Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One major obstacle limiting market expansion is the difficulty of integrating these digital interfaces into legacy manufacturing systems, a process that often necessitates extensive retrofitting and technical expertise. Data from PROFIBUS & PROFINET International indicates that the total number of installed IO Link nodes reached 61 million in 2024. This figure highlights the continued industrial reliance on this technology, even as companies face the financial and technical challenges associated with upgrading older operational environments.

Market Drivers

The rapid advancement of Industry 4.0 and IIoT integration acts as a major catalyst for the market, transforming manufacturing from isolated control loops into interconnected, data-rich ecosystems. This shift requires standardized protocols capable of seamlessly transmitting process variables and parameter data between field-level devices and higher-level enterprise systems. Manufacturers increasingly prioritize this interface to automate sensor parameterization, which drastically cuts setup times during product changeovers and improves the granularity of production data. This expansion is highlighted by PROFIBUS & PROFINET International's April 2024 statement, which reported a record 15.9 million new nodes added in 2023, emphasizing the technology's critical role in digitizing the 'last meter' of communication in smart factories.Simultaneously, the rising demand for remote diagnostics and predictive maintenance drives adoption by necessitating access to real-time condition monitoring data. Unlike analog signals, IO-Link supports both acyclical and cyclical data transmission, enabling operators to continuously monitor signal quality and device health to preemptively address equipment failures. This capability is financially crucial, as a January 2024 Siemens report notes that Fortune Global 500 industrial firms lose approximately 1.5 trillion USD annually due to unplanned downtime. To support these capabilities, network infrastructure is evolving; HMS Networks reported in 2024 that Industrial Ethernet, often the integration layer for IO-Link masters, captured 71 percent of the global market for newly installed nodes.

Market Challenges

The substantial difficulty of embedding digital interfaces within legacy manufacturing environments acts as a primary restraint on the growth of the Global IO Link Market. Many industrial facilities utilize established control architectures that are incompatible with modern bidirectional protocols, requiring extensive retrofitting efforts. This modernization process involves significant financial investment and specialized engineering expertise to overhaul wiring and control logic without disrupting critical production schedules. Consequently, facility operators frequently delay upgrading older machinery, viewing the technical complexity and potential operational risks as prohibitive barriers to adoption.This friction significantly hinders the technology's expansion rate across mature industrial sectors. The reliance on traditional wiring configurations limits the immediate addressable market for advanced sensor communication, effectively capping the speed at which industries can transition to Industry 4.0 standards. According to PROFIBUS & PROFINET International, in 2024, an additional 9.7 million new IO Link nodes were put on the market. While this volume demonstrates continued demand, the normalization of these figures highlights how the challenges of retrofitting existing infrastructure dampen the potential for more aggressive exponential growth in the sector.

Market Trends

The adoption of IO-Link Wireless is revolutionizing flexible manufacturing by ensuring reliable communication in dynamic applications where physical cabling is susceptible to fatigue or breakage. This technology specifically addresses the requirements of mobile robotics, transport tracks, and rotating tooling by delivering a deterministic, low-latency connection comparable to wired systems but without mechanical constraints. By removing complex cable chains, manufacturers can design modular production lines that allow for rapid reconfiguration and unrestricted motion control. HMS Networks' June 2024 analysis indicates that wireless technologies accounted for 7 percent of newly installed nodes, a figure expected to grow as industrial-grade protocols gain wider acceptance in factory automation.Concurrently, the integration of functional safety via IO-Link Safety protocols is reshaping control architectures by merging standard and safety data onto a single cable. This trend eliminates the need for redundant hardwiring and dedicated safety relays, allowing safety sensors and actuators to be parameterized and diagnosed remotely just like standard devices. This consolidation simplifies safety-critical system design and significantly reduces installation costs while enhancing the granularity of diagnostic data for safety loops. As noted by PROFIBUS & PROFINET International in April 2024, the demand for integrated safety technology surged with a record 3.9 million new PROFIsafe nodes installed globally in 2023, underscoring strong momentum for extending safety protocols to the field level.

Key Players Profiled in the IO Link Market

- Siemens AG

- Rockwell Automation, Inc.

- Omron Corporation

- Balluff GmbH

- ifm electronic GmbH

- SICK AG

- Pepperl+Fuchs SE

- Hans Turck GmbH & Co. KG

- Banner Engineering Corp

- Schneider Electric

Report Scope

In this report, the Global IO Link Market has been segmented into the following categories:IO Link Market, by Type:

- IO-Link Wired

- IO-Link Wireless

IO Link Market, by Component:

- IO-Link Master

- IO-Link Devices

IO Link Market, by Application:

- Machine Tool

- Handling & Assembly Automation

- Intralogistics

- Packaging

IO Link Market, by Industry Vertical:

- Oil & Gas

- Energy & Power

- Automotive

- Aerospace & Defense

- Pharmaceuticals

- Food & Beverages

- Chemicals

- Others

IO Link Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global IO Link Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this IO Link market report include:- Siemens AG

- Rockwell Automation, Inc.

- Omron Corporation

- Balluff GmbH

- ifm electronic GmbH

- SICK AG

- Pepperl+Fuchs SE

- Hans Turck GmbH & Co. KG

- Banner Engineering Corp

- Schneider Electric

Table Information

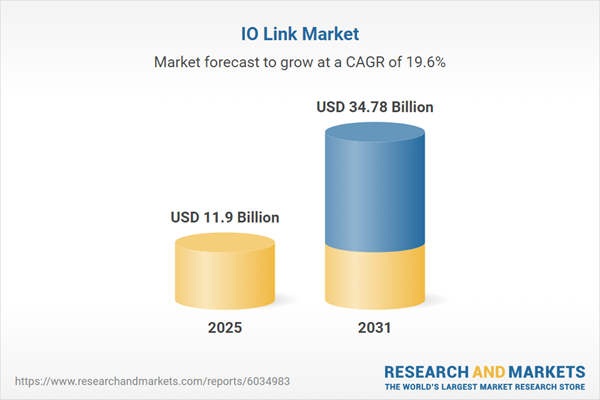

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 11.9 Billion |

| Forecasted Market Value ( USD | $ 34.78 Billion |

| Compound Annual Growth Rate | 19.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |