Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these favorable indicators, the industry faces significant challenges related to raw material procurement. Fluctuations in the prices of wood, steel, and aluminum frequently result in higher production costs and supply chain interruptions. This financial instability creates a substantial hurdle for manufacturers attempting to maintain competitive pricing while satisfying the changing needs of the global market.

Market Drivers

The growth of global residential and commercial construction activities serves as a primary catalyst for the industry, creating a steady demand for new entry systems. This expansion is driven by rapid infrastructure development in emerging economies and the continued need for housing to support increasing populations. As contractors expedite project timelines, the volume of procurement for both interior and exterior door units has risen to match development speeds. According to an analysis of federal spending data by the Associated General Contractors of America in March 2024, total construction spending in the United States rose by 11.7 percent year-over-year in January 2024, signaling a robust pipeline of building projects that directly correlates with higher orders for fenestration products.Concurrently, the rising demand for energy-efficient and eco-friendly door solutions is transforming manufacturing standards and consumer preferences. Market players are prioritizing sustainable materials to comply with environmental regulations and attract eco-conscious buyers who value thermal performance. This strategic shift is reflected in supply chain adjustments, with companies aggressively increasing their use of certified raw materials. For instance, JELD-WEN noted in its August 2024 '2023 ESG Report' that 35 percent of its global wood sourcing consisted of sustainable or certified wood. This trend also extends to the renovation sector, where upgrading to high-performance barriers is a common goal; Houzz reported in 2024 that 18 percent of renovating homeowners in the United States upgraded their exterior doors, highlighting strong replacement demand driven by functional improvements.

Market Challenges

The principal obstacle currently straining the Global Doors Market is the persistent volatility in raw material procurement, particularly regarding the rising costs of steel, aluminum, and lumber. Because manufacturers depend heavily on these inputs to produce durable and secure entryways for residential and commercial sectors, sudden price surges disrupt production budgets and reduce profit margins. This financial instability forces companies to raise product prices to sustain operations, which subsequently suppresses buyer demand and delays new construction projects that require these essential installations. When input costs fluctuate unpredictably, manufacturers struggle to maintain the competitive pricing necessary to capture market share in developing regions.This constraint is highlighted by recent inflationary trends in essential building materials which directly impact manufacturing overhead. Data from the Associated General Contractors of America indicates that in 2025, the producer price index for steel mill products rose by 13.1 percent over the previous twelve months, while aluminum mill shapes saw a significant increase of 22.8 percent during the same period. Such substantial double-digit hikes in core material costs directly hamper the market by making finished door products more expensive, thereby causing developers to scale back or postpone the building activities that drive industry revenue.

Market Trends

The rapid integration of IoT-enabled smart locking and biometric access systems is fundamentally altering product development within the residential and commercial sectors. Manufacturers are increasingly moving beyond traditional mechanical barriers to offer connected entry solutions that integrate seamlessly with home automation ecosystems and building management platforms. This transition is driven by consumer demand for remote monitoring, keyless entry, and enhanced security features such as facial recognition and fingerprint scanning, which provide superior access control compared to standard deadbolts. This technological pivot is yielding significant financial returns for industry leaders focusing on digital transformation; according to Allegion's 'Fourth Quarter and Full-Year 2023 Financial Results' from February 2024, the company achieved approximately 20 percent global organic growth in its electronics and software solutions portfolio, highlighting the surging adoption of intelligent access technologies.Simultaneously, there is a distinct shift toward high-speed automated doors in industrial facilities, driven by the need to optimize logistics workflows and maintain environmental control. Warehouses, cold storage units, and manufacturing plants are prioritizing entry systems that open and close rapidly to minimize air exchange, thereby reducing energy costs and preventing contamination in sensitive production areas. This trend is particularly evident in the growing investment in non-residential infrastructure where operational efficiency is paramount, contrasting with broader fluctuations in the housing market. This divergence in sector performance is reflected in recent corporate financial data; Assa Abloy's 'Quarterly Report Q4 2023' from February 2024 noted that its Entrance Systems division recorded organic sales growth of 3 percent, primarily fueled by strong demand in non-residential business areas which successfully offset a slowdown in the residential segment.

Key Players Profiled in the Doors Market

- Andersen Corporation

- ASSA ABLOY

- ATIS Group

- Atrium Corporation

- JELD-WEN, Inc.

- Lixil Group Corporation

- YKK Corporation

- Pella Corporation

- LIXIL Group Corporation

Report Scope

In this report, the Global Doors Market has been segmented into the following categories:Doors Market, by Mechanism:

- Sliding Doors

- Swinging Doors

- Overhead Doors

- Folding Doors

- Others

Doors Market, by Application:

- Residential

- Non-Residential

Doors Market, by Material:

- Wood

- Glass

- Composite

- Plastic

- Metal

Doors Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Doors Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Doors market report include:- Andersen Corporation

- ASSA ABLOY

- ATIS Group

- Atrium Corporation

- JELD-WEN, Inc.

- Lixil Group Corporation

- YKK Corporation

- Pella Corporation

- LIXIL Group Corporation

Table Information

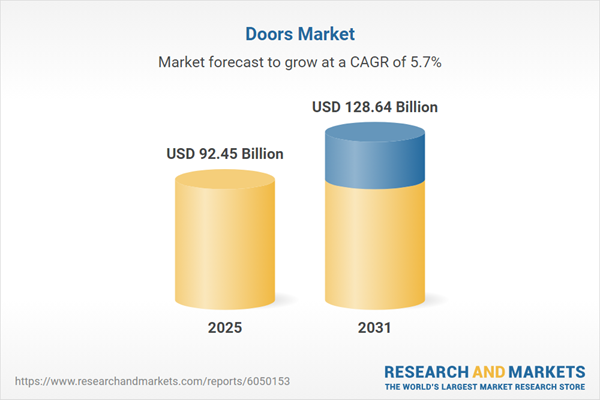

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 92.45 Billion |

| Forecasted Market Value ( USD | $ 128.64 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |