Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the continued growth of this market faces a substantial obstacle regarding the credibility of environmental claims, a challenge often described as greenwashing. The lack of globally unified reporting standards and definitions can deter investors who worry that their capital may not achieve the promised environmental impact, resulting in skepticism and potential regulatory scrutiny. Despite these verification difficulties, the sector remains resilient in attracting investment; according to the Climate Bonds Initiative, global green bond issuance totaled $535 billion in the first three quarters of 2024, highlighting the enduring commitment of capital toward climate finance.

Market Drivers

The widespread issuance of sovereign green bonds by major economies serves as a primary catalyst for the market, establishing benchmark yield curves and signaling a long-term government commitment to climate objectives. By utilizing sovereign debt to fund environmental projects, nations not only finance their Nationally Determined Contributions but also de-risk the asset class, thereby stimulating private sector participation. This top-down validation encourages corporate issuers to follow suit, effectively deepening the market beyond niche investors. For example, the Ministry of Finance Japan announced in a February 2024 press release the successful inaugural auction of 1.6 trillion yen in sovereign climate transition bonds, demonstrating the significant scale at which state-backed instruments are mobilizing capital for decarbonization initiatives.Simultaneously, the rapid development of low-carbon infrastructure and renewable energy projects creates the essential use-of-proceeds pipeline required for market liquidity. As utilities and developers aggressively transition away from fossil fuels, the high capital intensity of wind, solar, and grid modernization projects necessitates the large-scale, long-dated funding that green bonds provide. The International Energy Agency's 'World Energy Investment 2024' report projects that global investment in clean energy technologies will reach $2 trillion in 2024, highlighting a massive financing gap that bond markets are uniquely suited to fill. This synergy between physical infrastructure needs and financial instruments ensures sustained activity; according to the OECD, the outstanding stock of global sustainable bonds reached a record $4.3 trillion by the end of 2023, reflecting the broader financial ecosystem's reliance on these environmental debt instruments.

Market Challenges

The expansion of the Global Green Bond Market is significantly constrained by concerns regarding the credibility of environmental claims, often associated with greenwashing. The lack of globally harmonized reporting standards and definitions introduces uncertainty for institutional investors who prioritize Environmental, Social, and Governance (ESG) compliance. When investors are unable to confidently verify that proceeds are supporting genuine sustainable projects, the due diligence process becomes both time-consuming and expensive. This friction slows the deployment of capital and engenders reluctance among asset managers, who fear the reputational risks involved in funding projects that fail to deliver the promised environmental benefits.Consequently, this absence of standardization impedes market efficiency and restricts the pool of capital available to new issuers. The resulting uncertainty leads to market fragmentation, wherein only issuers with substantial resources can afford the third-party verification necessary to prove their legitimacy. According to the Climate Bonds Initiative, the total volume of aligned green bond issuance was USD 589.5 billion in 2023. While this figure represents a significant market, persistent verification hurdles prevent the sector from reaching its full potential, as continuing skepticism regarding data integrity limits broader investor participation.

Market Trends

The integration of blockchain technology for digital bond tokenization is fundamentally transforming the market's operational infrastructure by improving settlement efficiency and transparency. This trend surpasses traditional clearing mechanisms, enabling fractional ownership and real-time data tracking that validates environmental impact claims directly on a distributed ledger. Such digitization lowers issuance costs and expands the investor base to include a wider array of institutional participants seeking streamlined access to green assets. Notably, the Hong Kong Monetary Authority announced in February 2024 that the government successfully completed the world's first multi-currency digital green bond issuance of approximately HK$6 billion, utilizing four distinct currencies to attract diverse global capital.Concurrently, there is a marked surge in green financing directed toward energy-efficient data center infrastructure, driven by the exponential energy requirements of cloud computing and artificial intelligence. As technology giants face pressure to decarbonize their rapid digital expansion, they are increasingly using green bonds to fund liquid cooling systems, renewable energy power purchase agreements (PPAs), and low-carbon building retrofits. This infusion of capital is essential for ensuring that the digital economy's growth does not undermine net-zero commitments. As detailed in an Equinix press release from November 2024, the company issued €1.15 billion in green notes specifically allocated to finance eligible green projects, such as energy efficiency upgrades, reinforcing the sector's pivotal role in the green bond market.

Key Players Profiled in the Green Bond Market

- Apple Inc.

- Bank of America

- JP Morgan Chase

- Barclays

- Citigroup

- Credit Agricole

- BNP Paribas

- HSBC Holdings

- Deutsche Bank

- Iberdrola SA

Report Scope

In this report, the Global Green Bond Market has been segmented into the following categories:Green Bond Market, by Issuer:

- Public Sector Issuers and Private Sector Issuers

Green Bond Market, by Sector:

- Government Backed Entities

- Financial Corporations

- Non-Financial Corporations

- Development Banks

- Local Government

- and Others

Green Bond Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Green Bond Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Green Bond market report include:- Apple Inc

- Bank of America

- JP Morgan Chase

- Barclays

- Citigroup

- Credit Agricole

- BNP Paribas

- HSBC Holdings

- Deutsche Bank

- Iberdrola SA

Table Information

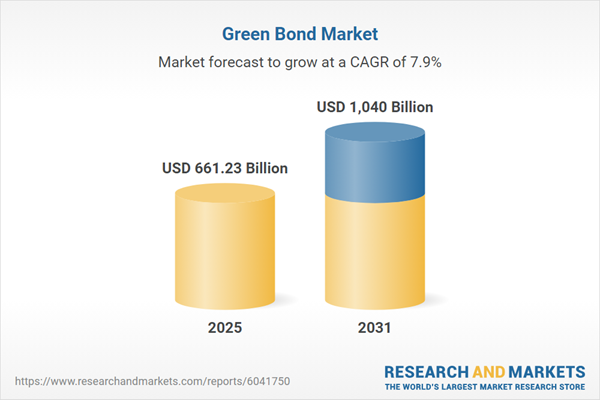

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 661.23 Billion |

| Forecasted Market Value ( USD | $ 1040 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |