

- Solvay SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

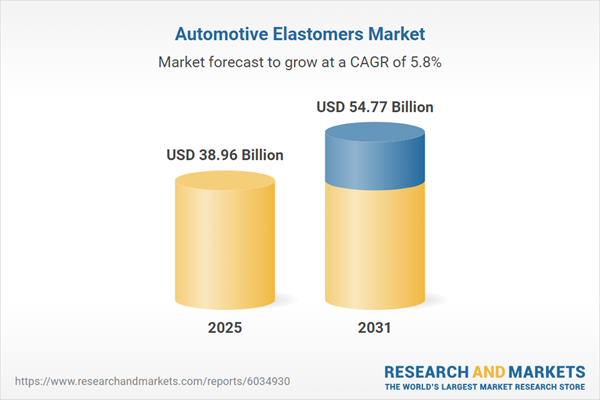

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 38.96 Billion |

| Forecasted Market Value ( USD | $ 54.77 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |