Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite the robust demand for regulatory compliance and performance validation, the market encounters a major obstacle in the form of high initial capital requirements for facility integration and equipment procurement. The significant expense involved in installing advanced testing cells serves as a formidable barrier to entry for smaller independent service providers and workshops operating with limited budgets. As a result, while major original equipment manufacturers continue to enhance their testing infrastructures, these financial limitations may restrict the wider adoption of such sophisticated systems among lower-tier market participants. This disparity potentially limits the market's reach, confining the most advanced capabilities to entities with substantial financial resources.

Market Drivers

The enforcement of stringent emission standards and environmental regulations acts as a fundamental driver for the global chassis dynamometer market. Governments around the world are imposing increasingly tight restrictions on tailpipe pollutants and greenhouse gas emissions, obliging automotive manufacturers to employ advanced testing systems for accurate powertrain calibration and certification. These regulatory mandates require high-precision dynamometers that can simulate complex, real-world driving cycles to guarantee adherence to multi-pollutant protocols. To illustrate the severity of these changes, the U.S. Environmental Protection Agency finalized standards in March 2024 that require a reduction of nearly 50% in fleet average greenhouse gas emissions for light-duty vehicles by model year 2032 compared to 2026 levels, thereby significantly increasing both the volume and complexity of necessary compliance testing.Furthermore, the rapid shift toward electric and hybrid vehicle development is stimulating the demand for specialized testing infrastructure. In contrast to traditional internal combustion engines, electrified powertrains necessitate chassis dynamometers capable of assessing regenerative braking efficiency, battery thermal management, and range verification under repeatable load conditions. This technological transition is supported by the swift adoption of electric mobility; the International Energy Agency projected in April 2024 that global electric car sales would reach approximately 17 million units by year-end. To facilitate this pivot, manufacturers are significantly boosting their spending on validation capabilities. According to Allianz, the research and development spending ratio of the top 30 global automakers was expected to climb to 4.5% of revenue in 2024, indicating a substantial capital influx into next-generation vehicle testing and performance optimization.

Market Challenges

The Global Automotive Chassis Dynamometers Market confronts a significant hurdle arising from the substantial initial capital investment needed for facility integration and equipment procurement. This financial barrier is especially pronounced as the industry transitions toward electric vehicle development, which requires testing infrastructure equipped to manage high-voltage power regeneration, intricate thermal management systems, and strict safety protocols. Modern dynamometer cells demand extensive structural modifications and complex auxiliary support systems, which drastically elevate the total cost of ownership. As a consequence, small and medium-sized enterprises, including independent technical centers and aftermarket service providers, frequently face difficulties in securing the funding necessary to upgrade or install these advanced testing systems.This financial disparity results in a consolidated market landscape where only large original equipment manufacturers possess the resources to sustain such heavy expenditures, effectively curbing the broader adoption of next-generation testing units. The exclusivity of these essential resources impedes market volume growth by locking out budget-constrained participants who play a critical role in independent validation. Highlighting the scale of this challenge, the German Association of the Automotive Industry (VDA) projected in 2025 that the sector would allocate approximately €220 billion toward capital expenditure for production and infrastructure upgrades over the following five-year cycle. Such massive spending requirements underscore the severe financial pressure that restricts market entry for smaller entities, thereby limiting the overall expansion of the chassis dynamometer sector.

Market Trends

The integration of Vehicle-in-the-Loop (ViL) and Hardware-in-the-Loop (HiL) simulation is transforming the market by merging physical testing with virtual validation processes. As vehicles increasingly become software-defined, manufacturers are moving validation activities into controlled laboratory environments to speed up development and decrease reliance on physical prototypes. This shift promotes the adoption of dynamometers that can interface with digital twins for early-stage verification, enabling engineers to test complex interactions without the need for extensive road trials. Reflecting this infrastructural evolution, the BMW Group invested approximately €100 million in November 2024 into a new testing center in Wackersdorf specifically designed to validate electric powertrain components well in advance of series production.Concurrently, the application of Artificial Intelligence for real-time data analysis is emerging as a critical trend to handle the exponential rise in telemetry data. Modern dynamometers produce immense datasets that necessitate machine learning algorithms to automate fault detection and optimize testing efficiency. These AI-driven systems improve predictive maintenance strategies and significantly reduce the time required for feedback between testing and design engineering. Emphasizing this technological shift, CBT News reported in September 2025 that Volkswagen announced plans to invest up to €1 billion by 2030 to integrate AI across its operations, with the goal of shortening vehicle development timelines by at least 25%.

Key Players Profiled in the Automotive Chassis Dynamometers Market

- AVL List GmbH

- HORIBA, Ltd.

- MAHA Maschinenbau Haldenwang GmbH & Co. KG

- Robert Bosch GmbH

- MTS Systems Corporation

- Avery Weigh-Tronix, LLC

- Schenck RoTec GmbH

- ATS Corporation

- Phoenix Dynamometer Technologies LLC

- Dynamometer World Ltd.

Report Scope

In this report, the Global Automotive Chassis Dynamometers Market has been segmented into the following categories:Automotive Chassis Dynamometers Market, by Type:

- Single Roller

- Multi Roller

Automotive Chassis Dynamometers Market, by End Use:

- OEM

- Aftermarket

Automotive Chassis Dynamometers Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Chassis Dynamometers Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Chassis Dynamometers market report include:- AVL List GmbH

- HORIBA, Ltd

- MAHA Maschinenbau Haldenwang GmbH & Co. KG

- Robert Bosch GmbH

- MTS Systems Corporation

- Avery Weigh-Tronix, LLC

- Schenck RoTec GmbH

- ATS Corporation

- Phoenix Dynamometer Technologies LLC

- Dynamometer World Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

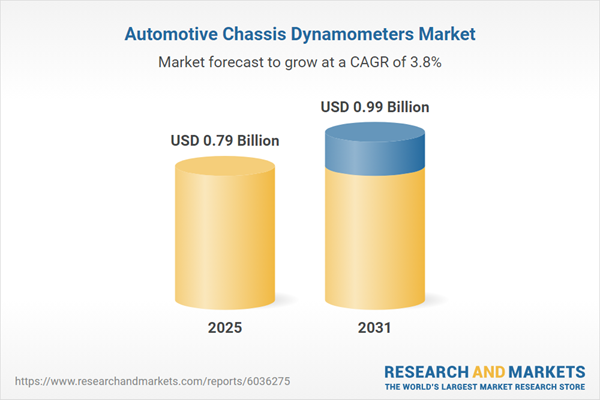

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 0.79 Billion |

| Forecasted Market Value ( USD | $ 0.99 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |