Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces significant hurdles due to the prohibitive costs associated with procuring and maintaining advanced naval assets. Budgetary constraints, compounded by supply chain volatility and inflationary pressures on raw materials, frequently force the postponement of essential shipbuilding contracts, thereby slowing the pace of global fleet expansion. These financial and logistical challenges limit the ability of nations to swiftly implement modernization strategies, acting as a substantial restraint on the overall progression of the naval market.

Market Drivers

Escalating geopolitical tensions and regional maritime disputes act as primary catalysts for the expansion of the naval vessels market, compelling nations to aggressively counter perceived threats to sovereignty and trade routes. This strategic shift involves replacing aging platforms with advanced surface combatants designed to operate in contested environments, such as the Red Sea and the Indo-Pacific, necessitating the deployment of versatile frigates and destroyers with enhanced survivability. The urgency of these requirements is visible in major industrial order books; for instance, Fincantieri reported a backlog of €41.1 billion in July 2024, a figure significantly bolstered by the defense sector's robust demand for new naval units amidst global instability.Consequently, increased national defense budgets are directly facilitating the acquisition of these next-generation maritime assets, with governments allocating record funding for directed energy weapons, missile defense systems, and unmanned technologies. This financial commitment supports the continuity of long-term shipbuilding projects and the industrial base required for complex construction. In the U.S., the Department of the Navy requested $32.4 billion in its FY 2025 budget specifically for shipbuilding to procure six new battle force ships, while China raised its defense spending by 7.2% to 1.67 trillion yuan in March 2024, underscoring a global trend of militarization that drives competitive procurement cycles.

Market Challenges

The primary obstacle restricting the Global Naval Vessels and Surface Combatants Market is the prohibitive cost of procurement and maintenance, which is further aggravated by supply chain volatility and inflation. These financial and logistical barriers directly impede market expansion by forcing nations to scale back or delay modernization efforts despite rising security needs. When raw material prices surge and component availability becomes unpredictable, shipbuilders face extended lead times and cost overruns that often exceed initial budget allocations, compelling defense ministries to revise procurement strategies and postpone new vessel contracts.This financial instability creates a precarious environment for long-term industrial planning, significantly affecting the execution of shipbuilding programs. For example, the National Defense Industrial Association reported in 2024 that the Department of the Navy estimated 30% of its shipbuilding account would be inexecutable under a year-long continuing resolution due to such fiscal uncertainties. These budgetary constraints disable the industry's ability to maintain steady production lines, ultimately stalling the delivery of critical maritime assets and hampering the overall growth trajectory of the global naval market.

Market Trends

The utilization of additive manufacturing for naval maintenance is emerging as a critical solution to mitigate persistent supply chain vulnerabilities and casting delays associated with traditional shipbuilding. By shifting from centralized factory production to point-of-need fabrication, navies can rapidly produce essential components onboard or at forward operating bases, drastically reducing logistical lead times from months to days. This capability is particularly vital for sustaining aging fleets where original parts are no longer manufactured, as evidenced by the U.S. Navy's announcement in February 2025 that the USS Michigan's overhaul would integrate 33 3D-printed metal components, validating the technology's growing role in operational sustainment.Simultaneously, the enhancement of cybersecurity protocols for ship systems has become a strategic priority as naval platforms increasingly rely on interconnected digital architectures and data links. With the convergence of operational technology and information systems, vessels are exposed to sophisticated cyber threats that can compromise navigation, propulsion, and combat capabilities without physical engagement. Navies are responding by embedding robust defensive cyber operations into lifecycle support, a trend illustrated by Specialty Systems, Inc. securing a $66.2 million contract in December 2025 to provide cybersecurity and systems engineering support for the 'SHIELD' portfolio, aimed at hardening the digital infrastructure of deployed naval platforms.

Key Players Profiled in the Naval Vessels and Surface Combatants Market

- BAE Systems PLC

- Mazagon Dock Shipbuilders Limited

- Damen Shipyards Group

- FINCANTIERI S.p.A.

- General Dynamics Corporation

- LARSEN & TOUBRO LIMITED

- Navantia S.A.

- thyssenkrupp AG

- Korea Shipbuilding & Offshore Engineering Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

Report Scope

In this report, the Global Naval Vessels and Surface Combatants Market has been segmented into the following categories:Naval Vessels and Surface Combatants Market, by Ship Type:

- Destroyers

- Corvettes

- Submarines

- Amphibious Ships

- Frigates

- Auxiliary Vessels

Naval Vessels and Surface Combatants Market, by System Type:

- Marine Engine System

- Weapon Launch System

- Sensor System

- Control System

- Electrical System

- Auxiliary System

- Communication System

Naval Vessels and Surface Combatants Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Naval Vessels and Surface Combatants Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Naval Vessels and Surface Combatants market report include:- BAE Systems PLC

- Mazagon Dock Shipbuilders Limited

- Damen Shipyards Group

- FINCANTIERI S.p.A.

- General Dynamics Corporation

- LARSEN & TOUBRO LIMITED

- Navantia S.A.

- thyssenkrupp AG

- Korea Shipbuilding & Offshore Engineering Co., Ltd

- Mitsubishi Heavy Industries, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

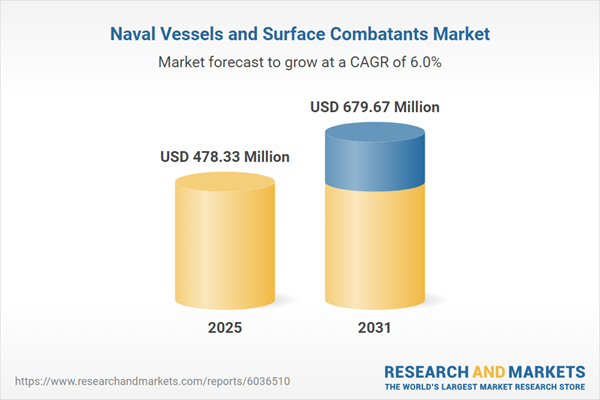

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 478.33 Million |

| Forecasted Market Value ( USD | $ 679.67 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |