Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Nevertheless, the market faces a substantial obstacle regarding the volatility of raw material costs, particularly for petrochemical-based resins. Since resin prices are tied to fluctuating oil markets, component manufacturers face instability that complicates long-term supply contracts. This price unpredictability often squeezes profit margins within the intensely competitive automotive supply chain, posing a hindrance to broader market expansion.

Market Drivers

Strict government mandates regarding fuel economy and emissions are compelling the industry to integrate lightweight materials to ensure compliance. To reduce gross vehicle weight, fuel consumption, and carbon output, manufacturers are increasingly replacing heavy metal components with high-performance plastics. This shift is reinforced by legislative pressure, such as the regulation highlighted in a May 2024 press release by the Council of the European Union, which mandates a 90% reduction in CO2 emissions for new heavy-duty vehicles by 2040 compared to 2019 levels. Consequently, engineers are incorporating polymer composites throughout vehicle architectures to meet environmental targets while preserving payload capacity.The rise of the electric heavy-duty vehicle market is also accelerating the demand for plastic components as a means to mitigate range anxiety through weight optimization. Because electric powertrains rely on heavy battery packs, significant weight reductions in areas like thermal management systems, interior trim, and body panels are necessary to maximize range. As noted in the 'Global EV Outlook 2024' by the International Energy Agency in April 2024, global electric truck sales reached approximately 54,000 units in 2023, spurring innovation in heat-resistant plastics for battery casings. Furthermore, the China Association of Automobile Manufacturers reported that commercial vehicle production in China hit 4.04 million units for the prior year in 2024, emphasizing the vast scale of vehicles requiring these advanced material solutions.

Market Challenges

A major impediment to the growth of the Global Heavy-Duty Vehicles Plastic Component Market is the cost volatility associated with raw materials, particularly petrochemical-based resins. Because these components rely heavily on crude oil, erratic shifts in global oil prices lead to immediate and unstable resin costs. This unpredictability creates a risky financial landscape for manufacturers, who struggle to sustain profitable margins while adhering to fixed-price contracts with original equipment manufacturers (OEMs). As a result, suppliers frequently hesitate to commit to capacity expansions or long-term agreements, effectively slowing the transition from metal to plastic assemblies.This instability extends to the broader supply chain, causing delays in component orders and vehicle deployment. The market's difficulty in maintaining momentum under these economic pressures is evident in recent industry data. For example, the Society of Motor Manufacturers and Traders reported a 14.5% year-on-year decline in new heavy goods vehicle registrations in the UK during the third quarter of 2025. This contraction in vehicle volume highlights how operational and financial uncertainties, fueled by fluctuating input costs, can disrupt the overall market trajectory.

Market Trends

The integration of Post-Consumer Recycled Materials is transforming the market as manufacturers adopt circular economy principles to mitigate the environmental footprint of vehicle production. This trend involves converting waste plastics into vehicle-grade resins for non-structural parts, such as interior trims and front grilles, thereby reducing reliance on virgin fossil fuel extraction. By using recovered materials, OEMs can decrease a vehicle's embodied carbon without compromising mechanical performance. For instance, Scania reported in May 2025 that replacing virgin materials with recycled PET plastic in truck grilles reduced annual CO2 emissions by 62 tonnes, a strategy that supports sustainability goals while buffering against petrochemical price volatility.Additionally, the expansion of Additive Manufacturing for Custom Parts is reshaping logistics and maintenance within the heavy-duty vehicle sector. This shift favors a decentralized model where spare polymer components are printed on-demand at local hubs, moving away from centralized mass production and reducing physical warehousing inefficiencies. This approach is essential for supplying low-volume plastic parts like clips, covers, and handles, keeping older truck models operational without extended delays. As highlighted in a January 2025 press release by Daimler Truck, implementing this digital inventory system cut spare part delivery wait times by up to 75%, allowing fleet operators to minimize downtime while manufacturers reduce capital tied up in slow-moving stock.

Key Players Profiled in the Heavy-Duty Vehicles Plastic Component Market

- Adient PLC

- BASF SE

- Toyota Boshoku Corporation

- Continental AG

- Lear Corporation

- FORVIA Group

- Magna International Inc.

- OPmobility SE

- IAC Group GmbH

- LyondellBasell Industries N.V.

Report Scope

In this report, the Global Heavy-Duty Vehicles Plastic Component Market has been segmented into the following categories:Heavy-Duty Vehicles Plastic Component Market, by Component Type:

- Engine Covers

- Transmission Covers

- Intake Air Modules

- Oil Pan Modules

- Cam Cover Modules

- Cluster Panels/Dashboard

- Bumpers

- Seating

- Wheels and Tires

- Doors

- Interior & Exterior Trims

- Others

Heavy-Duty Vehicles Plastic Component Market, by Material Type:

- Polyvinyl Chloride

- Polyurethane

- Polypropylene

- Polyethylene

- Polyamide

- Acrylonitrile Butadiene Styrene

- Polycarbonate

- Others

Heavy-Duty Vehicles Plastic Component Market, by Vehicle Type:

- Tractors

- Loaders

- Scrapers

- Excavators

- Trucks

- Combine Harvester

- Buses

Heavy-Duty Vehicles Plastic Component Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Heavy-Duty Vehicles Plastic Component Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Heavy-Duty Vehicles Plastic Component market report include:- Adient PLC

- BASF SE

- Toyota Boshoku Corporation

- Continental AG

- Lear Corporation

- FORVIA Group

- Magna International Inc.

- OPmobility SE

- IAC Group GmbH

- LyondellBasell Industries N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

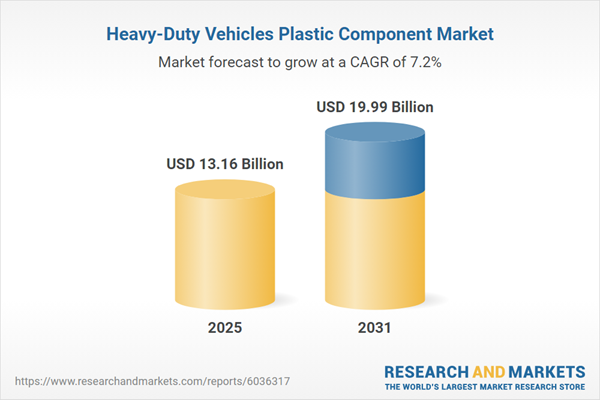

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 13.16 Billion |

| Forecasted Market Value ( USD | $ 19.99 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |