Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market encounters significant obstacles due to the high capital expenditure required for facility construction and the substantial energy costs associated with continuous high-speed operations. This financial barrier limits testing frequency for smaller manufacturers and restricts rapid infrastructure expansion. Despite these constraints, the escalating need for advanced aerodynamic testing capacities is underscored by expanding commercial aviation activity; according to the International Air Transport Association, global full-year passenger traffic for 2024 increased by 10.4% compared to the previous year, highlighting the growing necessity for capacity to support the enlarging commercial fleet.

Market Drivers

The escalating global demand for commercial and military aircraft acts as the primary force propelling the Global Wind Tunnel Market, as manufacturers face immense pressure to certify next-generation fleets. This surge in production necessitates rigorous aerodynamic testing to ensure stability, fuel efficiency, and safety compliance for new airframes before they enter service. According to Airbus's "Global Market Forecast 2024-2043" from July 2024, the aviation sector anticipates a demand for 42,430 new aircraft deliveries over the next two decades, signaling a sustained trajectory of development activity that will require thousands of wind tunnel testing hours. Simultaneously, the defense sector is pushing the boundaries of speed, further intensifying the need for specialized high-velocity testing infrastructure; for instance, Sacyr reported in March 2024 that the newly operational JF-22 facility has achieved the capability to simulate flight conditions up to Mach 30, underscoring the critical role of advanced wind tunnels in developing hypersonic military capabilities.A growing focus on aerodynamic efficiency to maximize electric vehicle range serves as the second critical driver, transforming wind tunnel testing from a performance luxury into a necessity for the automotive mass market. As the industry shifts toward electrification, reducing aerodynamic drag is the most cost-effective method to extend battery range and reduce energy consumption without increasing battery size. This requirement compels manufacturers to utilize wind tunnels for fine-tuning body contours, managing airflow around wheels, and optimizing underbody designs. According to the International Energy Agency's "Global EV Outlook 2024" released in April 2024, global electric car sales were projected to reach 17 million units by the end of the year, a volume that demands extensive aerodynamic validation capacity to ensure these vehicles meet competitive efficiency standards and consumer range expectations.

Market Challenges

The substantial capital investment required to construct wind tunnel facilities constitutes a primary restraint on market expansion. Specialized testing infrastructure demands precise engineering and expensive materials, creating high entry barriers for potential market participants. These initial financial obligations often deter smaller manufacturers from establishing private testing centers, compelling them to rely on limited third-party availability. Consequently, the high cost of facility development restricts the proliferation of testing sites and slows the overall development of physical testing infrastructure across the aerospace and automotive sectors.Operational expenses further compound these financial challenges, specifically regarding the substantial energy consumption required for continuous high-speed testing. Wind tunnels demand immense power loads to sustain airflow consistency, rendering them highly sensitive to electricity pricing volatility. According to the International Energy Agency, in 2025, global electricity demand is projected to grow by 4%, creating sustained upward pressure on utility costs for energy-intensive industrial facilities. This financial burden forces operators to limit testing durations to maintain profitability, thereby reducing the overall volume of aerodynamic data collection and constraining the market’s capacity to meet growing testing schedules.

Market Trends

The adoption of moving ground plane systems for automotive testing is rapidly advancing as manufacturers seek to replicate real-world road conditions with higher fidelity to meet stringent efficiency targets. Unlike traditional fixed-floor testing, this technology simulates the aerodynamic interaction between rotating wheels and the road surface, which is a critical area for reducing turbulence in electric vehicles. According to a Stellantis press release in October 2024, the company invested $29.5 million to upgrade its Auburn Hills facility with moving ground plane technology to specifically measure airflow resistance from wheels, which accounts for up to 10% of total drag. This trend highlights the industry shift toward sophisticated infrastructure capable of isolating complex aerodynamic variables to maximize battery range.The expansion of hypersonic testing facilities for defense applications has shifted focus toward specialized infrastructure for validating thermal protection systems and high-temperature materials. As hypersonic vehicles endure extreme heat during atmospheric re-entry, facilities must now integrate aerothermal capabilities that go beyond standard velocity metrics to ensure vehicle survivability. According to a University of Tennessee article from December 2024, researchers secured a $17.8 million grant from the U.S. Air Force to construct a wind tunnel designed to subject materials like ceramics to hypersonic conditions experienced above Mach 5. This underscores the defense sector's reliance on purpose-built testing environments to ensure structural integrity under the severe thermal loads associated with next-generation missile and spacecraft development.

Key Players Profiled in the Wind Tunnel Market

- Aerolab LLC.

- Aiolos

- Altair Engineering, Inc.

- Atlas Obscura.

- BMT

- Boeing

- Calspan

- DALLARA

- Deutsche WindGuard GmbH

- DNW

Report Scope

In this report, the Global Wind Tunnel Market has been segmented into the following categories:Wind Tunnel Market, by Application:

- Transportation

- Building Construction

- Wind Energy

- Racing Championships

- Training and Simulation

- Adventure Sports Skydiving

- Aerospace and Defense

Wind Tunnel Market, by Design Type:

- Open Circuit Wind Tunnel

- Closed Circuit Wind Tunnel

Wind Tunnel Market, by Air Speed:

- Supersonic

- Transonic

- Subsonic

- Hypersonic

Wind Tunnel Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wind Tunnel Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Wind Tunnel market report include:- Aerolab LLC.

- Aiolos

- Altair Engineering, Inc.

- Atlas Obscura.

- BMT

- Boeing

- Calspan

- DALLARA

- Deutsche WindGuard GmbH

- DNW

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

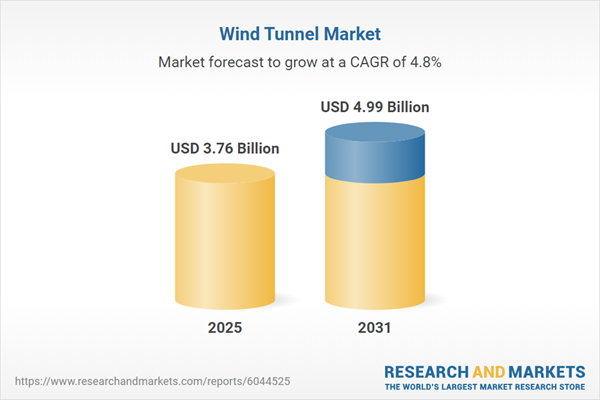

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.76 Billion |

| Forecasted Market Value ( USD | $ 4.99 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |