Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

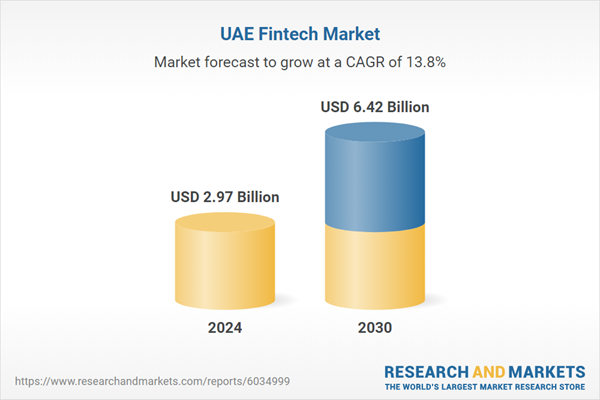

The government’s proactive stance, including the establishment of regulatory sandboxes and financial free zones like the Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC), has created a favorable environment for fintech startups to thrive. The market is also characterized by the integration of advanced technologies such as artificial intelligence, blockchain, and big data analytics, which are reshaping financial services. As traditional financial institutions collaborate with fintech firms, the UAE fintech market is poised for continued expansion, driven by ongoing innovation and evolving consumer demands. In 2024, the UAE emerged as the MENA region’s leader by securing $1.1 billion in startup funding. This achievement underscores the nation's strong growth potential and provides key takeaways for FinTech companies around the globe looking to expand within a dynamic and evolving financial ecosystem.

Key Market Drivers

Regulatory Support

The UAE government has actively fostered a conducive regulatory environment for fintech innovation. Initiatives like the Financial Free Zones (e.g., Abu Dhabi Global Market and Dubai International Financial Centre) provide startups with a flexible framework to operate. The Central Bank of the UAE has also introduced regulatory sandboxes that allow fintech firms to test their products in a controlled environment. This supportive approach encourages investment and innovation by reducing barriers to entry. Furthermore, initiatives such as the UAE Vision 2021 and the Dubai Blockchain Strategy aim to position the UAE as a global fintech hub.The regulatory clarity helps build trust among consumers and businesses, attracting both local and international players to the market. In addition to strong regulatory backing, the UAE is accelerating financial innovation through the integration of technologies like artificial intelligence and blockchain. Startups like Warburg AI are at the forefront of this transformation, while collaborations between the public and private sectors such as the partnership between e& Enterprise and PayPal are strengthening cross-border payment infrastructure. Further highlighting this advancement are initiatives like the integration of AANI with India’s UPI and the implementation of the GCC’s Afaq Payment System.

Key Market Challenges

Regulatory Hurdles

While regulatory support is a key driver, navigating the complex regulatory landscape remains a significant challenge for fintech companies in the UAE. The regulatory environment can be fragmented, with different authorities overseeing various aspects of financial services, such as the Central Bank, the Securities and Commodities Authority, and free zone regulators.This complexity can lead to confusion regarding compliance requirements and the approval process for new products. Additionally, as fintech evolves rapidly, regulators may struggle to keep pace, potentially resulting in outdated regulations that stifle innovation. Fintech startups often face lengthy approval times and high compliance costs, which can hinder their ability to enter the market or scale effectively. To overcome these hurdles, fintech firms must invest in legal expertise and develop strong relationships with regulators to ensure compliance while advocating for regulatory frameworks that foster innovation.

Key Market Trends

Rise of Digital Payments

The digital payments segment is experiencing explosive growth in the UAE, driven by an increasing preference for cashless transactions among consumers and businesses. This trend has been accelerated by the COVID-19 pandemic, which prompted a shift toward contactless payments and online shopping. Mobile wallets, QR code payments, and digital banking apps are becoming increasingly popular, supported by government initiatives promoting a cashless economy. Major players in the market, such as Emirates NBD and Abu Dhabi Commercial Bank, are enhancing their digital payment solutions to provide seamless and secure experiences.Additionally, partnerships between fintech firms and traditional banks are facilitating the adoption of innovative payment technologies. Building on supportive government initiatives, companies like Telr, Network International, PayTabs, Checkout.com, YAP, NymCard, Tabby, and Beehive Group have expanded their services and enhanced customer experiences.

For instance, Checkout.com began 2025 by partnering with Visa to introduce a push-to-card solution in the UAE. Shortly after, it teamed up with Mastercard Move to streamline money transfers for both individuals and businesses. In the following months, the company collaborated with Tabby to deliver BNPL (Buy Now, Pay Later) services across the UAE and Saudi Arabia. Additionally, Checkout.com announced its ambition to become a global digital payment service provider (PSP) and introduced secure card issuing solutions in the UAE.

Key Market Players

- Tabby FZ LLC

- Yallacompare Insurance Broker LLC

- Beehive P2P Limited

- Sarwa Digital Wealth (Capital) Limited

- Shuaa Capital psc

- Sehteq

- N O W Payment Services Provider LLC

- Mamo Limited

- Tap Payments

- Ziina Payment LLC

Report Scope:

In this report, the UAE Fintech Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Fintech Market, By Technology:

- API

- AI

- Blockchain

- Distributed Computing

- Others

UAE Fintech Market, By Service:

- Payment

- Fund Transfer

- Personal Finance

- Loans

- Insurance

- Others

UAE Fintech Market, By Application:

- Banking

- Insurance

- Securities

- Others

UAE Fintech Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Ajman

- Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Fintech Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tabby FZ LLC

- Yallacompare Insurance Broker LLC

- Beehive P2P Limited

- Sarwa Digital Wealth (Capital) Limited

- Shuaa Capital psc

- Sehteq

- N O W Payment Services Provider LLC

- Mamo Limited

- Tap Payments

- Ziina Payment LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.97 Billion |

| Forecasted Market Value ( USD | $ 6.42 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 10 |