Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces substantial hurdles regarding the high costs and technical complexities involved in certifying these integrated systems for airworthiness and cybersecurity. Manufacturers are required to navigate strict testing standards, which can delay deployment and inflate development costs. Highlighting the broader economic context, the Aerospace Industries Association reported that the aerospace and defense industry generated 995 billion dollars in combined sales in 2024, emphasizing the significant scale within which these cockpit procurements take place despite persistent supply chain pressures.

Market Drivers

Increasing global defense expenditures and the procurement of next-generation combat aircraft serve as primary catalysts for the adoption of digital glass cockpit systems. With escalating geopolitical tensions, nations are prioritizing fifth and sixth-generation fighters that require integrated touchscreen displays and sensor fusion capabilities as standard. This financial commitment guarantees a steady manufacturing pipeline for advanced flight deck technologies, transitioning away from legacy mechanical interfaces to support network-centric warfare. According to the Stockholm International Peace Research Institute's April 2024 report on 2023 trends, global military spending rose by 6.8 percent to reach 2.44 trillion dollars, creating a strong financial environment for acquiring high-tech aerial platforms outfitted with these sophisticated avionics suites.Concurrently, modernization programs for aging military fleets reinforce market demand by retrofitting reliable digital interfaces into older airframes. Defense agencies are focused on extending the service life of existing assets through block upgrades that replace obsolete analog gauges with large-area displays, enhancing situational awareness and safety without the expense of new acquisitions. Highlighting this investment, the U.S. Department of the Air Force's March 2024 budget estimates requested 18.8 billion dollars for Weapon System Sustainment. This activity generates significant supplier revenue, as evidenced by RTX's July 2024 earnings release, where the Collins Aerospace segment reported sales of 6.9 billion dollars, reflecting the industrial scale needed to support both new production and aftermarket avionics.

Market Challenges

Market growth is impeded by the exorbitant costs and intricate technical requirements necessary to obtain airworthiness and cybersecurity certifications for digital glass cockpit systems. As flight decks evolve into complex software-driven architectures, manufacturers must adhere to rigorous validation protocols to ensure operational safety and data integrity. This compliance burden extends development timelines, resulting in prolonged procurement cycles that delay the deployment of modernized aircraft. Consequently, high barriers to entry restrict market competition and compel defense ministries to divert significant budget portions toward regulatory approval rather than capability acquisition, slowing the momentum of fleet digitization.This friction within the deployment pipeline is particularly critical given the substantial volume of international trade dependent on these cleared technologies. According to the Aerospace Industries Association, United States aerospace and defense exports reached 138.6 billion dollars in 2024, underscoring the immense economic value reliant on meeting stringent international certification standards. Any bottlenecks in the technical approval process not only stall domestic fleet upgrades but also hinder the global exportability of these advanced avionics systems, directly limiting the sector's potential revenue growth.

Market Trends

The integration of Manned-Unmanned Teaming (MUM-T) interfaces is rapidly becoming a critical trend, fundamentally reshaping cockpit configurations to facilitate the simultaneous control of manned aircraft and autonomous wingmen. This capability demands advanced flight deck systems that enable pilots to manage drone swarms and interpret off-board sensor data without cognitive overload, shifting the pilot's role from a manual operator to a mission commander. Substantial funding for collaborative platforms supports this operational shift; according to an Army Recognition article from May 2025 regarding U.S. Air Force testing, the Collaborative Combat Aircraft program, which relies on these teaming architectures, has total planned funding of 8.89 billion dollars from FY2025 to FY2029.Simultaneously, the market is making a decisive transition toward Modular Open Systems Architecture (MOSA) standards to eliminate vendor lock-in and accelerate technology insertion. By utilizing standardized interfaces and reusable software components, defense agencies can rapidly upgrade specific cockpit functions - such as communications or targeting - without redesigning the entire avionics suite, thereby lowering lifecycle costs and shortening deployment timelines. This shift is illustrated by recent contracting activities; as reported by AviTrader in March 2025, Collins Aerospace was awarded an 80 million dollar contract to upgrade Black Hawk helicopter avionics using their Mosarc family of MOSA-compliant products.

Key Players Profiled in the Military Aircraft Digital Glass Cockpit Systems Market

- Kearfott Corporation

- Elbit Systems Ltd.

- TransDigm Group Incorporated

- Honeywell International Inc.

- Garmin Ltd.

- RTX Corporation

- Thales S.A.

- L3Harris Technologies Inc.

- Safran S.A.

- Astronautics Corporation of America

Report Scope

In this report, the Global Military Aircraft Digital Glass Cockpit Systems Market has been segmented into the following categories:Military Aircraft Digital Glass Cockpit Systems Market, by System Type:

- Multi-Functional Display Systems

- Primary Flight Display

- Engine-Indicating & Crew Alerting System (EICAS) Display

Military Aircraft Digital Glass Cockpit Systems Market, by Aircraft Type:

- Fighter Jet

- Transport Aircraft

- Helicopter

Military Aircraft Digital Glass Cockpit Systems Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Military Aircraft Digital Glass Cockpit Systems Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Military Aircraft Digital Glass Cockpit Systems market report include:- Kearfott Corporation

- Elbit Systems Ltd.

- TransDigm Group Incorporated

- Honeywell International Inc.

- Garmin Ltd.

- RTX Corporation

- Thales S.A.

- L3Harris Technologies Inc.

- Safran S.A.

- Astronautics Corporation of America

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

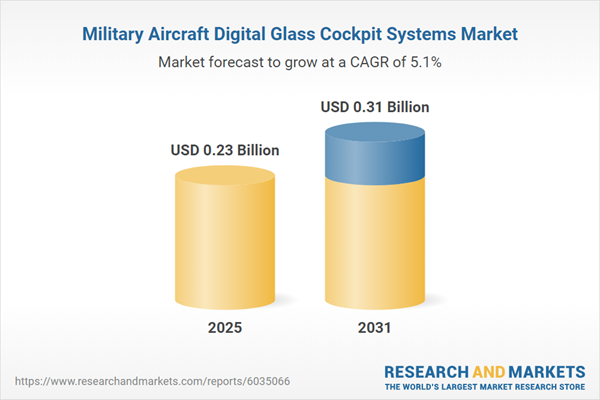

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 0.23 Billion |

| Forecasted Market Value ( USD | $ 0.31 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |